Homestyle Brands imports materials from other countries and

Homestyle Brands imports materials from other countries and exports nished products to customers throughout the world. Information regarding four such transactions occurring in the last accounting period, all denominated in units of foreign currency, is given below:

Calculate gain or loss for each of the four scenarios.

| Country | Amount | Spot Rate at transaction date | Spot Rate at payment date |

|---|---|---|---|

| Import from Taiwan | 100,000 Taiwan dollars | $0.033 | $0.038 |

| Import from Poland | 600,000 zloty | 0.300 | 0.285 |

| Export to Brazil | 400,000 reais | 0.421 | 0.403 |

| Export to Switzerland | 950,000 Swiss francs | 1.050 | 1.084 |

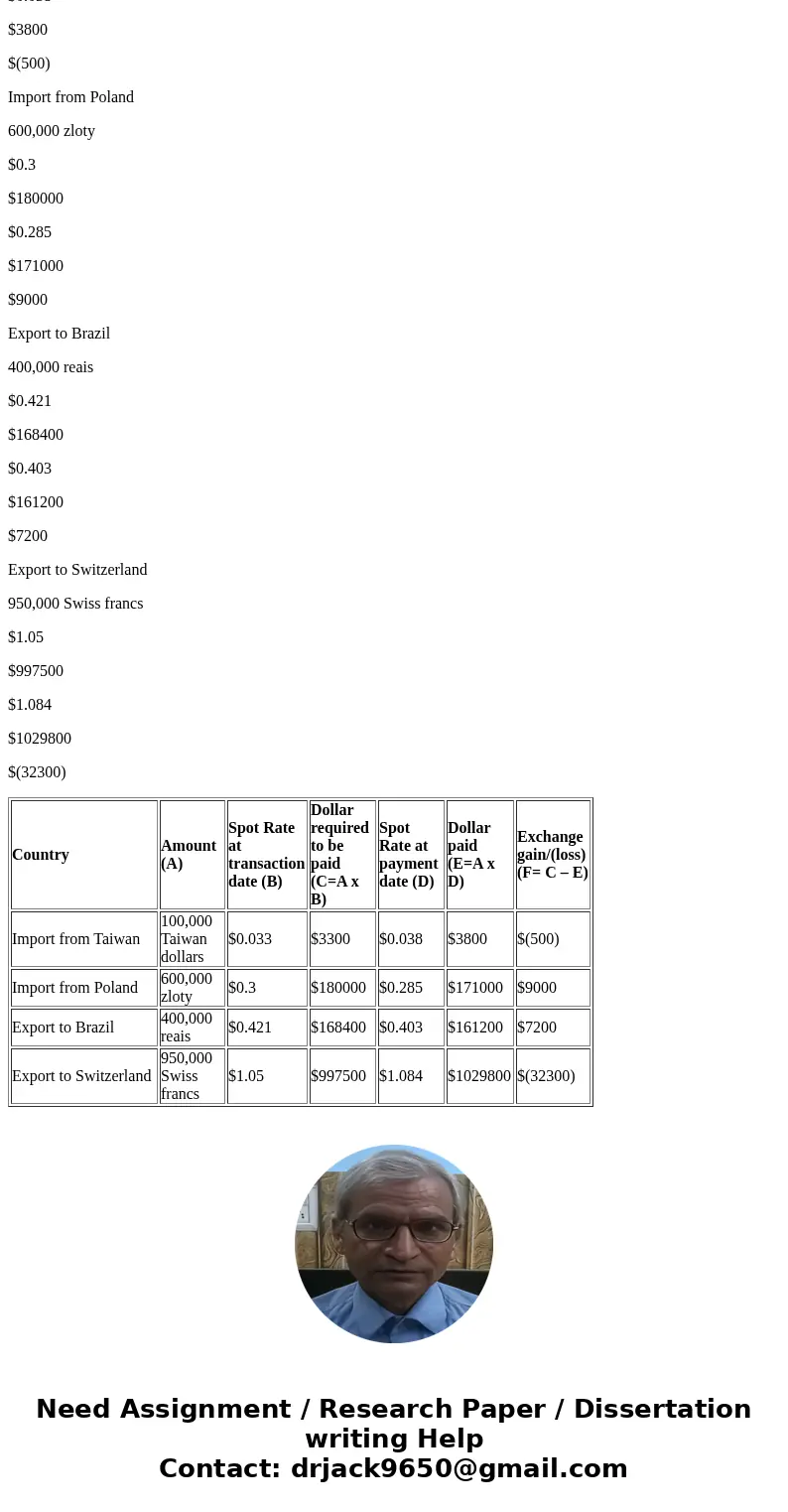

Solution

Answer

Country

Amount (A)

Spot Rate at transaction date (B)

Dollar required to be paid (C=A x B)

Spot Rate at payment date (D)

Dollar paid (E=A x D)

Exchange gain/(loss) (F= C – E)

Import from Taiwan

100,000 Taiwan dollars

$0.033

$3300

$0.038

$3800

$(500)

Import from Poland

600,000 zloty

$0.3

$180000

$0.285

$171000

$9000

Export to Brazil

400,000 reais

$0.421

$168400

$0.403

$161200

$7200

Export to Switzerland

950,000 Swiss francs

$1.05

$997500

$1.084

$1029800

$(32300)

| Country | Amount (A) | Spot Rate at transaction date (B) | Dollar required to be paid (C=A x B) | Spot Rate at payment date (D) | Dollar paid (E=A x D) | Exchange gain/(loss) (F= C – E) |

| Import from Taiwan | 100,000 Taiwan dollars | $0.033 | $3300 | $0.038 | $3800 | $(500) |

| Import from Poland | 600,000 zloty | $0.3 | $180000 | $0.285 | $171000 | $9000 |

| Export to Brazil | 400,000 reais | $0.421 | $168400 | $0.403 | $161200 | $7200 |

| Export to Switzerland | 950,000 Swiss francs | $1.05 | $997500 | $1.084 | $1029800 | $(32300) |

Homework Sourse

Homework Sourse