RAK Inc has no debt outstanding and a total market value of

RAK, Inc, has no debt outstanding and a total market value of $240,000 Earnings before interest and taxes, EBIT, are projected to be $32,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 15 percent higher. If there is a recession, then EBIT will be 30 percent lower. RAK is considering a $80,000 debt issue with an interest rate of 7 percent The proceeds will be used to repurchase shares of stock There are currently 15,000 shares outstanding Ignore taxes for questions a and b. Assume the company has a market-to-book ratio of 1.0 a-1 Calculate return on equity (ROE) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) ROE Recession Normal Expansion 933 | % 13.33 % 15331% a-2 Calculate the percentage changes in ROE when the economy expands or enters a recession. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) %change inROE 30.01 | % 15 % Recession Expansion Assume the firm goes through with the proposed recapitalization b-1 Calculate the return on equity (ROE) under each of the three economic scenarios. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g 32.16.) ROE Recession Normal Expansion

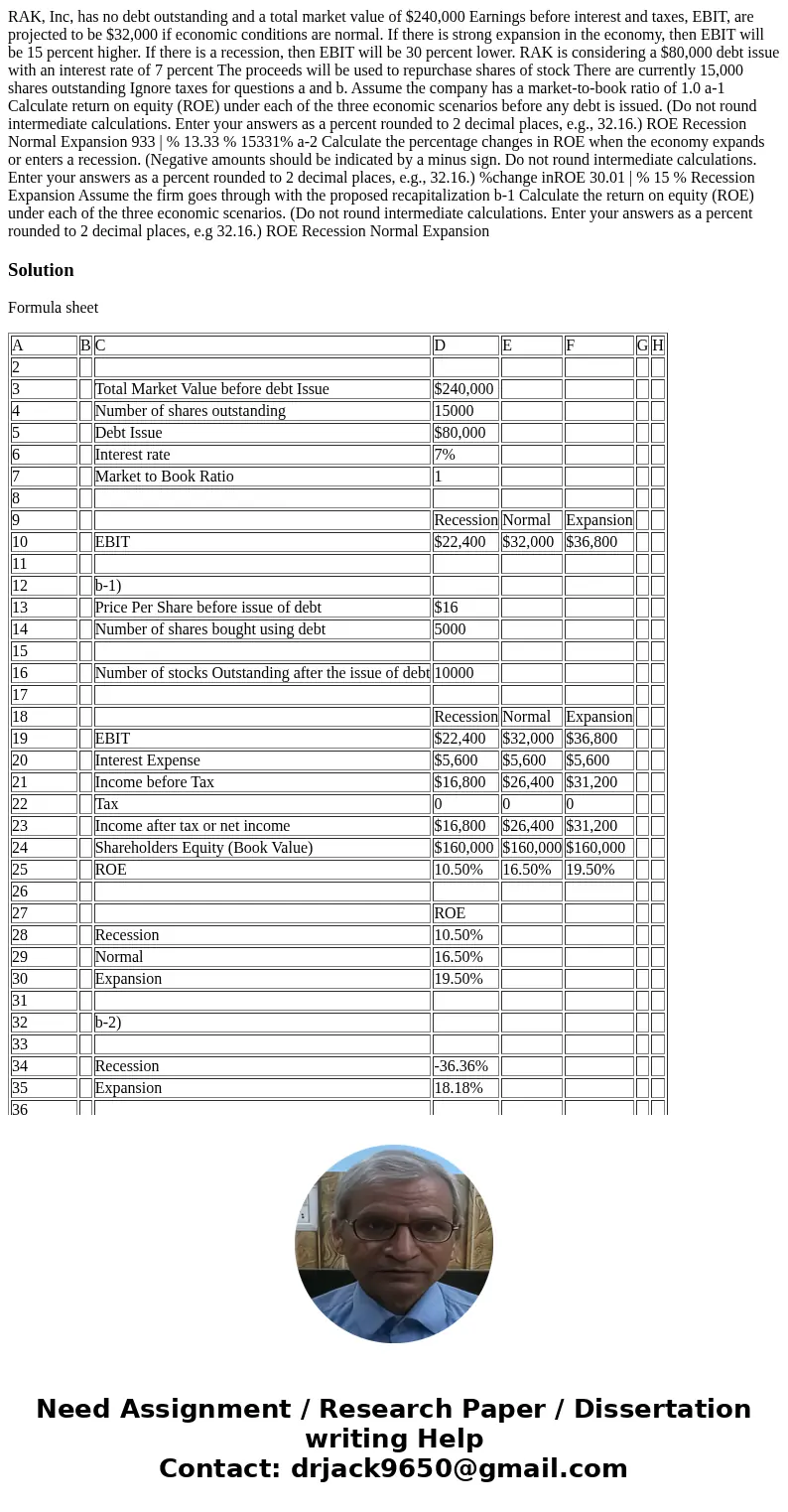

Solution

Formula sheet

| A | B | C | D | E | F | G | H |

| 2 | |||||||

| 3 | Total Market Value before debt Issue | $240,000 | |||||

| 4 | Number of shares outstanding | 15000 | |||||

