Montoure Company uses a perpetual inventory system It entere

Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions. (For specific identification, units sold consist of 600 units from beginning inventory, 300 from the February 10 purchase, 200 from the March 13 purchase, 50 from the August 21 purchase, and 250 from the September 5 purchase.) Date Activities Units Acquired at Cost Units Sold at Retail Jan. 1 Beginning inventory 600 units @ $45.00 per unit Feb. 10 Purchase 400 units @ $42.00 per unit Mar. 13 Purchase 200 units @ $27.00 per unit Mar. 15 Sales 800 units @ $75.00 per unit Aug. 21 Purchase 100 units @ $50.00 per unit Sept. 5 Purchase 500 units @ $46.00 per unit Sept. 10 Sales 600 units @ $75.00 per unit Totals 1,800 units 1,400 units Required 1.Compute cost of goods available for sale and the number of units available for sale. 2.Compute the number of units in ending inventory. 3.Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to cents.) Check (3) Ending inventory: FIFO, $18,400; LIFO, $18,000; WA, $17,760 4.Compute gross profit earned by the company for each of the four costing methods in part 3. (4) LIFO gross profit, $45,800

Solution

Answer

Purchase

Units

Rate

Amount

Feb-10

400

42

16800

Mar-13

200

27

5400

Aug-21

