Consider a Treasury Bond with a 1000 face value 15 years to

Solution

Price of a bond is the present value of all future cash flows receivable from the bond discounted at current market interest rates

Cash flows from bond are periodic interest and maturity value

When interest is paid semi-annually, discount rate is divided by 2 and time period is multiplied by 2

Periodic interest

= Principal x Rate x Time / 12 months

= $1,000 x 6% x 6 / 12

= $30 every 6 months

Present value factor

= 1 / (1 + r) ^ n

Where,

r = Market rate of interest every 6 month = Annual rate / 2 = 5 / 2 = 2.5% or 0.025

n = Time period = Number of years x 2 = 15 x 2 = 30 semi-annual periods

So, PV Factor for n = 2 will be

= 1 / (1.025) ^ 2

= 1 / 1.050625

= 0.951814

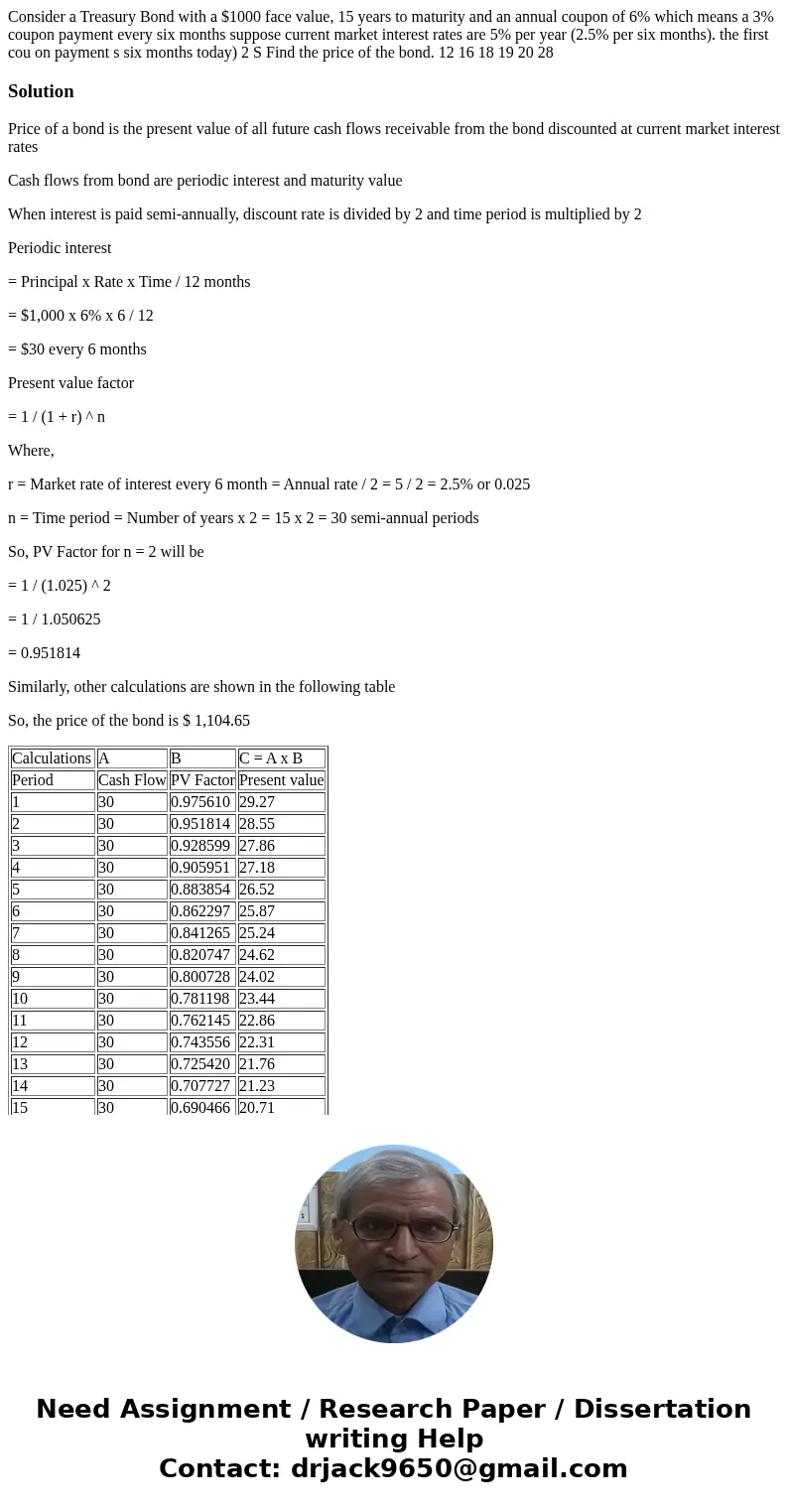

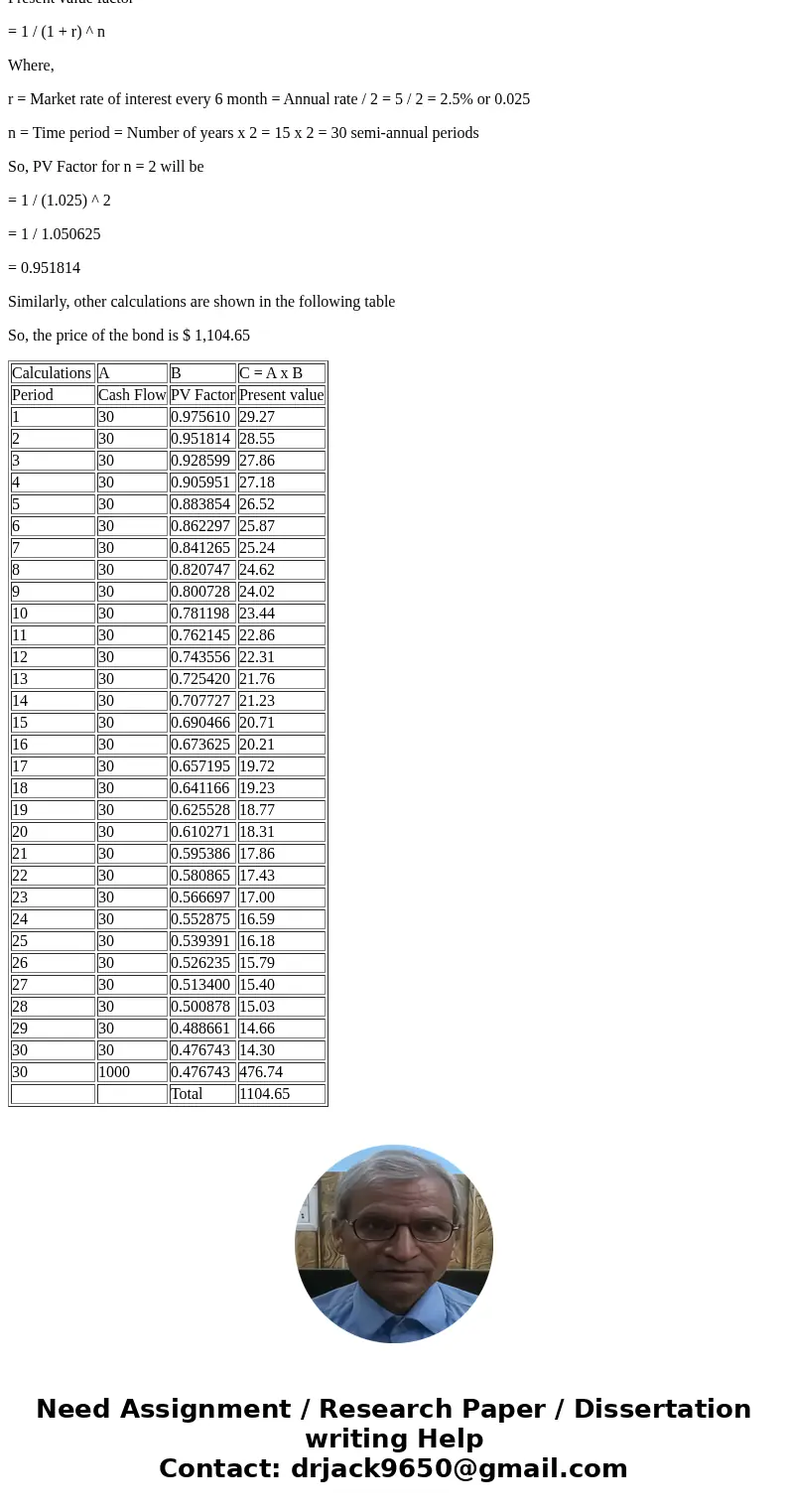

Similarly, other calculations are shown in the following table

So, the price of the bond is $ 1,104.65

| Calculations | A | B | C = A x B |

| Period | Cash Flow | PV Factor | Present value |

