Points 2 Portfolio betas bF Swxb Portfolio B Portfolio A Ass

Points: /2 Portfolio betas: bF Sw.xb Portfolio B Portfolio A Asset Beta WB 11v 4

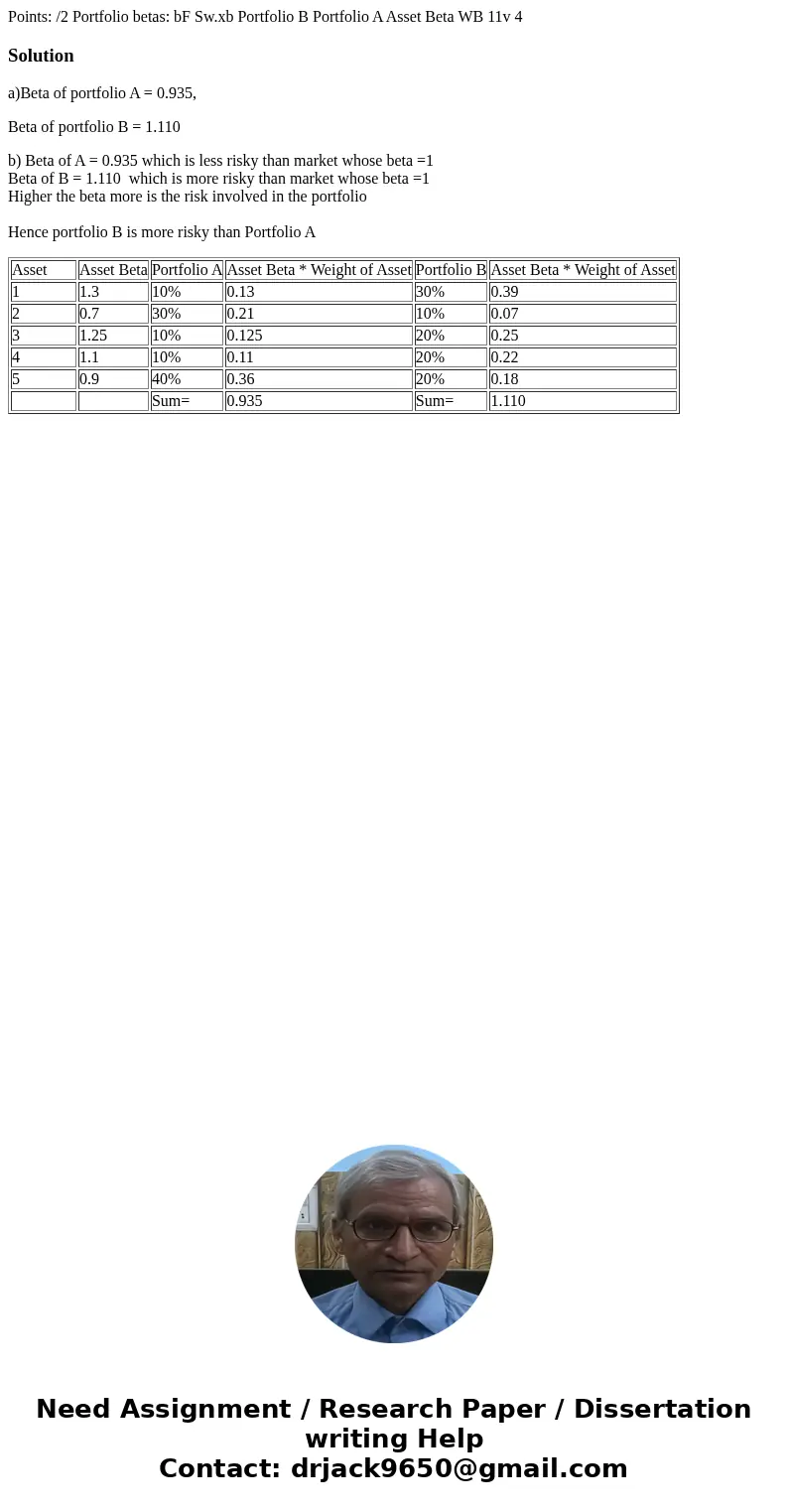

Solution

a)Beta of portfolio A = 0.935,

Beta of portfolio B = 1.110

b) Beta of A = 0.935 which is less risky than market whose beta =1

Beta of B = 1.110 which is more risky than market whose beta =1

Higher the beta more is the risk involved in the portfolio

Hence portfolio B is more risky than Portfolio A

| Asset | Asset Beta | Portfolio A | Asset Beta * Weight of Asset | Portfolio B | Asset Beta * Weight of Asset |

| 1 | 1.3 | 10% | 0.13 | 30% | 0.39 |

| 2 | 0.7 | 30% | 0.21 | 10% | 0.07 |

| 3 | 1.25 | 10% | 0.125 | 20% | 0.25 |

| 4 | 1.1 | 10% | 0.11 | 20% | 0.22 |

| 5 | 0.9 | 40% | 0.36 | 20% | 0.18 |

| Sum= | 0.935 | Sum= | 1.110 |

Homework Sourse

Homework Sourse