100

50

5000

Sep-05

500

46

23000

Total

1200

50200

Sales

Units

Rate

Amount

Mar-15

800

75

60000

Sep-10

600

75

45000

0

Total

1400

105000

Cost of Goods Available for Sale = Opening Inventory + Purchases

= 27000 + 50200 = $77,200

Closing Inventory = Opening Inventory + Purchased units - Sold Units

= 600 + 1200 – 1400 = 400 units

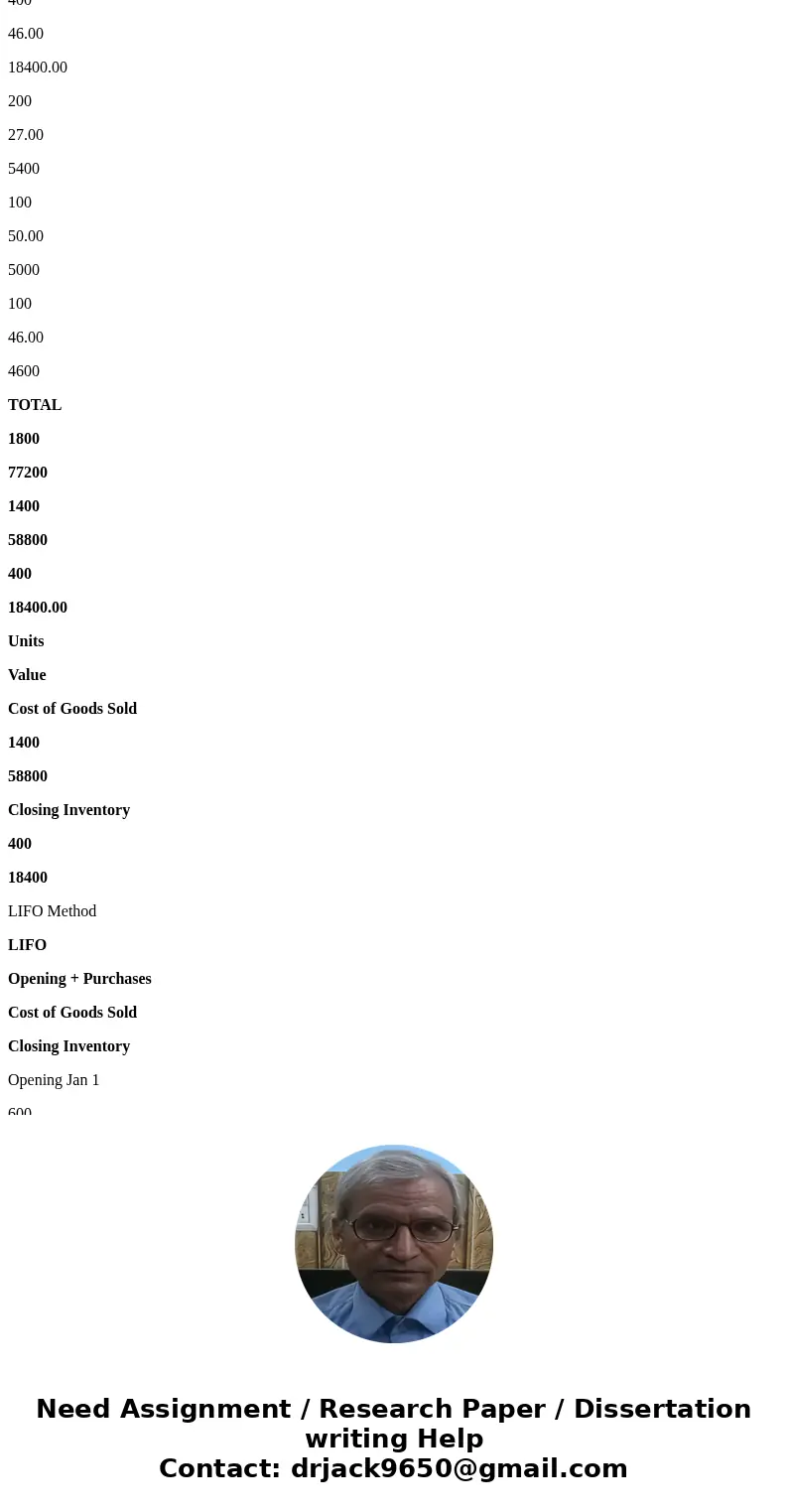

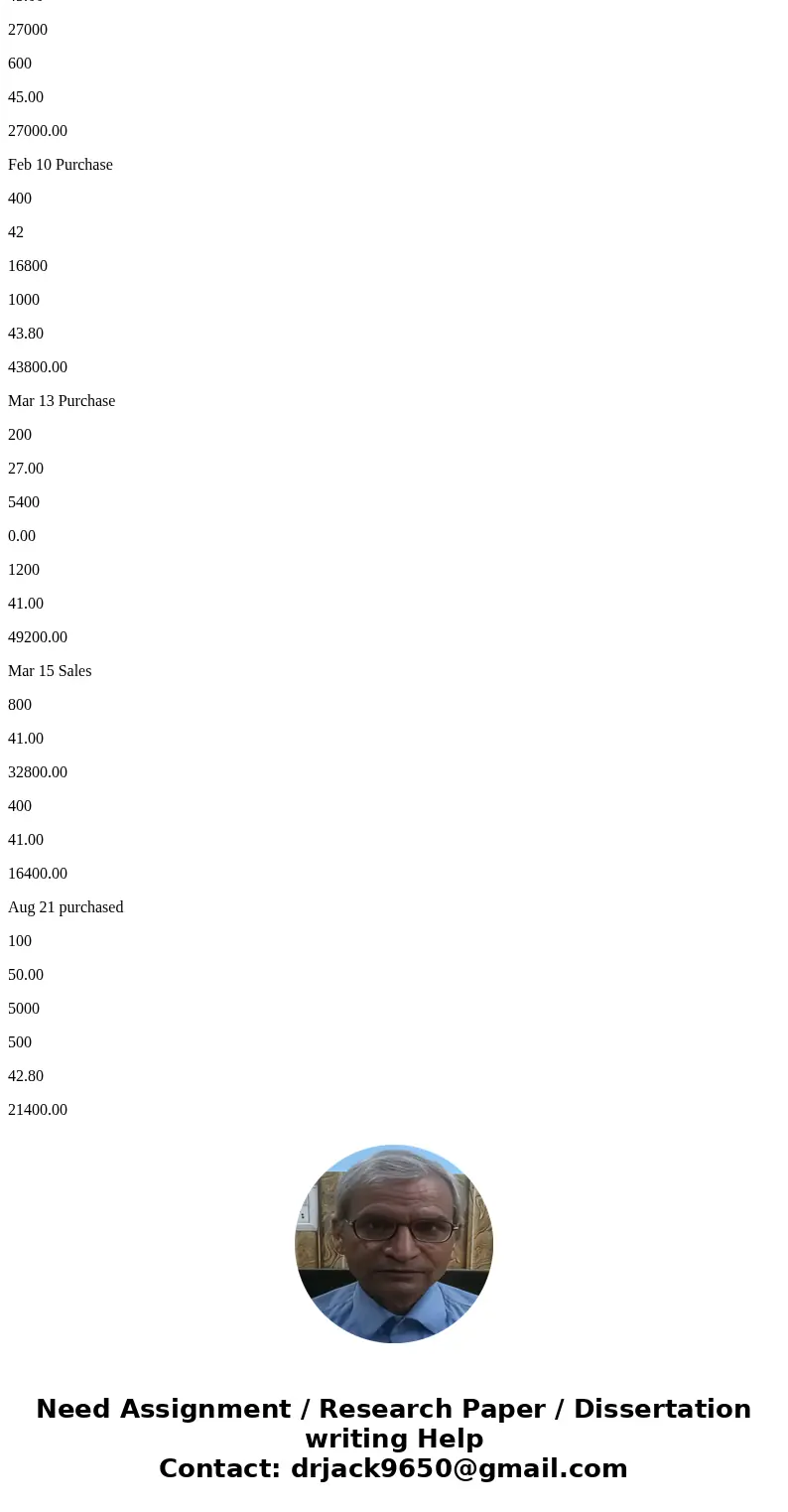

First, FIFO

FIFO

Opening + Purchases

Cost of Goods Sold

Closing Inventory

Opening Jan 1

600

45.00

27000

600

45.00

27000.00

Feb 10 Purchase

400

42.00

16800

600

45.00

27000.00

