ouona uu g 201 the companys 10th year of operations to view

ouona uu g 201, the company\'s 10th year of operations to view the transactions.) More Info Feb Mar Apr Aug Sep Nov 3 19 24 15 1 22 Issued 10,000 shares of common stock ($3.00 par) for cash of $297,000. Purchased 2,700 shares of the company\'s own common stock at $31 per share. Sold 1,400 shares of treasury stock for $32 per share. Declared a cash dividend on the 16,000 shares of $0.50 no-par preferred stock. Paid the cash dividends. Declared and distributed a 20% stock dividend on the 94,000 shares of $3.00 par common stock outstanding. The market value of the common stock was $35 per share. Print Done in the edit fields and then continue to the next question.

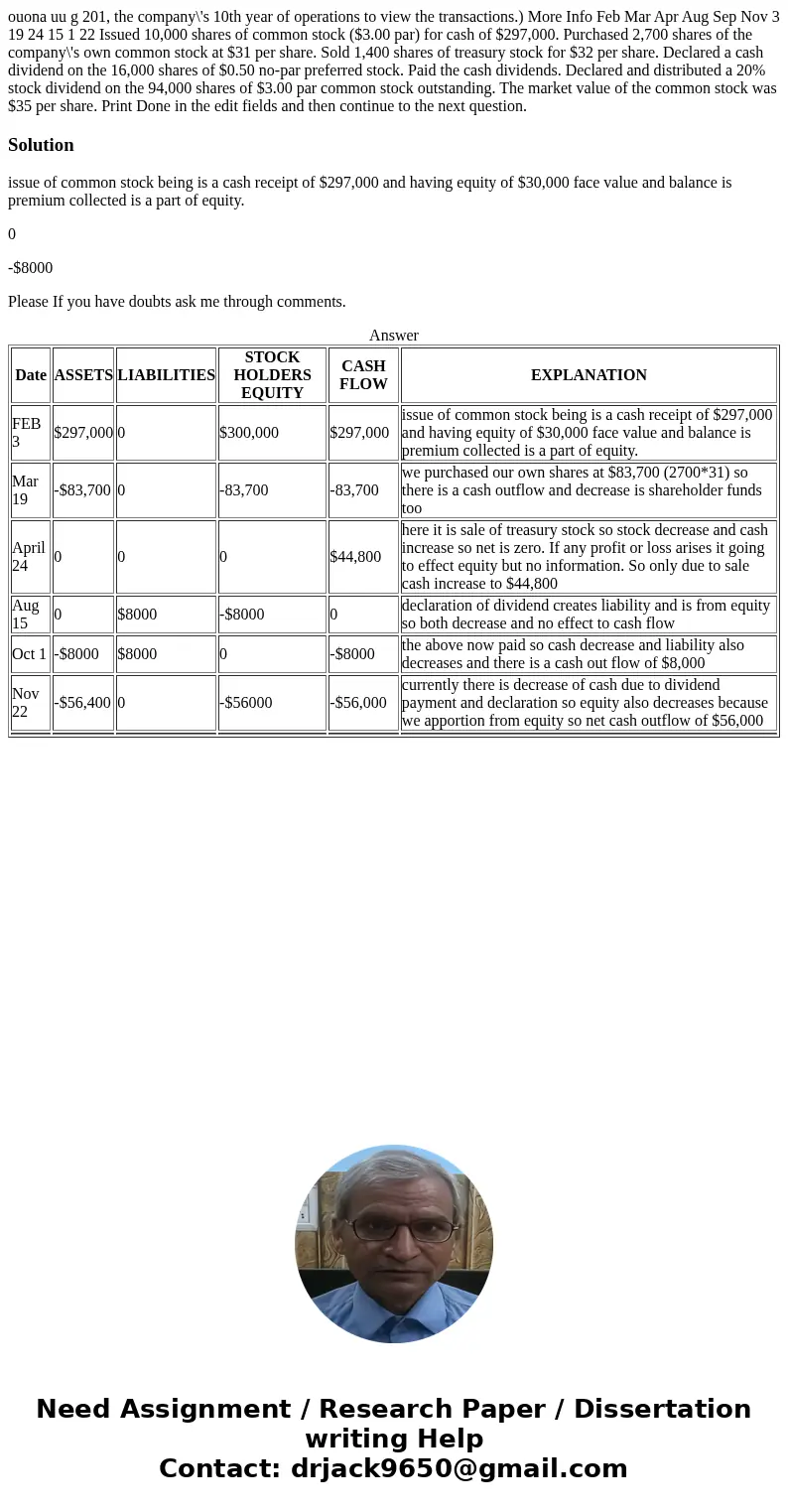

Solution

issue of common stock being is a cash receipt of $297,000 and having equity of $30,000 face value and balance is premium collected is a part of equity.

0

-$8000

Please If you have doubts ask me through comments.

| Date | ASSETS | LIABILITIES | STOCK HOLDERS EQUITY | CASH FLOW | EXPLANATION |

|---|---|---|---|---|---|

| FEB 3 | $297,000 | 0 | $300,000 | $297,000 | issue of common stock being is a cash receipt of $297,000 and having equity of $30,000 face value and balance is premium collected is a part of equity. |

| Mar 19 | -$83,700 | 0 | -83,700 | -83,700 | we purchased our own shares at $83,700 (2700*31) so there is a cash outflow and decrease is shareholder funds too |

| April 24 | 0 | 0 | 0 | $44,800 | here it is sale of treasury stock so stock decrease and cash increase so net is zero. If any profit or loss arises it going to effect equity but no information. So only due to sale cash increase to $44,800 |

| Aug 15 | 0 | $8000 | -$8000 | 0 | declaration of dividend creates liability and is from equity so both decrease and no effect to cash flow |

| Oct 1 | -$8000 | $8000 | 0 | -$8000 | the above now paid so cash decrease and liability also decreases and there is a cash out flow of $8,000 |

| Nov 22 | -$56,400 | 0 | -$56000 | -$56,000 | currently there is decrease of cash due to dividend payment and declaration so equity also decreases because we apportion from equity so net cash outflow of $56,000 |

Homework Sourse

Homework Sourse