Class 7 Spring 2017 Mid term Exam 3 questions in 100 minutes

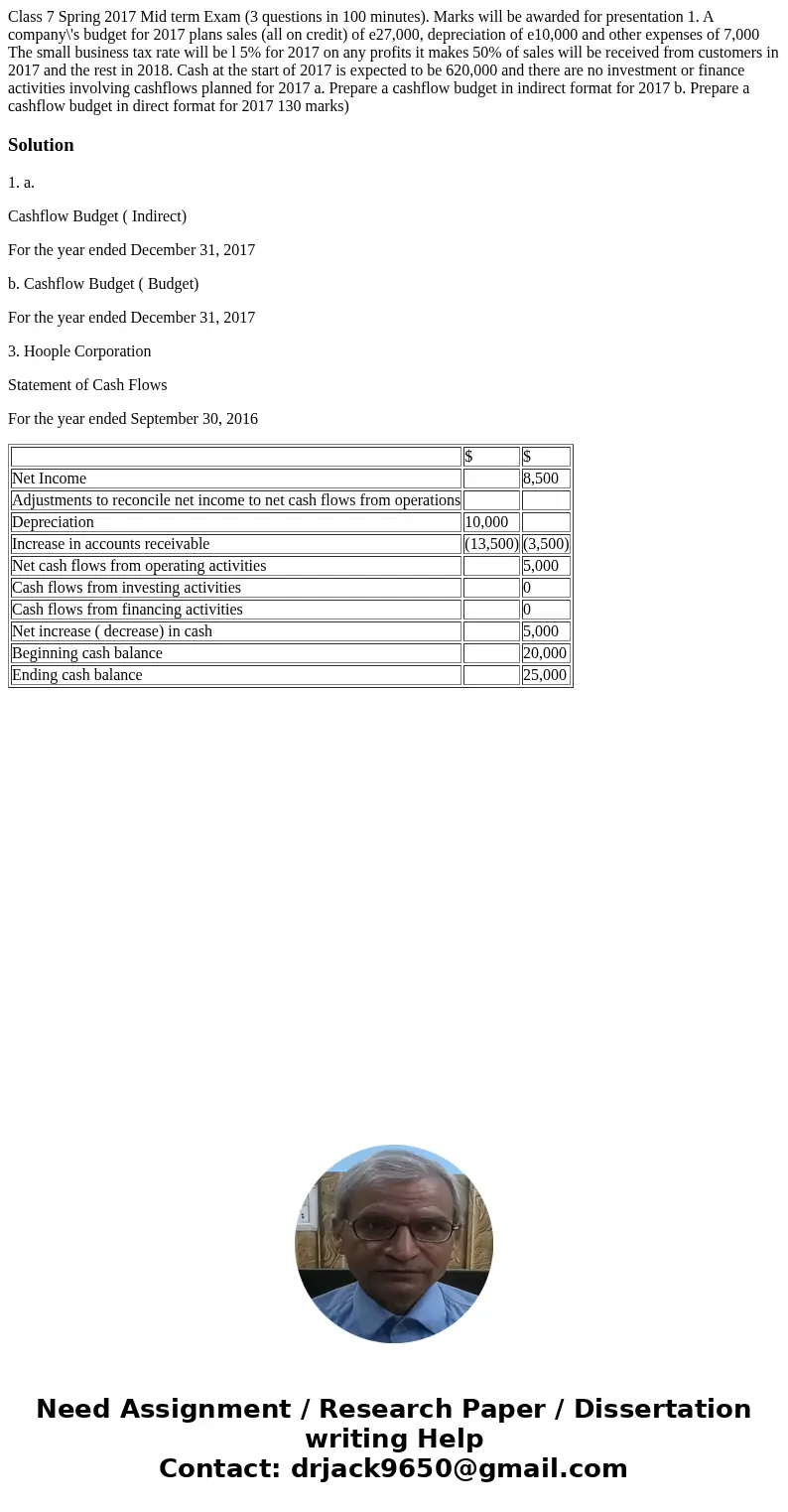

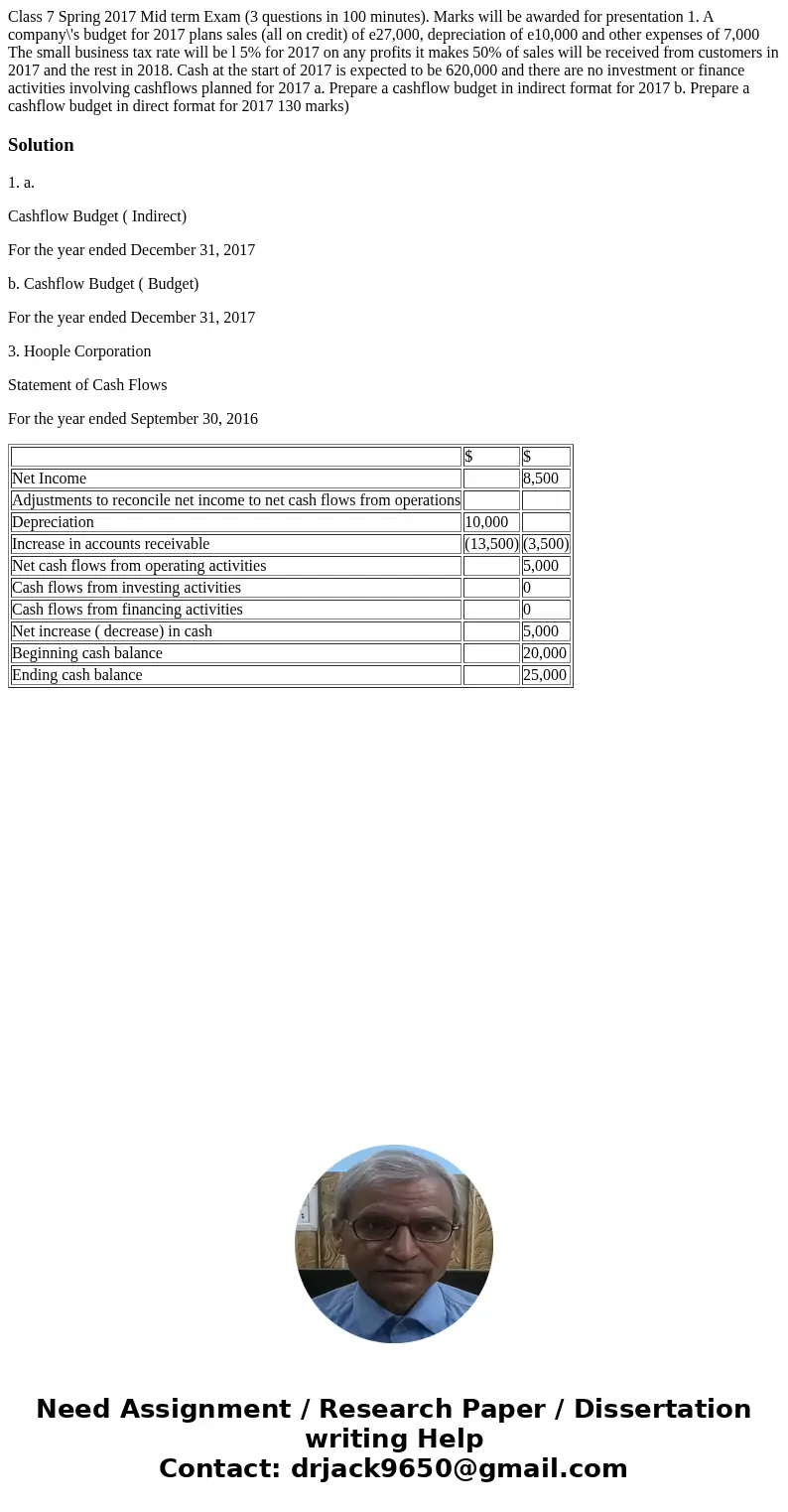

Class 7 Spring 2017 Mid term Exam (3 questions in 100 minutes). Marks will be awarded for presentation 1. A company\'s budget for 2017 plans sales (all on credit) of e27,000, depreciation of e10,000 and other expenses of 7,000 The small business tax rate will be l 5% for 2017 on any profits it makes 50% of sales will be received from customers in 2017 and the rest in 2018. Cash at the start of 2017 is expected to be 620,000 and there are no investment or finance activities involving cashflows planned for 2017 a. Prepare a cashflow budget in indirect format for 2017 b. Prepare a cashflow budget in direct format for 2017 130 marks)

Solution

1. a.

Cashflow Budget ( Indirect)

For the year ended December 31, 2017

b. Cashflow Budget ( Budget)

For the year ended December 31, 2017

3. Hoople Corporation

Statement of Cash Flows

For the year ended September 30, 2016

| $ | $ | |

| Net Income | 8,500 | |

| Adjustments to reconcile net income to net cash flows from operations | ||

| Depreciation | 10,000 | |

| Increase in accounts receivable | (13,500) | (3,500) |

| Net cash flows from operating activities | 5,000 | |

| Cash flows from investing activities | 0 | |

| Cash flows from financing activities | 0 | |

| Net increase ( decrease) in cash | 5,000 | |

| Beginning cash balance | 20,000 | |

| Ending cash balance | 25,000 |

Homework Sourse

Homework Sourse