Consider the following three coupon bonds available for sale

Consider the following three coupon bonds available for sale in the bond market (assume annual coupons):

Maturity

Price

Coupon

1 year

$997

3%

2 years

$985

6%

3 years

$990

8.5%

Find the term structure of interest rates, implied by the above bond prices.

Suppose you wish to issue a three-year bond priced at $983. At what rate should you set the coupon on this bond to justify this price?

What is the yield to maturity on the bond in part b?

If you wanted to issue a three-year zero-coupon bond, instead of a coupon bond, what would be its price?

| Maturity | Price | Coupon |

| 1 year | $997 | 3% |

| 2 years | $985 | 6% |

| 3 years | $990 | 8.5% |

Solution

Interest term structure: Yield to Maturity or YTM = Interest term structure

For one-year bond interest = 3.31%

For two-year bond interest = 6.83%

For three-year bond interest = 8.89%

Please check the below working for interest term structure for each bond.

Working:

Using financial calculator BA II Plus - Input details:

Price $997

FV = Future Value =

$1,000.00

PV = Present Value =

-$997.00

N = Total number of periods = Years x frequency of coupon =

1

PMT = Payment = Coupon / frequency of coupon =

$30.00

CPT > I/Y = Rate or YTM =

3.3099

Convert Yield in annual and percentage form = Yield / 100 =

3.31%

Using financial calculator BA II Plus - Input details:

Price $985

FV = Future Value =

$1,000

PV = Present Value =

-$985

N = Total number of periods = Years x frequency of coupon =

2

PMT = Payment = Coupon / frequency of coupon =

$60.00

CPT > I/Y = Rate or YTM =

6.8277

Convert Yield in annual and percentage form = Yield / 100 =

6.83%

Using financial calculator BA II Plus - Input details:

Price $990

FV = Future Value =

$1,000

PV = Present Value =

-$990

N = Total number of periods = Years x frequency of coupon =

3

PMT = Payment = Coupon / frequency of coupon =

$85.00

CPT > I/Y = Rate or YTM =

8.8943

Convert Yield in annual and percentage form = Yield / 100 =

8.89%

---------

Coupon rate for price of $983 = 8.22%

Using financial calculator BA II Plus - Input details:

#

I/Y = Rate = Yield / Frequency of payment in a year

8.8943

FV =

$1,000

N = Remaining term x frequency

3

PV =

-$983

CPT > PMT = Coupon =

$82.2

Yearly coupon rate = PMT /FV =

8.22%

Price of the Zero-coupon bond:

Using financial calculator BA II Plus - Input details:

#

I/Y = Rate or yield / frequency of coupon in a year =

8.8943

PMT = Payment = Coupon / frequency of coupon =

$0.00

N = Total number of periods = Years x frequency of coupon =

3

FV = Future Value =

-$1,000.00

CPT > PV = Bond Value =

$774.53

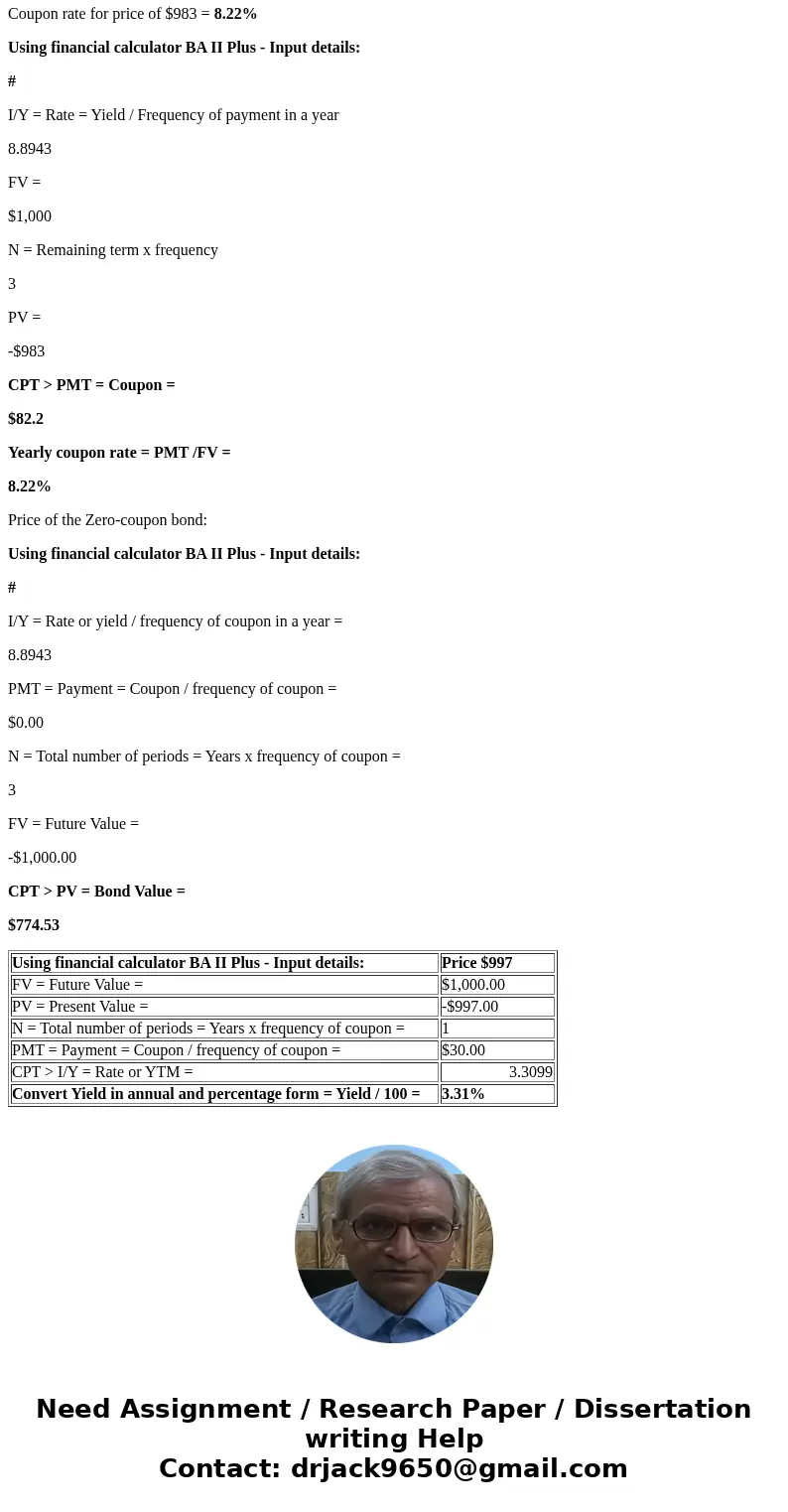

| Using financial calculator BA II Plus - Input details: | Price $997 |

| FV = Future Value = | $1,000.00 |

| PV = Present Value = | -$997.00 |

| N = Total number of periods = Years x frequency of coupon = | 1 |

| PMT = Payment = Coupon / frequency of coupon = | $30.00 |

| CPT > I/Y = Rate or YTM = | 3.3099 |

| Convert Yield in annual and percentage form = Yield / 100 = | 3.31% |

Homework Sourse

Homework Sourse