23 The following net cash flows are projected for two separa

Solution

23

(a) Payback Period :-

Project A

Since cash flow follows an annuity the pay back period would be = Cost of Project/Annuity

= 150000/30000

Project A Pay back Period = 5 years

Project B

Pay Back Period = 400000/100000 = 4 years.

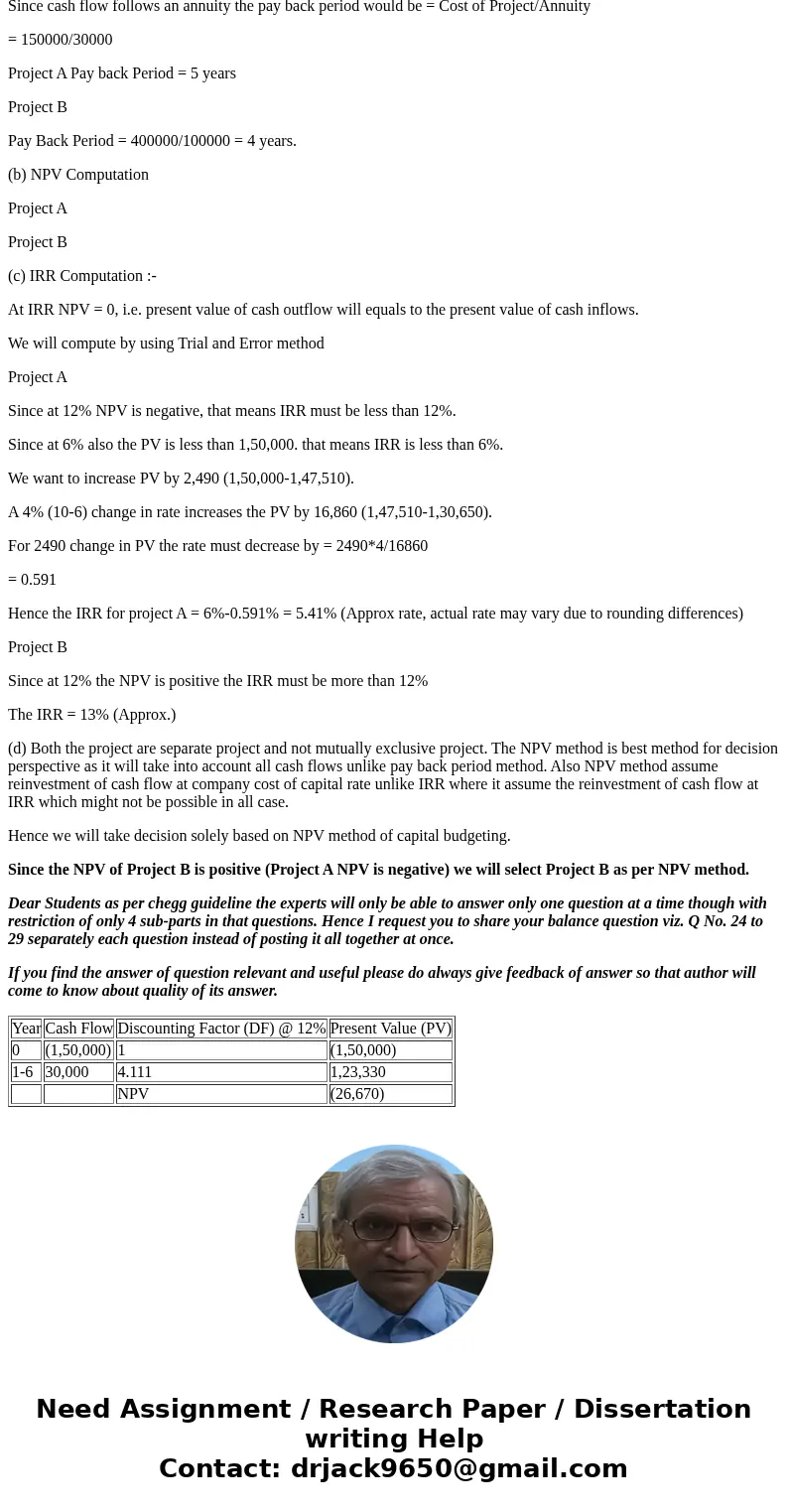

(b) NPV Computation

Project A

Project B

(c) IRR Computation :-

At IRR NPV = 0, i.e. present value of cash outflow will equals to the present value of cash inflows.

We will compute by using Trial and Error method

Project A

Since at 12% NPV is negative, that means IRR must be less than 12%.

Since at 6% also the PV is less than 1,50,000. that means IRR is less than 6%.

We want to increase PV by 2,490 (1,50,000-1,47,510).

A 4% (10-6) change in rate increases the PV by 16,860 (1,47,510-1,30,650).

For 2490 change in PV the rate must decrease by = 2490*4/16860

= 0.591

Hence the IRR for project A = 6%-0.591% = 5.41% (Approx rate, actual rate may vary due to rounding differences)

Project B

Since at 12% the NPV is positive the IRR must be more than 12%

The IRR = 13% (Approx.)

(d) Both the project are separate project and not mutually exclusive project. The NPV method is best method for decision perspective as it will take into account all cash flows unlike pay back period method. Also NPV method assume reinvestment of cash flow at company cost of capital rate unlike IRR where it assume the reinvestment of cash flow at IRR which might not be possible in all case.

Hence we will take decision solely based on NPV method of capital budgeting.

Since the NPV of Project B is positive (Project A NPV is negative) we will select Project B as per NPV method.

Dear Students as per chegg guideline the experts will only be able to answer only one question at a time though with restriction of only 4 sub-parts in that questions. Hence I request you to share your balance question viz. Q No. 24 to 29 separately each question instead of posting it all together at once.

If you find the answer of question relevant and useful please do always give feedback of answer so that author will come to know about quality of its answer.

| Year | Cash Flow | Discounting Factor (DF) @ 12% | Present Value (PV) |

| 0 | (1,50,000) | 1 | (1,50,000) |

| 1-6 | 30,000 | 4.111 | 1,23,330 |

| NPV | (26,670) |

Homework Sourse

Homework Sourse