At December 31 2017 Blue Spruce Inc is involved in a lawsuit

At December 31, 2017, Blue Spruce Inc. is involved in a lawsuit. Under existing standards in IAS 37, prepare the December 31 entry assuming it is probable (and very likely) that Blue Spruce will be liable for $640,000 as a result of this suit. (Credit account titles are automatically indented when the amount is entered. Do not indent manually, If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2017 Under existing standards in IAS 37, prepare the December 31 entry, if any, assuming it is probable (although not likely) that Blue Spruce will be liable for a payment as a result of this suit. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2017 Under existing standards in IAS 37, prepare the December 31 entry assuming it is not probable that Blue Spruce will be liable for 640,000 as a result of this suit. (credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2017 Prepare the December 31 entry assuming it is probable (and very likely) that Blue Spruce will be liable for $640,000 as a result of this suit. Assume that Blue Spruce follows ASPE. (Credit account titles are automatically indented when the amount is entered Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2017 Prepare the December 31 entry, if any, assuming it is probable (although not likely) that Blue Spruce will be liable for $640,000 as a result of this suit. Assume that Blue Spruce follows ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually, If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2017

Solution

In IAS contingent loss is recorded as provision if it is likely to occur.

b) In case of contingent liabilities, it is recorded in Financial statement only when loss is likely to be occur. In this case loss is probable but not likely to occur so only disclosure is made outside the balance sheet for $640000

c)In third case loss is not at all probable so there is no need to make disclosure also.

d)as per ASPE contingent loss are recorded when they are more likely to be occur.

e)No recording of transaction since loss is not likely to occur

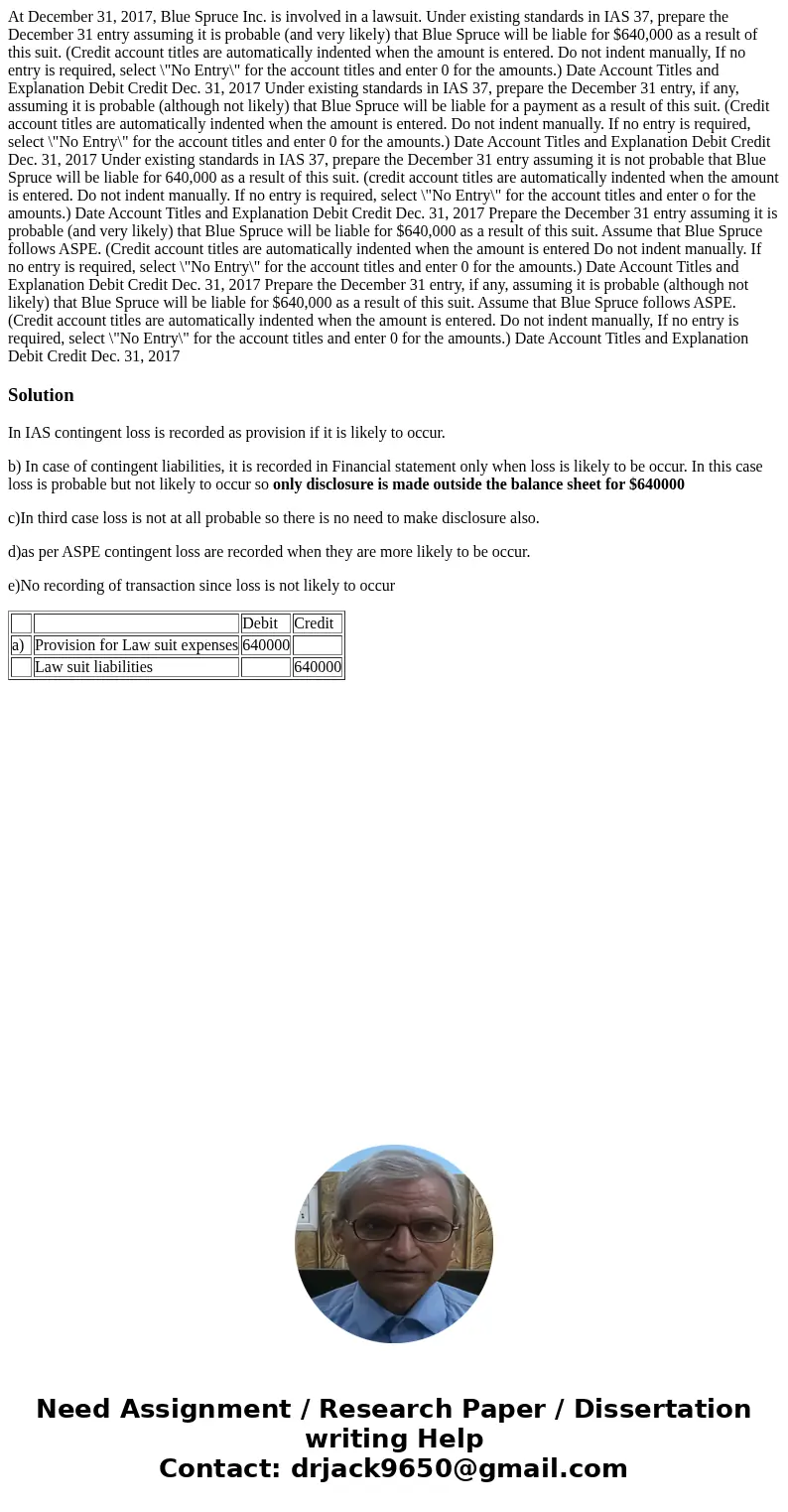

| Debit | Credit | ||

| a) | Provision for Law suit expenses | 640000 | |

| Law suit liabilities | 640000 |

Homework Sourse

Homework Sourse