| 5 | Debt Issue | $80,000 | |||||

| 6 | Interest rate | 7% | |||||

| 7 | Market to Book Ratio | 1 | |||||

| 8 | |||||||

| 9 | Recession | Normal | Expansion | ||||

| 10 | EBIT | $22,400 | $32,000 | $36,800 | |||

| 11 | |||||||

| 12 | b-1) | ||||||

| 13 | Price Per Share before issue of debt | $16 | |||||

| 14 | Number of shares bought using debt | 5000 | |||||

| 15 | |||||||

| 16 | Number of stocks Outstanding after the issue of debt | 10000 | |||||

| 17 | |||||||

| 18 | Recession | Normal | Expansion | ||||

| 19 | EBIT | $22,400 | $32,000 | $36,800 | |||

| 20 | Interest Expense | $5,600 | $5,600 | $5,600 | |||

| 21 | Income before Tax | $16,800 | $26,400 | $31,200 | |||

| 22 | Tax | 0 | 0 | 0 | |||

| 23 | Income after tax or net income | $16,800 | $26,400 | $31,200 | |||

| 24 | Shareholders Equity (Book Value) | $160,000 | $160,000 | $160,000 | |||

| 25 | ROE | 10.50% | 16.50% | 19.50% | |||

| 26 | |||||||

| 27 | ROE | ||||||

| 28 | Recession | 10.50% | |||||

| 29 | Normal | 16.50% | |||||

| 30 | Expansion | 19.50% | |||||

| 31 | |||||||

| 32 | b-2) | ||||||

| 33 | |||||||

| 34 | Recession | -36.36% | |||||

| 35 | Expansion | 18.18% | |||||

| 36 | |||||||

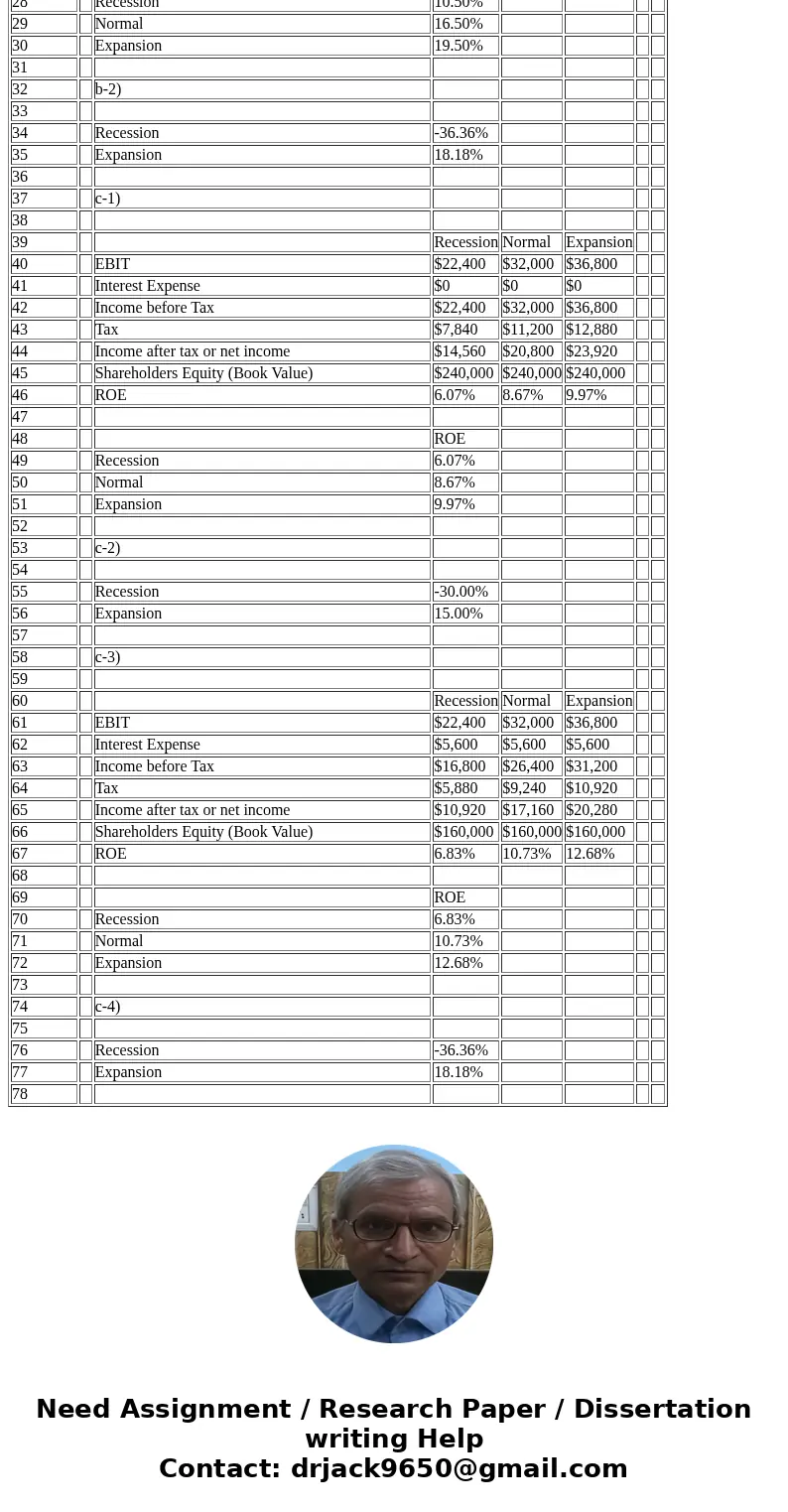

| 37 | c-1) | ||||||

| 38 | |||||||

| 39 | Recession | Normal | Expansion | ||||

| 40 | EBIT | $22,400 | $32,000 | $36,800 | |||