400

42.00

16800.00

Mar 13 Purchase

200

27.00

5400

600

45.00

27000.00

400

42.00

16800.00

200

27.00

5400.00

Mar 15 Sales

600

45.00

27000

200

42.00

8400.00

200

42.00

8400

200

27.00

5400.00

Aug 21 purchased

100

50.00

5000

200

42.00

8400.00

200

27.00

5400.00

100

50.00

5000.00

Sept 5 Purchase

500

46.00

23000

200

42.00

8400.00

200

27.00

5400.00

100

50.00

5000.00

500

46.00

23000.00

Sep 10 Sales

200

42.00

8400

400

46.00

18400.00

200

27.00

5400

100

50.00

5000

100

46.00

4600

TOTAL

1800

77200

1400

58800

400

18400.00

Units

Value

Cost of Goods Sold

1400

58800

Closing Inventory

400

18400

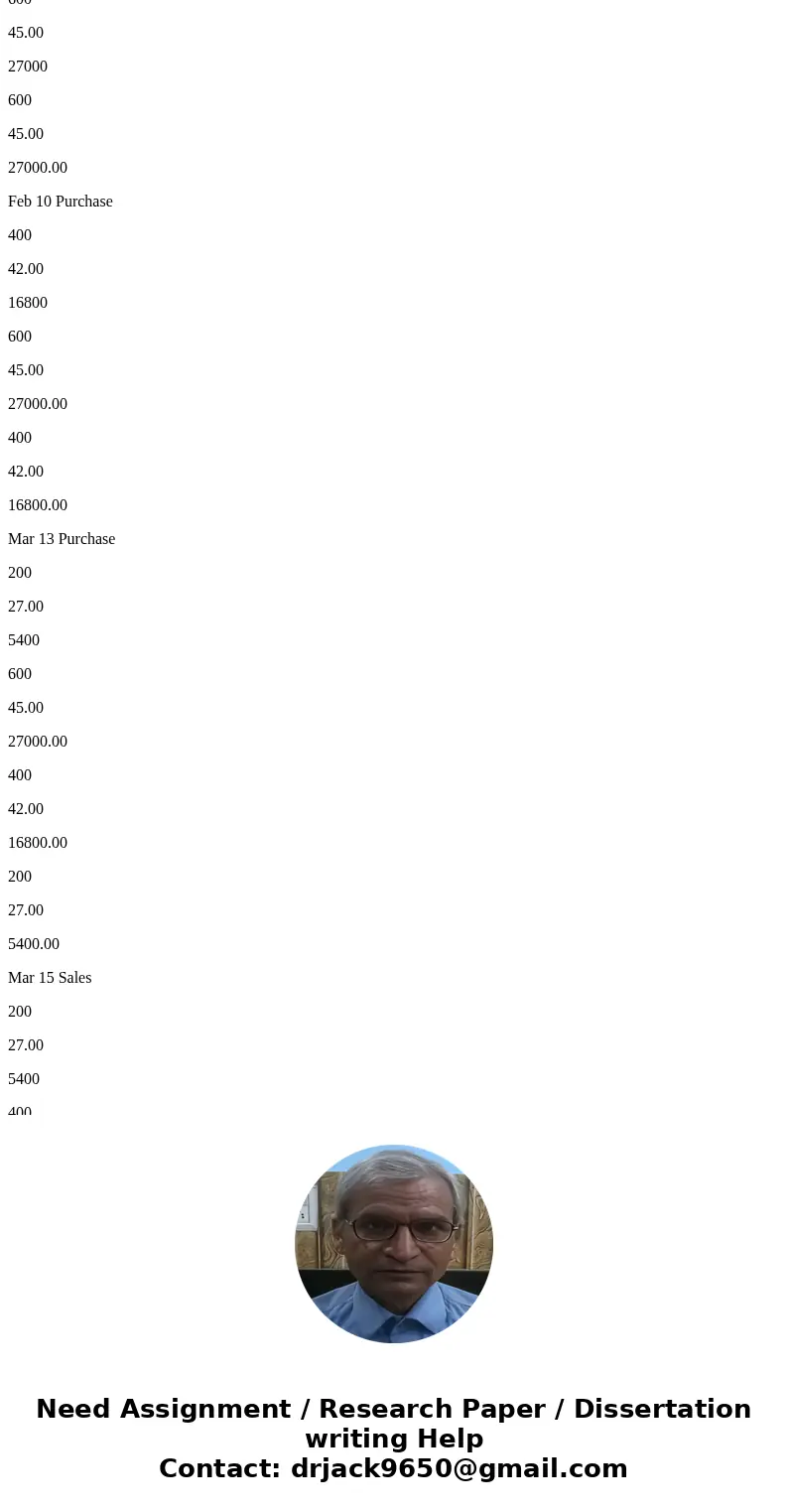

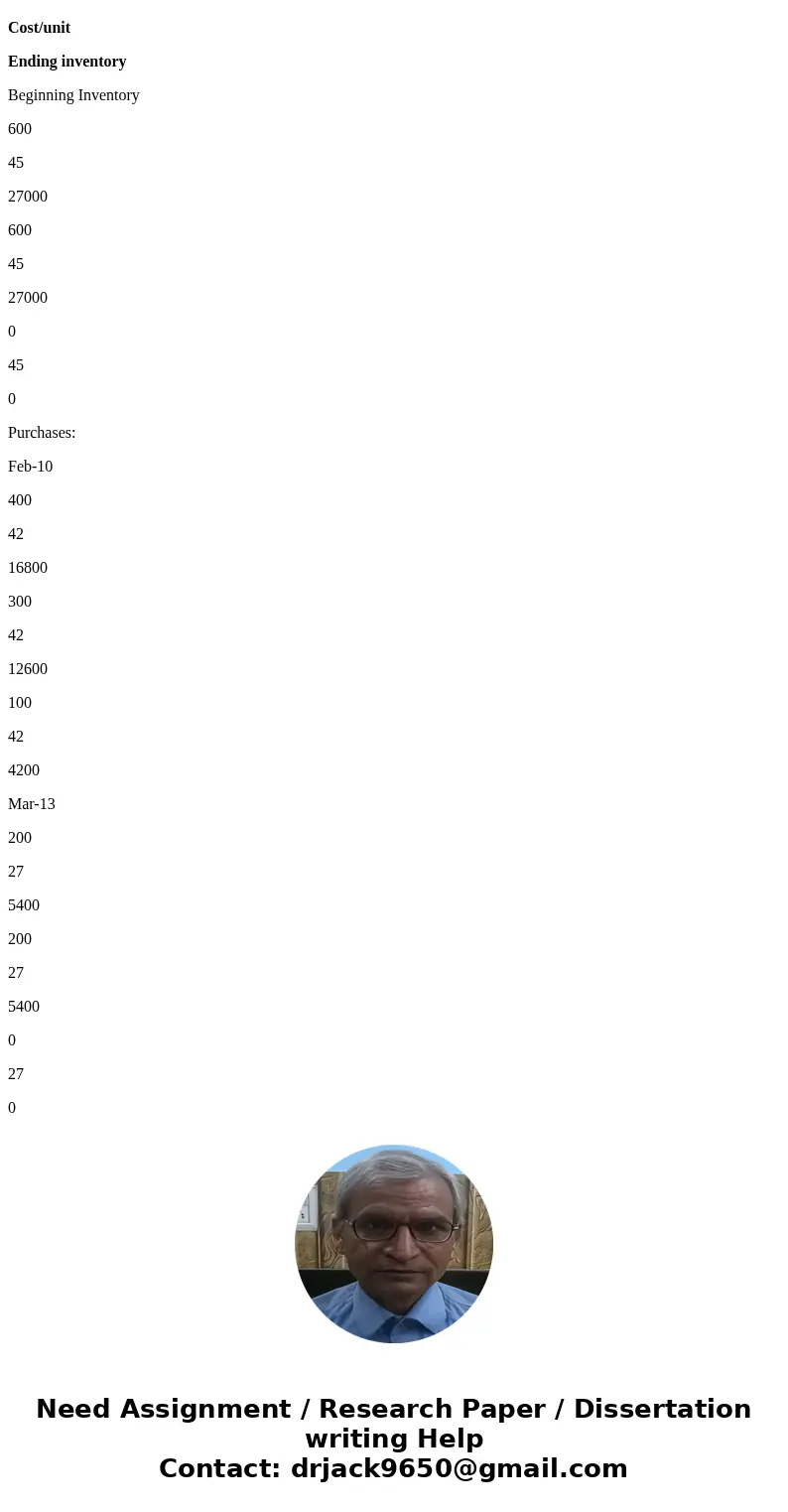

LIFO Method

LIFO

Opening + Purchases

Cost of Goods Sold

Closing Inventory

Opening Jan 1

600

45.00

27000

600

45.00

27000.00

Feb 10 Purchase

400

42.00

16800

600

45.00

27000.00

400

42.00

16800.00

Mar 13 Purchase

200

27.00

5400

600

45.00

27000.00

400

42.00

16800.00

200

27.00

5400.00

Mar 15 Sales

200

27.00

5400

400

45.00

18000.00

400

42.00

16800

0.00

200

45.00

9000

Aug 21 purchased

100

50.00

5000

400

45.00

18000.00

100

50.00

5000.00

0.00

Sept 5 Purchase

500

