Quiz Chapter C5 Quiz Submit Qui This Question 1 pt 7 of 7 3

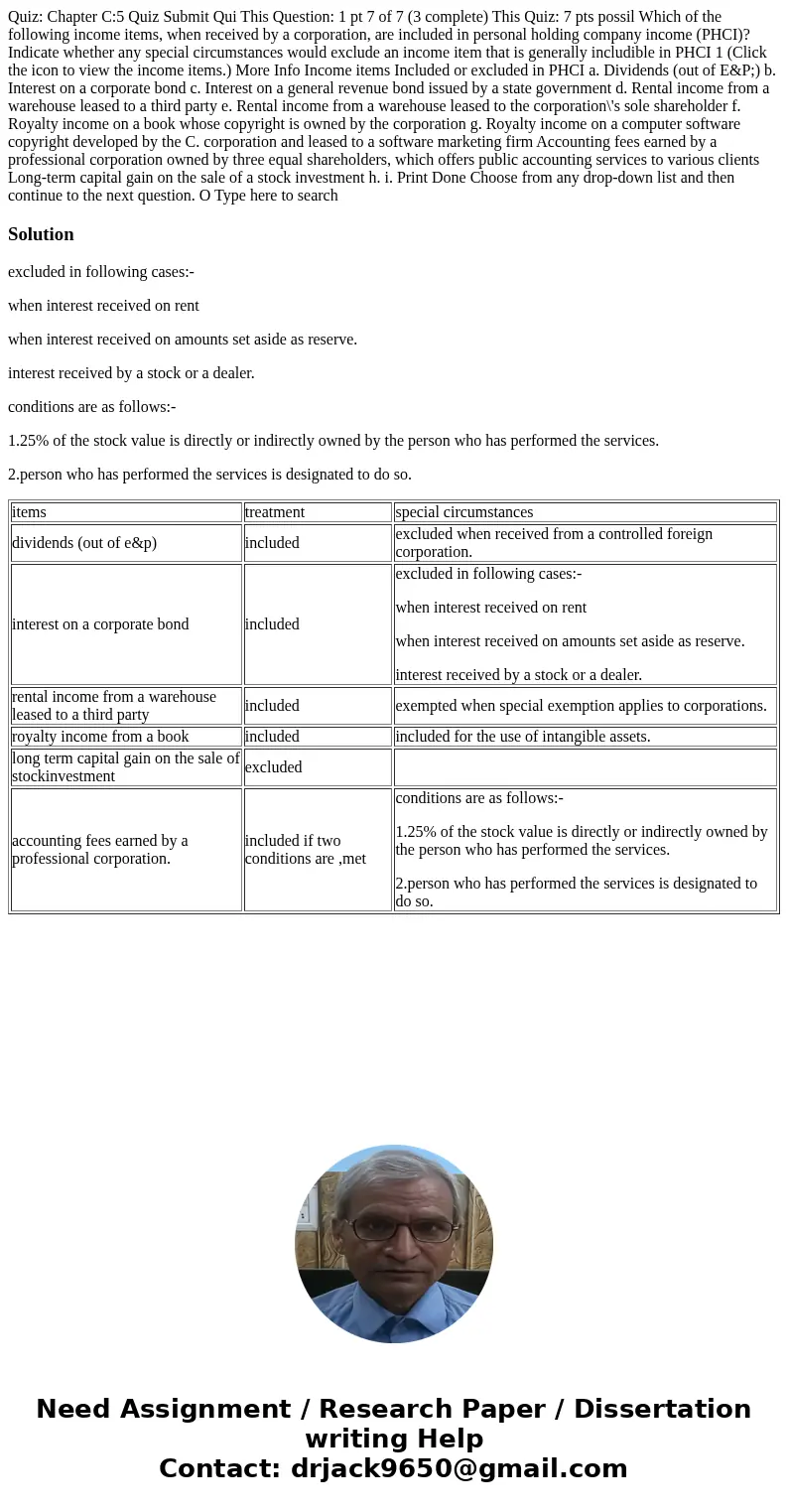

Quiz: Chapter C:5 Quiz Submit Qui This Question: 1 pt 7 of 7 (3 complete) This Quiz: 7 pts possil Which of the following income items, when received by a corporation, are included in personal holding company income (PHCI)? Indicate whether any special circumstances would exclude an income item that is generally includible in PHCI 1 (Click the icon to view the income items.) More Info Income items Included or excluded in PHCI a. Dividends (out of E&P;) b. Interest on a corporate bond c. Interest on a general revenue bond issued by a state government d. Rental income from a warehouse leased to a third party e. Rental income from a warehouse leased to the corporation\'s sole shareholder f. Royalty income on a book whose copyright is owned by the corporation g. Royalty income on a computer software copyright developed by the C. corporation and leased to a software marketing firm Accounting fees earned by a professional corporation owned by three equal shareholders, which offers public accounting services to various clients Long-term capital gain on the sale of a stock investment h. i. Print Done Choose from any drop-down list and then continue to the next question. O Type here to search

Solution

excluded in following cases:-

when interest received on rent

when interest received on amounts set aside as reserve.

interest received by a stock or a dealer.

conditions are as follows:-

1.25% of the stock value is directly or indirectly owned by the person who has performed the services.

2.person who has performed the services is designated to do so.

| items | treatment | special circumstances |

| dividends (out of e&p) | included | excluded when received from a controlled foreign corporation. |

| interest on a corporate bond | included | excluded in following cases:- when interest received on rent when interest received on amounts set aside as reserve. interest received by a stock or a dealer. |

| rental income from a warehouse leased to a third party | included | exempted when special exemption applies to corporations. |

| royalty income from a book | included | included for the use of intangible assets. |

| long term capital gain on the sale of stockinvestment | excluded | |

| accounting fees earned by a professional corporation. | included if two conditions are ,met | conditions are as follows:- 1.25% of the stock value is directly or indirectly owned by the person who has performed the services. 2.person who has performed the services is designated to do so. |

Homework Sourse

Homework Sourse