| 1 | 30 | 0.975610 | 29.27 |

| 2 | 30 | 0.951814 | 28.55 |

| 3 | 30 | 0.928599 | 27.86 |

| 4 | 30 | 0.905951 | 27.18 |

| 5 | 30 | 0.883854 | 26.52 |

| 6 | 30 | 0.862297 | 25.87 |

| 7 | 30 | 0.841265 | 25.24 |

| 8 | 30 | 0.820747 | 24.62 |

| 9 | 30 | 0.800728 | 24.02 |

| 10 | 30 | 0.781198 | 23.44 |

| 11 | 30 | 0.762145 | 22.86 |

| 12 | 30 | 0.743556 | 22.31 |

| 13 | 30 | 0.725420 | 21.76 |

| 14 | 30 | 0.707727 | 21.23 |

| 15 | 30 | 0.690466 | 20.71 |

| 16 | 30 | 0.673625 | 20.21 |

| 17 | 30 | 0.657195 | 19.72 |

| 18 | 30 | 0.641166 | 19.23 |

| 19 | 30 | 0.625528 | 18.77 |

| 20 | 30 | 0.610271 | 18.31 |

| 21 | 30 | 0.595386 | 17.86 |

| 22 | 30 | 0.580865 | 17.43 |

| 23 | 30 | 0.566697 | 17.00 |

| 24 | 30 | 0.552875 | 16.59 |

| 25 | 30 | 0.539391 | 16.18 |

| 26 | 30 | 0.526235 | 15.79 |

| 27 | 30 | 0.513400 | 15.40 |

| 28 | 30 | 0.500878 | 15.03 |

| 29 | 30 | 0.488661 | 14.66 |

| 30 | 30 | 0.476743 | 14.30 |

| 30 | 1000 | 0.476743 | 476.74 |

| Total | 1104.65 |

Homework Sourse

Homework Sourse