Youre evaluating a project with the following cash flows ini

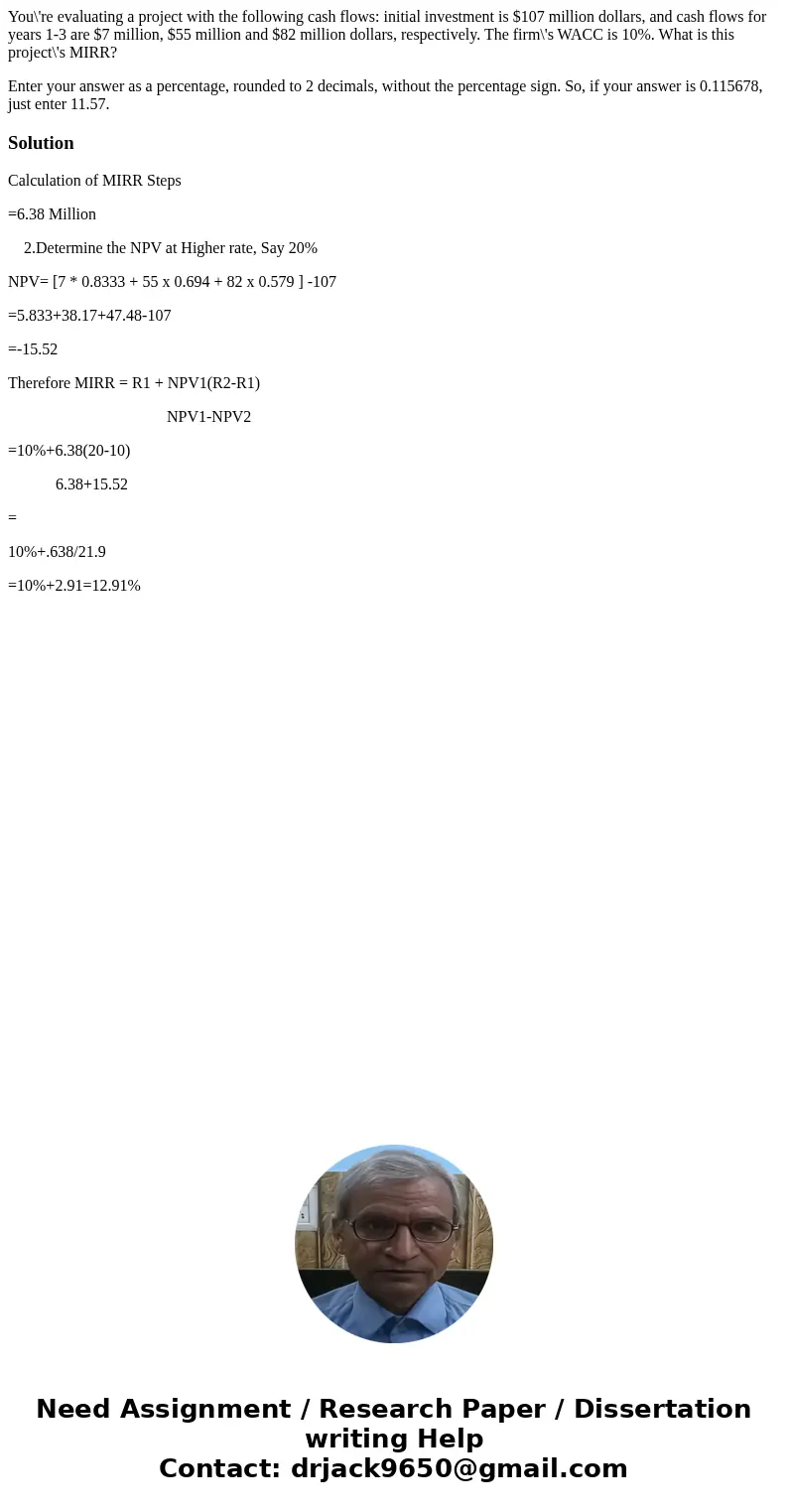

You\'re evaluating a project with the following cash flows: initial investment is $107 million dollars, and cash flows for years 1-3 are $7 million, $55 million and $82 million dollars, respectively. The firm\'s WACC is 10%. What is this project\'s MIRR?

Enter your answer as a percentage, rounded to 2 decimals, without the percentage sign. So, if your answer is 0.115678, just enter 11.57.

Solution

Calculation of MIRR Steps

=6.38 Million

2.Determine the NPV at Higher rate, Say 20%

NPV= [7 * 0.8333 + 55 x 0.694 + 82 x 0.579 ] -107

=5.833+38.17+47.48-107

=-15.52

Therefore MIRR = R1 + NPV1(R2-R1)

NPV1-NPV2

=10%+6.38(20-10)

6.38+15.52

=

10%+.638/21.9

=10%+2.91=12.91%

Homework Sourse

Homework Sourse