| 41 | Interest Expense | $0 | $0 | $0 | |||

| 42 | Income before Tax | $22,400 | $32,000 | $36,800 | |||

| 43 | Tax | $7,840 | $11,200 | $12,880 | |||

| 44 | Income after tax or net income | $14,560 | $20,800 | $23,920 | |||

| 45 | Shareholders Equity (Book Value) | $240,000 | $240,000 | $240,000 | |||

| 46 | ROE | 6.07% | 8.67% | 9.97% | |||

| 47 | |||||||

| 48 | ROE | ||||||

| 49 | Recession | 6.07% | |||||

| 50 | Normal | 8.67% | |||||

| 51 | Expansion | 9.97% | |||||

| 52 | |||||||

| 53 | c-2) | ||||||

| 54 | |||||||

| 55 | Recession | -30.00% | |||||

| 56 | Expansion | 15.00% | |||||

| 57 | |||||||

| 58 | c-3) | ||||||

| 59 | |||||||

| 60 | Recession | Normal | Expansion | ||||

| 61 | EBIT | $22,400 | $32,000 | $36,800 | |||

| 62 | Interest Expense | $5,600 | $5,600 | $5,600 | |||

| 63 | Income before Tax | $16,800 | $26,400 | $31,200 | |||

| 64 | Tax | $5,880 | $9,240 | $10,920 | |||

| 65 | Income after tax or net income | $10,920 | $17,160 | $20,280 | |||

| 66 | Shareholders Equity (Book Value) | $160,000 | $160,000 | $160,000 | |||

| 67 | ROE | 6.83% | 10.73% | 12.68% | |||

| 68 | |||||||

| 69 | ROE | ||||||

| 70 | Recession | 6.83% | |||||

| 71 | Normal | 10.73% | |||||

| 72 | Expansion | 12.68% | |||||

| 73 | |||||||

| 74 | c-4) | ||||||

| 75 | |||||||

| 76 | Recession | -36.36% | |||||

| 77 | Expansion | 18.18% | |||||

| 78 |

Homework Sourse

Homework Sourse