46.00

23000

400

45.00

18000.00

100

50.00

5000.00

500

46.00

23000.00

Sep 10 Sales

500

46.00

23000

400

45.00

18000.00

100

50.00

5000

TOTAL

1800

77200.00

1400

59200.00

400

18000.00

Units

Value

Cost of Goods Sold

1400

59200

Closing Inventory

400

18000

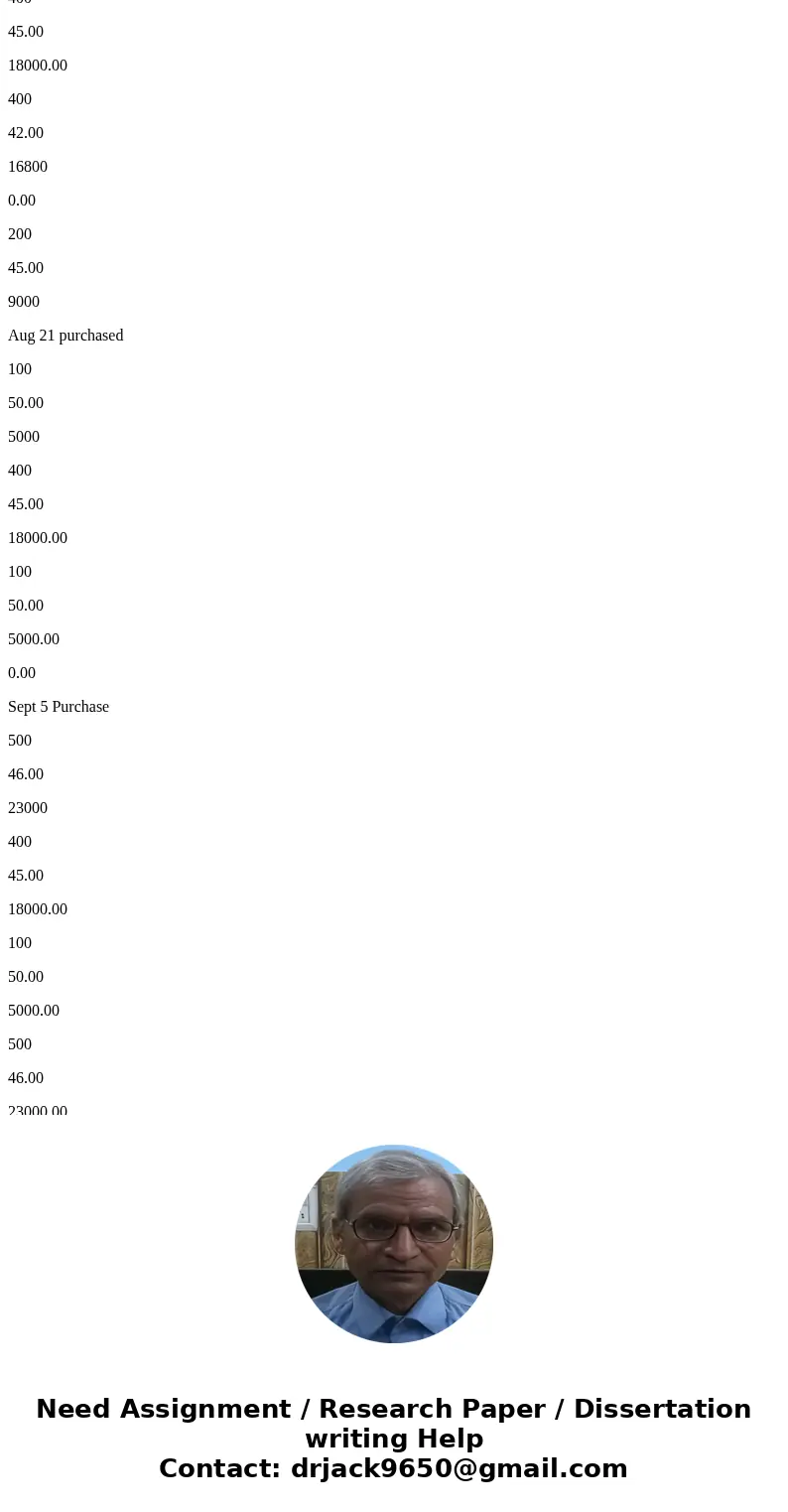

Weighted Average

Moving Average cost

Opening + Purchases

Cost of Goods Sold

Closing Inventory

Opening Jan 1

600

45.00

27000

600

45.00

27000.00

Feb 10 Purchase

400

42

16800

1000

43.80

43800.00

Mar 13 Purchase

200

27.00

5400

0.00

1200

41.00

49200.00

Mar 15 Sales

800

41.00

32800.00

