Due to erratic sales of its sole product a high capacity bat

Due to erratic sales of its sole product— a high- capacity battery for laptop computers— PEM, Inc., has been experiencing difficulty for some time. The company’s contribution format income statement for the most recent month is given below:

Sales ( 19,500 units 3 $ 30 per unit) . . . . . . . . . $ 585,000

Variable expenses . . . . . . . . . . . . . . . . . . . . . . 409,500

Contribution margin . . . . . . . . . . . . . . . . . . . . . 175,500

Fixed expenses . . . . . . . . . . . . . . . . . . . . . . . . 180,000

Net operating loss . . . . . . . . . . . . . . . . . . . . . . $ ( 4,500 )

5. Refer to the original data. By automating, the company could reduce variable expenses by $ 3 per unit. However, fixed expenses would increase by $ 72,000 each month.

a. Compute the new CM ratio and the new break- even point in both unit sales and dollar sales.

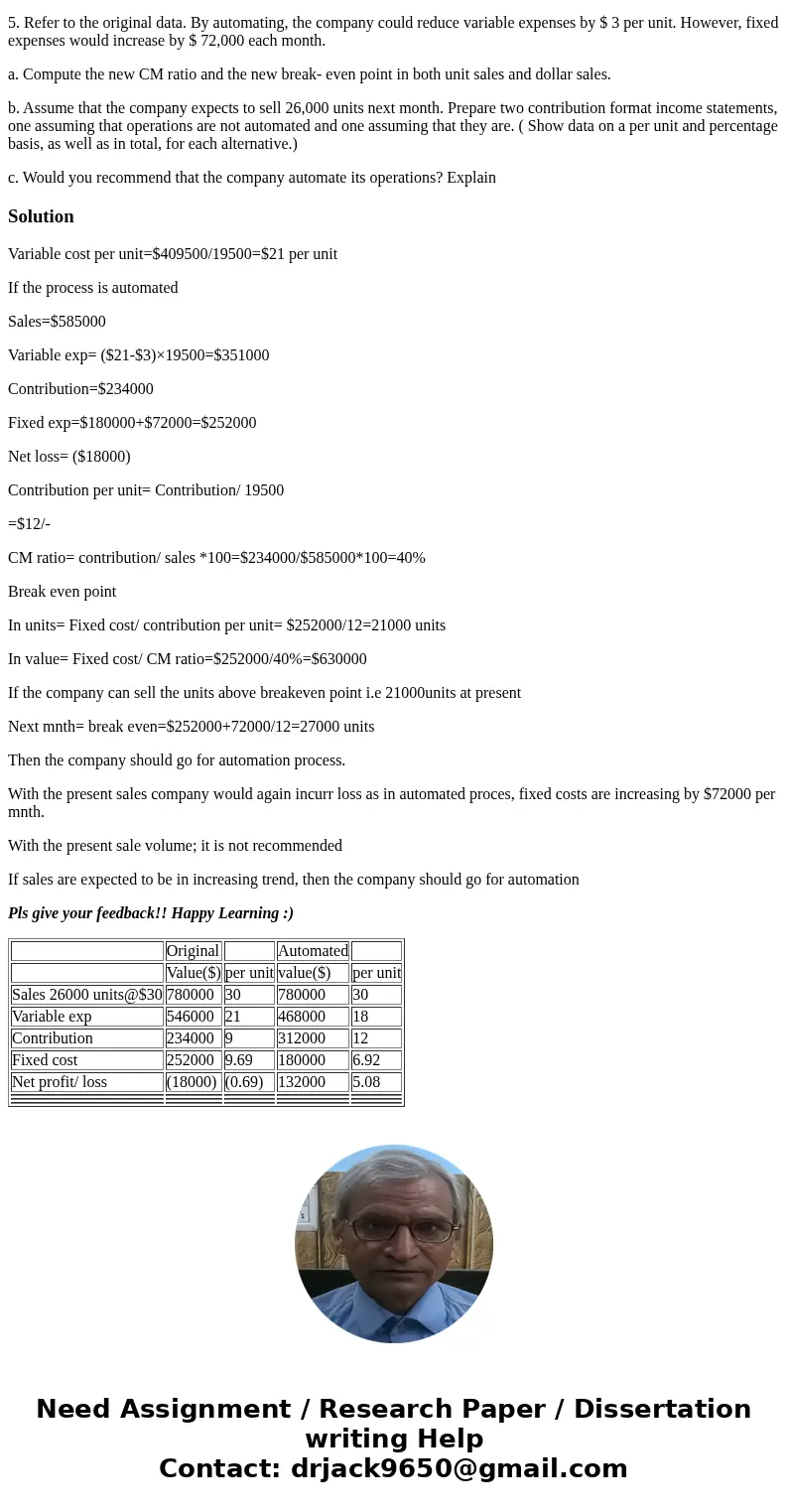

b. Assume that the company expects to sell 26,000 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. ( Show data on a per unit and percentage basis, as well as in total, for each alternative.)

c. Would you recommend that the company automate its operations? Explain

Solution

Variable cost per unit=$409500/19500=$21 per unit

If the process is automated

Sales=$585000

Variable exp= ($21-$3)×19500=$351000

Contribution=$234000

Fixed exp=$180000+$72000=$252000

Net loss= ($18000)

Contribution per unit= Contribution/ 19500

=$12/-

CM ratio= contribution/ sales *100=$234000/$585000*100=40%

Break even point

In units= Fixed cost/ contribution per unit= $252000/12=21000 units

In value= Fixed cost/ CM ratio=$252000/40%=$630000

If the company can sell the units above breakeven point i.e 21000units at present

Next mnth= break even=$252000+72000/12=27000 units

Then the company should go for automation process.

With the present sales company would again incurr loss as in automated proces, fixed costs are increasing by $72000 per mnth.

With the present sale volume; it is not recommended

If sales are expected to be in increasing trend, then the company should go for automation

Pls give your feedback!! Happy Learning :)

| Original | Automated | |||

| Value($) | per unit | value($) | per unit | |

| Sales 26000 units@$30 | 780000 | 30 | 780000 | 30 |

| Variable exp | 546000 | 21 | 468000 | 18 |

| Contribution | 234000 | 9 | 312000 | 12 |

| Fixed cost | 252000 | 9.69 | 180000 | 6.92 |

| Net profit/ loss | (18000) | (0.69) | 132000 | 5.08 |

Homework Sourse

Homework Sourse