Compucat is a Canadian manufacturing company that produces i

Compucat is a Canadian manufacturing company that produces inexpensive personal and laptop computers. The company has been generating progressively more of its sales from foreign markets. During 2016, the company started purchasing most of its components from a supplier in Germany.

To deal with the uncertainty associated with foreign exchange fluctuations, all of Compucat\'s foreign currency denominated receivables and payables are hedged with contracts with the company\'s bank. Compucat\'s year-end is on December 31. The following transactions took place in 2016:

On September 1, 2016, Compucat purchased components from its German supplier for 100,000 Euros. On that date Compucat entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1 Euro = CDN$1.50. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2016.

On December 1, 2016 Compucat also shipped a batch of laptop computers to an American client for US$250,000. The invoice required that Compucat receive its payment in full by January 31, 2017. On the date of the sale, the company entered into a forward contract for US$250,000 at the two-month forward rate of US$1 = CDN$1.25. This forward contract was designated to be a fair value hedge of the amount due from the American customer.

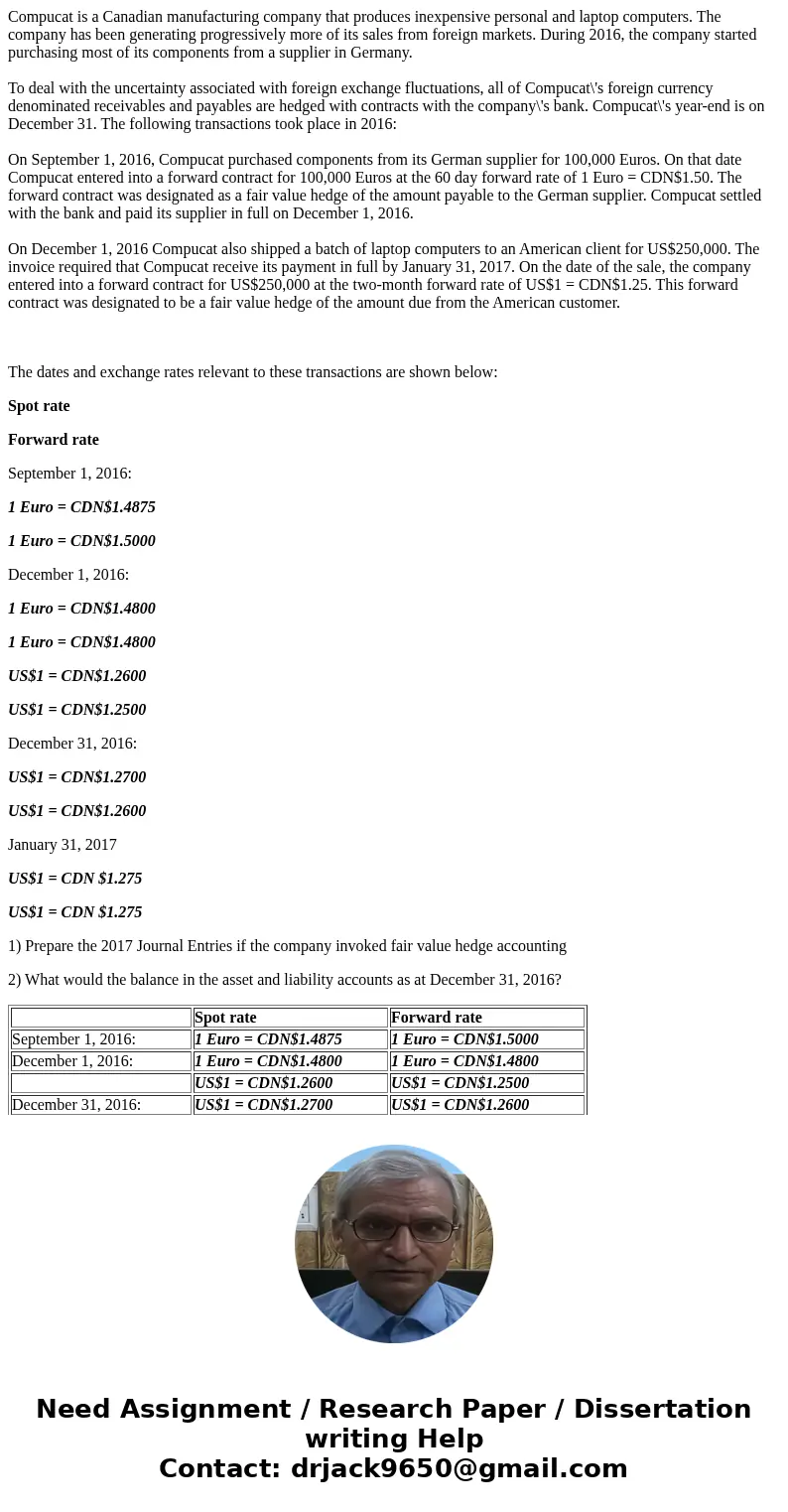

The dates and exchange rates relevant to these transactions are shown below:

Spot rate

Forward rate

September 1, 2016:

1 Euro = CDN$1.4875

1 Euro = CDN$1.5000

December 1, 2016:

1 Euro = CDN$1.4800

1 Euro = CDN$1.4800

US$1 = CDN$1.2600

US$1 = CDN$1.2500

December 31, 2016:

US$1 = CDN$1.2700

US$1 = CDN$1.2600

January 31, 2017

US$1 = CDN $1.275

US$1 = CDN $1.275

1) Prepare the 2017 Journal Entries if the company invoked fair value hedge accounting

2) What would the balance in the asset and liability accounts as at December 31, 2016?

| Spot rate | Forward rate | |

| September 1, 2016: | 1 Euro = CDN$1.4875 | 1 Euro = CDN$1.5000 |

| December 1, 2016: | 1 Euro = CDN$1.4800 | 1 Euro = CDN$1.4800 |

| US$1 = CDN$1.2600 | US$1 = CDN$1.2500 | |

| December 31, 2016: | US$1 = CDN$1.2700 | US$1 = CDN$1.2600 |

