Part1 Use the following information and prepare the May bank

Part>1

Use the following information and prepare the May bank reconciliation:

• Bank service charge for the month 40.00

• Cheque from J. Harvey dishonoured as insufficient funds 3200

• Interest earned during the month 32.

• Unpresented cheques at month end 11,553 (Chq No. 37 for $11,000 and Chq No. 39 for $553)

• Balance per bank statement at end of month 144,223 Cr • Outstanding deposits at month end 7,980

Part 2>

What journal entries are required to be entered into the Cash Receipts Journal and Cash Payments Journal? Please state which, if any, of these journals needs to be entered with bracketed amounts.

[Note: You do not need to provide the actual journal debit and credit entries. Simply state (describe) which additional transaction journals would be required.]

Solution

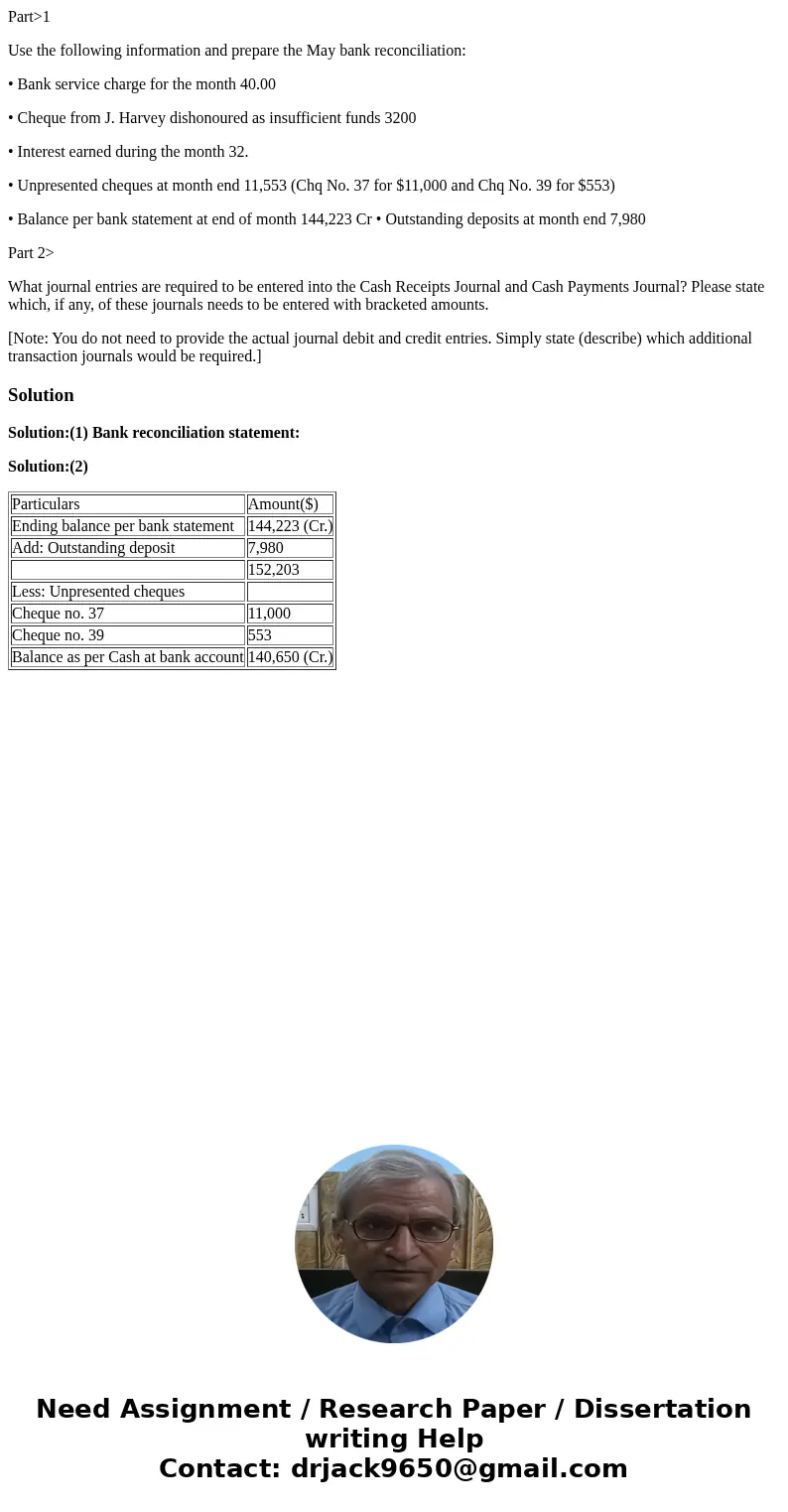

Solution:(1) Bank reconciliation statement:

Solution:(2)

| Particulars | Amount($) |

| Ending balance per bank statement | 144,223 (Cr.) |

| Add: Outstanding deposit | 7,980 |

| 152,203 | |

| Less: Unpresented cheques | |

| Cheque no. 37 | 11,000 |

| Cheque no. 39 | 553 |

| Balance as per Cash at bank account | 140,650 (Cr.) |

Homework Sourse

Homework Sourse