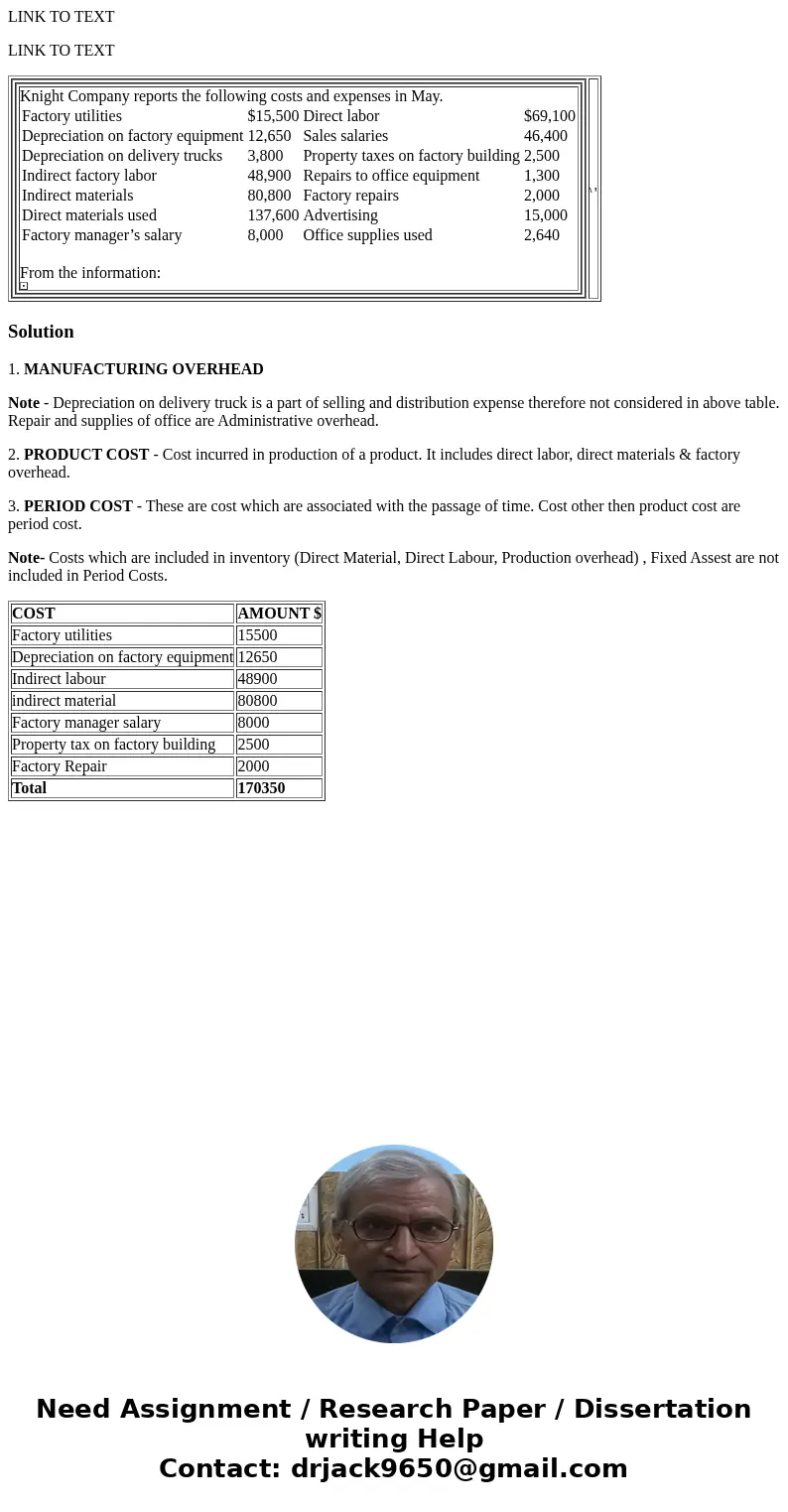

LINK TO TEXT LINK TO TEXT Knight Company reports the followi

LINK TO TEXT

LINK TO TEXT

|

Solution

1. MANUFACTURING OVERHEAD

Note - Depreciation on delivery truck is a part of selling and distribution expense therefore not considered in above table. Repair and supplies of office are Administrative overhead.

2. PRODUCT COST - Cost incurred in production of a product. It includes direct labor, direct materials & factory overhead.

3. PERIOD COST - These are cost which are associated with the passage of time. Cost other then product cost are period cost.

Note- Costs which are included in inventory (Direct Material, Direct Labour, Production overhead) , Fixed Assest are not included in Period Costs.

| COST | AMOUNT $ |

| Factory utilities | 15500 |

| Depreciation on factory equipment | 12650 |

| Indirect labour | 48900 |

| indirect material | 80800 |

| Factory manager salary | 8000 |

| Property tax on factory building | 2500 |

| Factory Repair | 2000 |

| Total | 170350 |

Homework Sourse

Homework Sourse