| January 31, 2017 | US$1 = CDN $1.275 | US$1 = CDN $1.275 |

Solution

1) Prepare the 2017 Journal Entries if the company invoked fair value hedge accounting.

Answer: Journal Entries

September 1, 2016: Debit Amount Credit Amount

Inventory a/c...........................dr. CDN$148,750

To Accounts Payable ac CDN$148,750

(Being Inventory purchased for Euros 100,000 * CDN $1.4875 on account )

Forward Contract a/c..............dr CDN$150,000

To Payable to Bank a/c CDN$150,000

(Being entered into a forward contract on the same day for fwd exchange rate of CDN$1.50 )

December 1, 2016:

Accounts Receivable a/c.........dr CDN$315,000

To Sales a/c CDN $315,000

(Being sale of inventory to US worth USD$ 25000 converted to CDN $ @ 1.26)

Receivable from Bank a/c.......dr $312,500

To forward contract a/c $312,500

(Being hedged the position by entering into a forward contract @1.25 )

Accounts Payable a/c.............dr $750

To Gain in Exchange a/c $750

(Being gain in the exchange recorded for payment made 148,000 instead of 148,750 )

Loss in Exchange a/c.............dr $2,000

To Forward contract a/c $2,000

(Being loss in exchange recorded from contract received 148000 instead of 150000 )

Payable to Bank a/c...............dr $150,000

To Cash a/c $150,000

(Being settlement done with bank, paid amount in full )

Cash a/c......................dr $148,000

To Forward Contract a/c $148,000

(Being forward contract settled for cash )

December 31, 2016:

Accounts Receivable a/c.........dr $2,500

To Gain in Exchange a/c $2,500

(Being gain in exchange recorded for receivables )

Loss in Exchange a/c..............dr $2,500

To Forward Contract a/c $2,500

(Being loss in forward contrat recorded )

January

2) What would the balance in the asset and liability accounts as at December 31, 2016?

Answer:

Balance in the asset and liability accounts as at December 31, 2016:

Compucat Inc.

Asset and Liability Account as at 31st December, 2016

Assets: Amount

Accounts Receivable $317,500

Liabilities:

Forward Contract $1250

(Receivables from Bank: $250,000@ $1.25 = $312,500)

(Less: Forward Contract $250,000 @ $1.26 = $315,000)

Deferred foreign exchang Credit $2,500

Homework Sourse

Homework Sourse