A city mayor decides to construct a new bridge over the majo

A city mayor decides to construct a new bridge over the major river in the town. The estimated life of such a structure will be 20 years. There is a 70% probability that the total initial costs (consulting fees and construction) will be $800,000 and a 30% probability that such costs would be $1 million. There is 100% probability that the maintenance costs would be $30,000 every 5 years. How much money should the city borrow now in order to carry out the entire project including maintenance? The interest rate is 5%.

Solution

Estimated life = 20 years

Initial cost can be 800,000 or 1,000,000

Prob 0.7 0.3

cost*prob 560,000 300,000 =860000

Expected initial cost = 860000

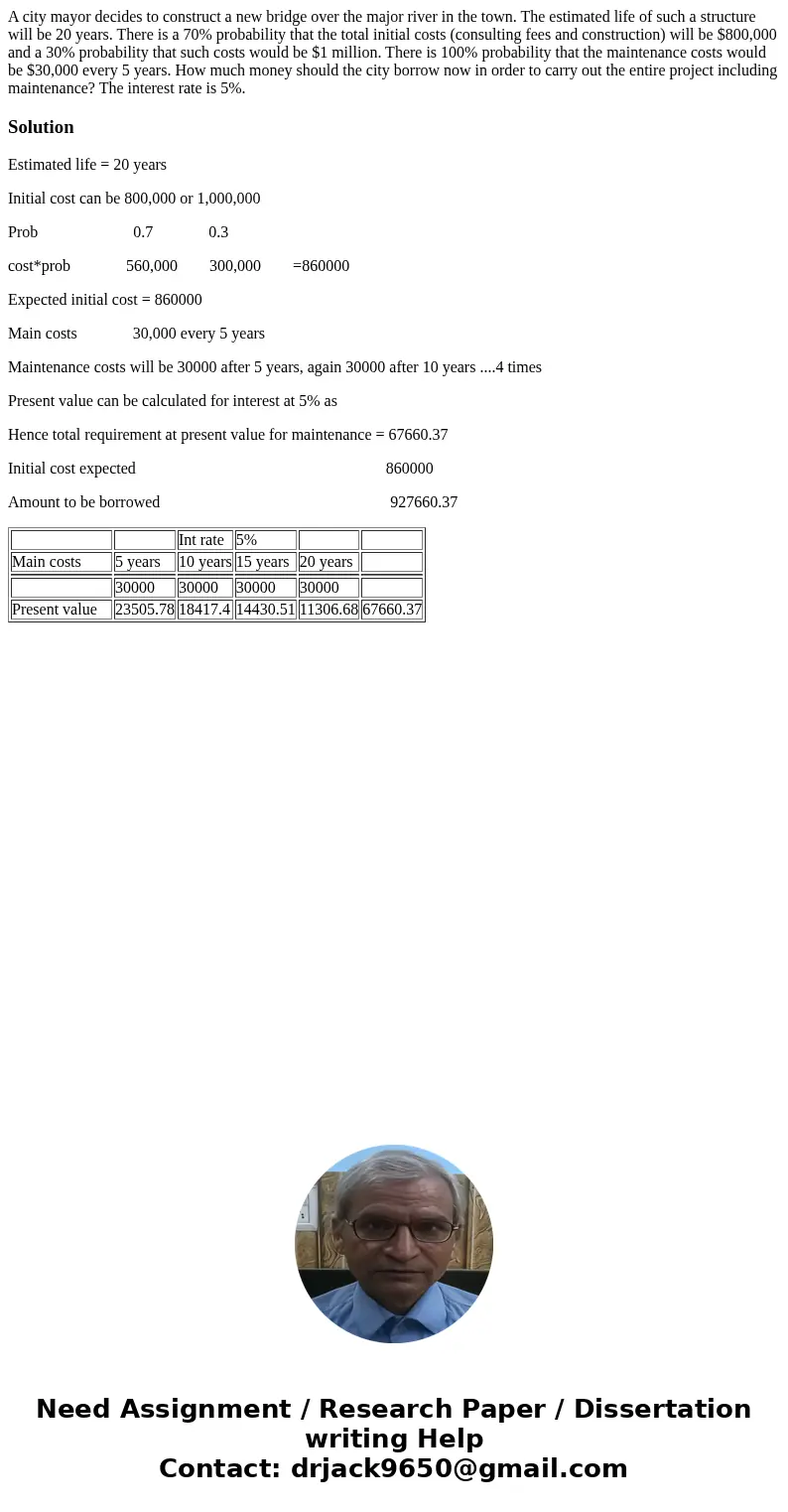

Main costs 30,000 every 5 years

Maintenance costs will be 30000 after 5 years, again 30000 after 10 years ....4 times

Present value can be calculated for interest at 5% as

Hence total requirement at present value for maintenance = 67660.37

Initial cost expected 860000

Amount to be borrowed 927660.37

| Int rate | 5% | ||||

| Main costs | 5 years | 10 years | 15 years | 20 years | |

| 30000 | 30000 | 30000 | 30000 | ||

| Present value | 23505.78 | 18417.4 | 14430.51 | 11306.68 | 67660.37 |

Homework Sourse

Homework Sourse