400

41.00

16400.00

Aug 21 purchased

100

50.00

5000

500

42.80

21400.00

Sept 5 Purchase

500

46

23000

1000

44.40

44400.00

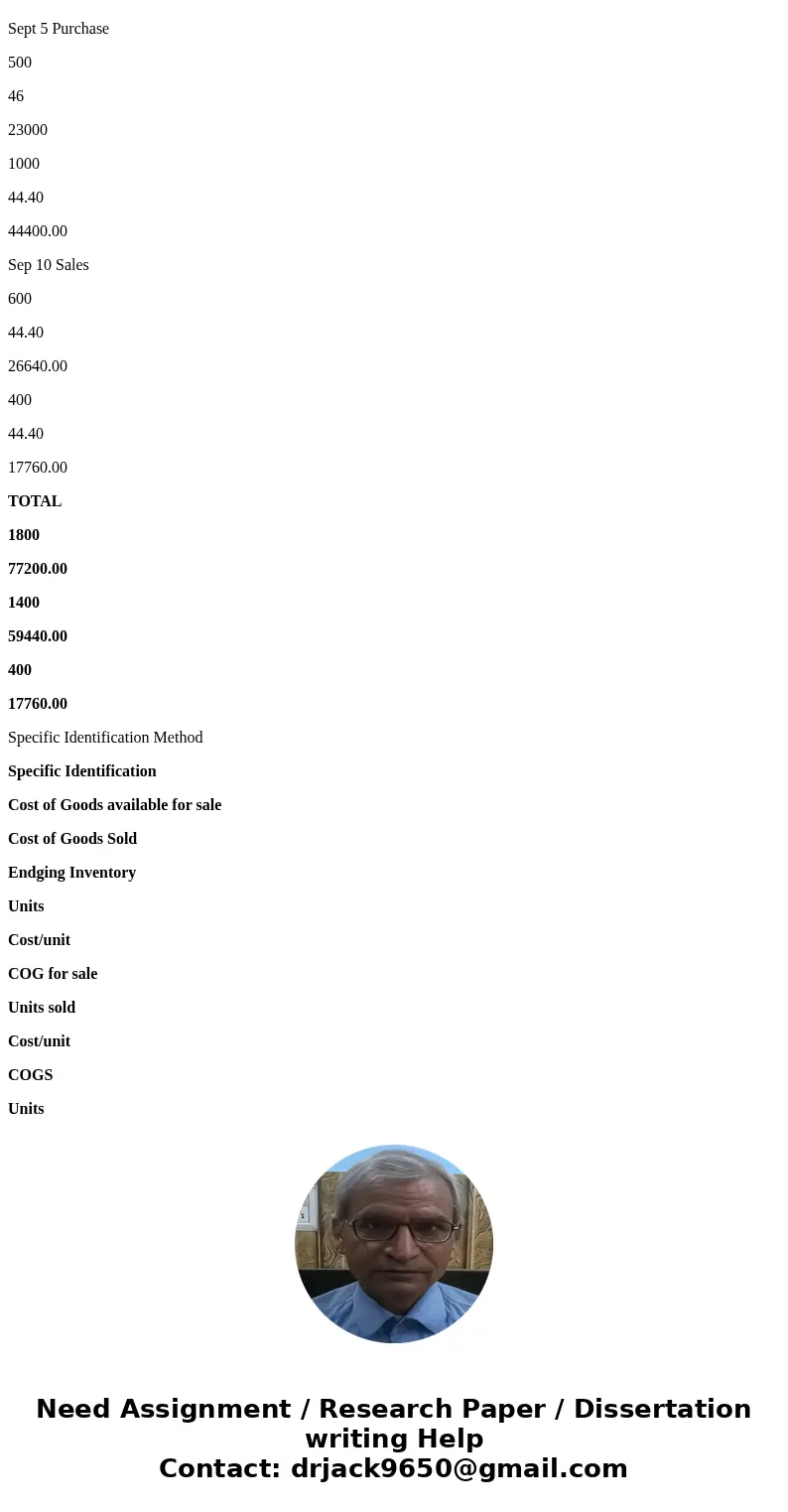

Sep 10 Sales

600

44.40

26640.00

400

44.40

17760.00

TOTAL

1800

77200.00

1400

59440.00

400

17760.00

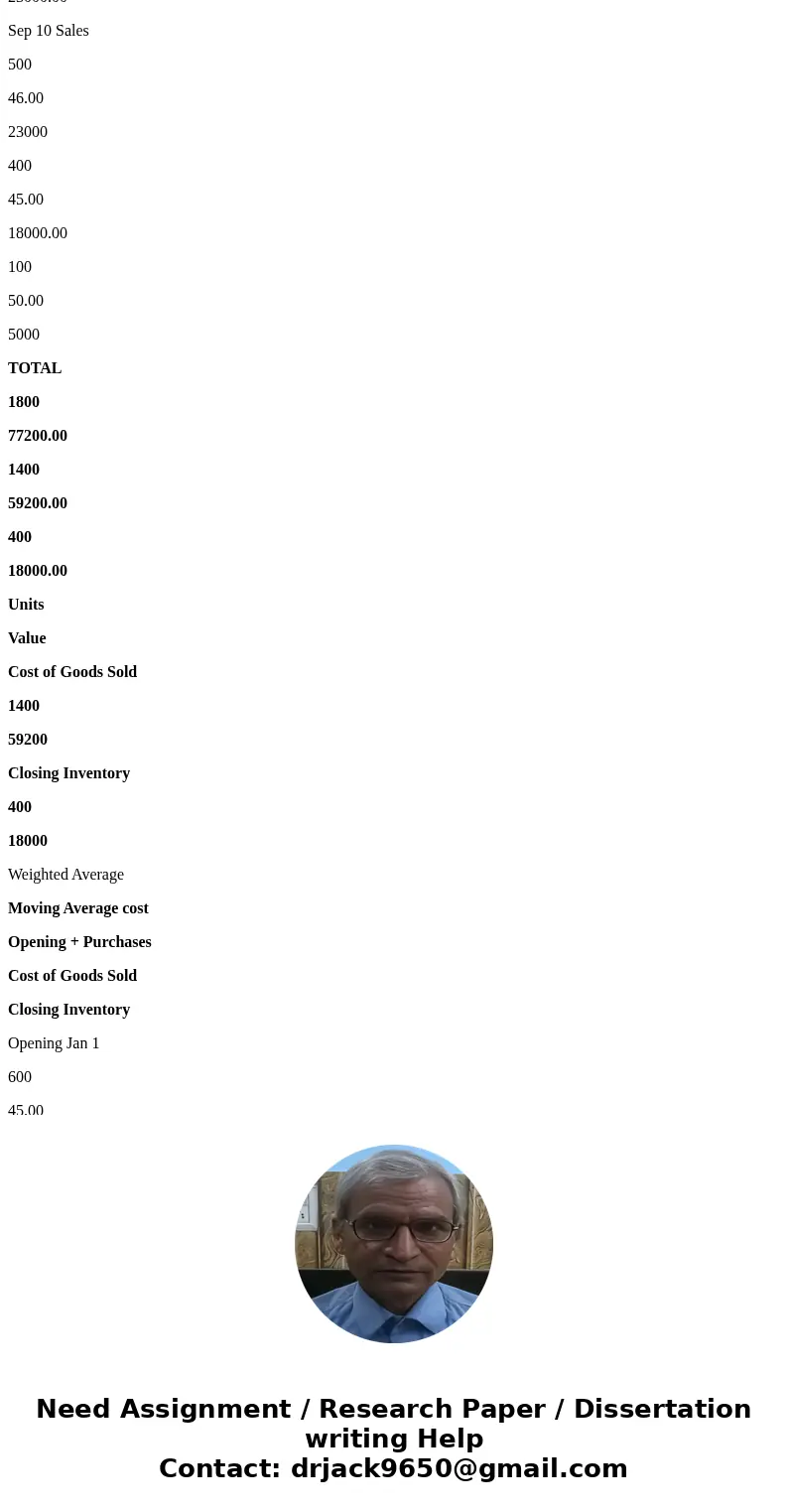

Specific Identification Method

Specific Identification

Cost of Goods available for sale

Cost of Goods Sold

Endging Inventory

Units

Cost/unit

COG for sale

Units sold

Cost/unit

COGS

Units

Cost/unit

Ending inventory

Beginning Inventory

600

45

27000

600

45

27000

0

45

0

Purchases:

