You are considering two mutually exclusive projects with the

You are considering two mutually exclusive projects with the following cash flows. Which project(s) should you accept if the discount rate is 7 percent? What if the discount rate is 8 percent? Year Project A Project B 0 -$80,000 -$80,000 1 32,000 0 2 32,000 0 3 32,000 105,000

Solution

1.

NPV at 7% discount rate:

NPV of Project A = $3,978.11

NPV of Project B = $5,711.28

As NPV of Project B is higher, we should accept Project B over Project A.

2.

NPV at 8% discount rate:

NPV of Project A = $2,467.10

NPV of Project B = $3,352.39

As NPV of Project B is higher, we should accept Project B over Project A.

-------------------------------

Please check the working of NPV below:

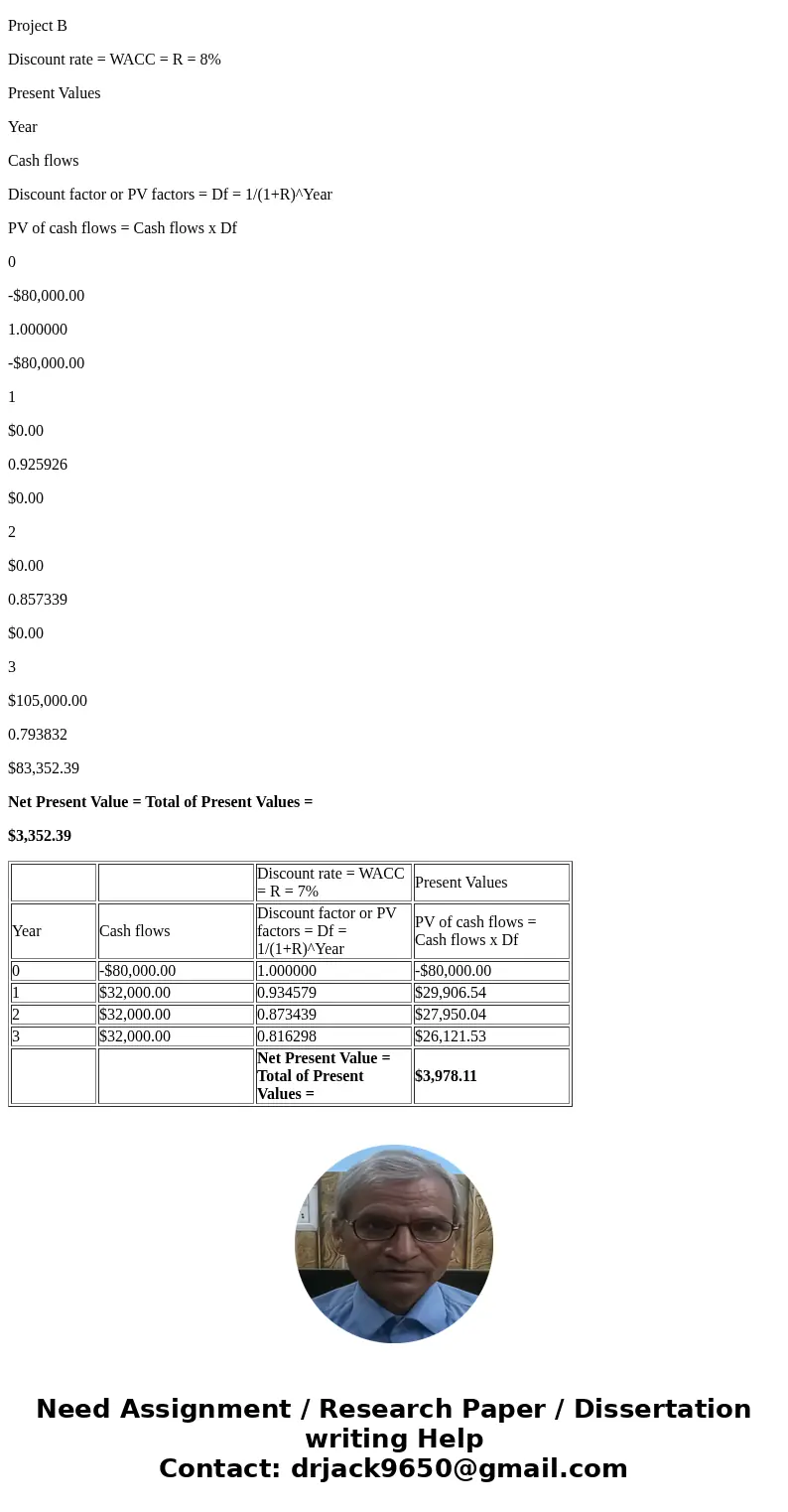

Working for NPV at 7%

Project A

Discount rate = WACC = R = 7%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$80,000.00

1.000000

-$80,000.00

1

$32,000.00

0.934579

$29,906.54

2

$32,000.00

0.873439

$27,950.04

3

$32,000.00

0.816298

$26,121.53

Net Present Value = Total of Present Values =

$3,978.11

Project B

Discount rate = WACC = R = 7%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$80,000.00

1.000000

-$80,000.00

1

$0.00

0.934579

$0.00

2

$0.00

0.873439

$0.00

3

$105,000.00

0.816298

$85,711.28

Net Present Value = Total of Present Values =

$5,711.28

Working for 8% discount rate:

Project A

Discount rate = WACC = R = 8%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$80,000.00

1.000000

-$80,000.00

1

$32,000.00

0.925926

$29,629.63

2

$32,000.00

0.857339

$27,434.84

3

$32,000.00

0.793832

$25,402.63

Net Present Value = Total of Present Values =

$2,467.10

Project B

Discount rate = WACC = R = 8%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$80,000.00

1.000000

-$80,000.00

1

$0.00

0.925926

$0.00

2

$0.00

0.857339

$0.00

3

$105,000.00

0.793832

$83,352.39

Net Present Value = Total of Present Values =

$3,352.39

| Discount rate = WACC = R = 7% | Present Values | ||

| Year | Cash flows | Discount factor or PV factors = Df = 1/(1+R)^Year | PV of cash flows = Cash flows x Df |

| 0 | -$80,000.00 | 1.000000 | -$80,000.00 |

| 1 | $32,000.00 | 0.934579 | $29,906.54 |

| 2 | $32,000.00 | 0.873439 | $27,950.04 |

| 3 | $32,000.00 | 0.816298 | $26,121.53 |

| Net Present Value = Total of Present Values = | $3,978.11 |

Homework Sourse

Homework Sourse