Carson Wentz of Philadelphia determined the following tax in

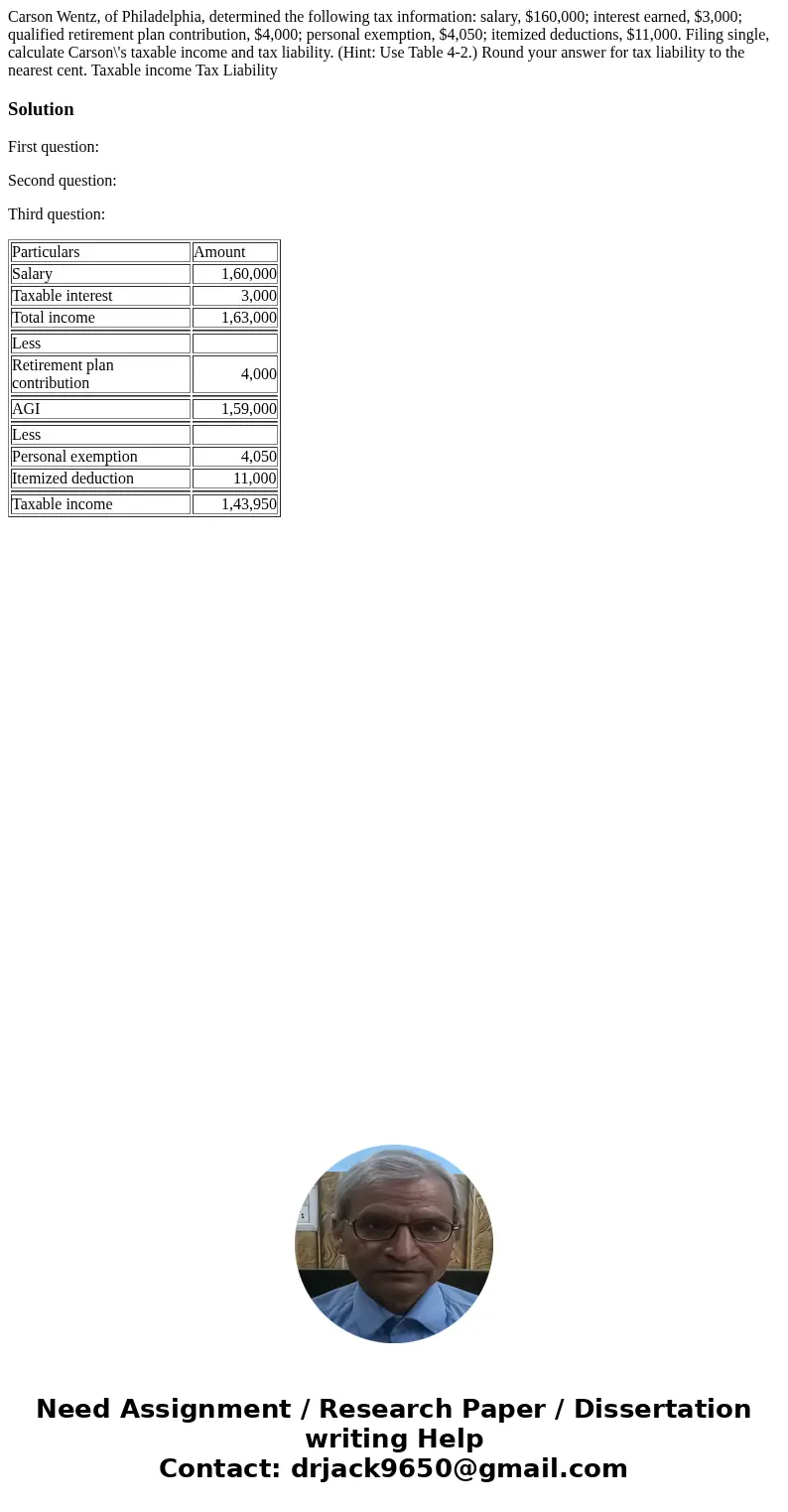

Carson Wentz, of Philadelphia, determined the following tax information: salary, $160,000; interest earned, $3,000; qualified retirement plan contribution, $4,000; personal exemption, $4,050; itemized deductions, $11,000. Filing single, calculate Carson\'s taxable income and tax liability. (Hint: Use Table 4-2.) Round your answer for tax liability to the nearest cent. Taxable income Tax Liability

Solution

First question:

Second question:

Third question:

| Particulars | Amount |

| Salary | 1,60,000 |

| Taxable interest | 3,000 |

| Total income | 1,63,000 |

| Less | |

| Retirement plan contribution | 4,000 |

| AGI | 1,59,000 |

| Less | |

| Personal exemption | 4,050 |

| Itemized deduction | 11,000 |

| Taxable income | 1,43,950 |

Homework Sourse

Homework Sourse