Feb-10

400

42

16800

300

42

12600

100

42

4200

Mar-13

200

27

5400

200

27

5400

0

27

0

Aug-21

100

50

5000

50

50

2500

50

50

2500

Sep-05

500

46

23000

250

46

11500

250

46

11500

TOTAL

1800

77200

1400

59000

400

18200

FIFO

LIFO

WA

Specific Identification

Sales

105000

105000

105000

105000

Cost of Goods Sold as calculated above

58800

59200

59440

59000

Gross Profit

46200

45800

45560

46000

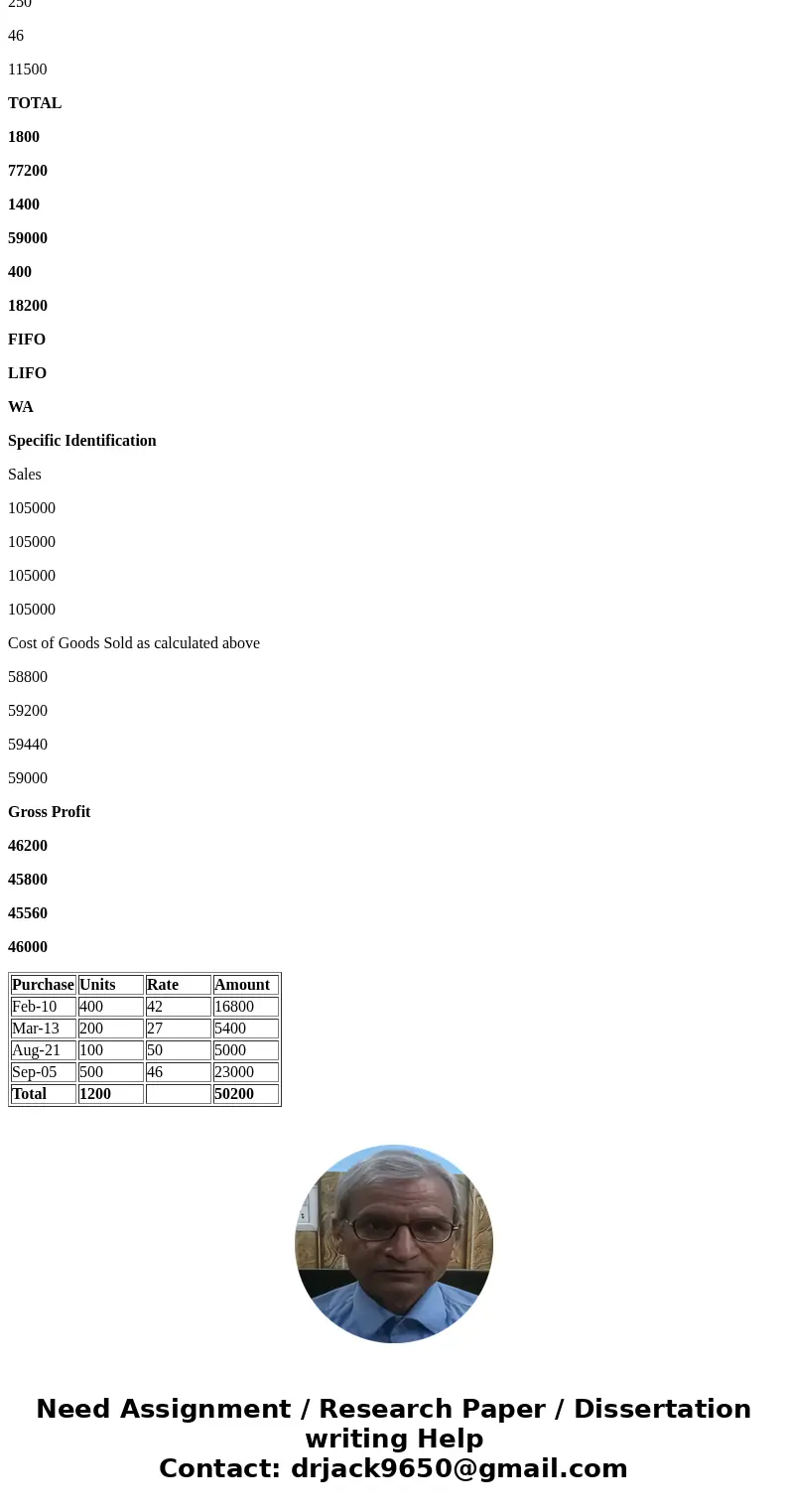

| Purchase | Units | Rate | Amount |

| Feb-10 | 400 | 42 | 16800 |

| Mar-13 | 200 | 27 | 5400 |

| Aug-21 | 100 | 50 | 5000 |

| Sep-05 | 500 | 46 | 23000 |

| Total | 1200 | 50200 |

Homework Sourse

Homework Sourse