Polk Incorporated issued 184000 of 8 bonds on July 1 2016 fo

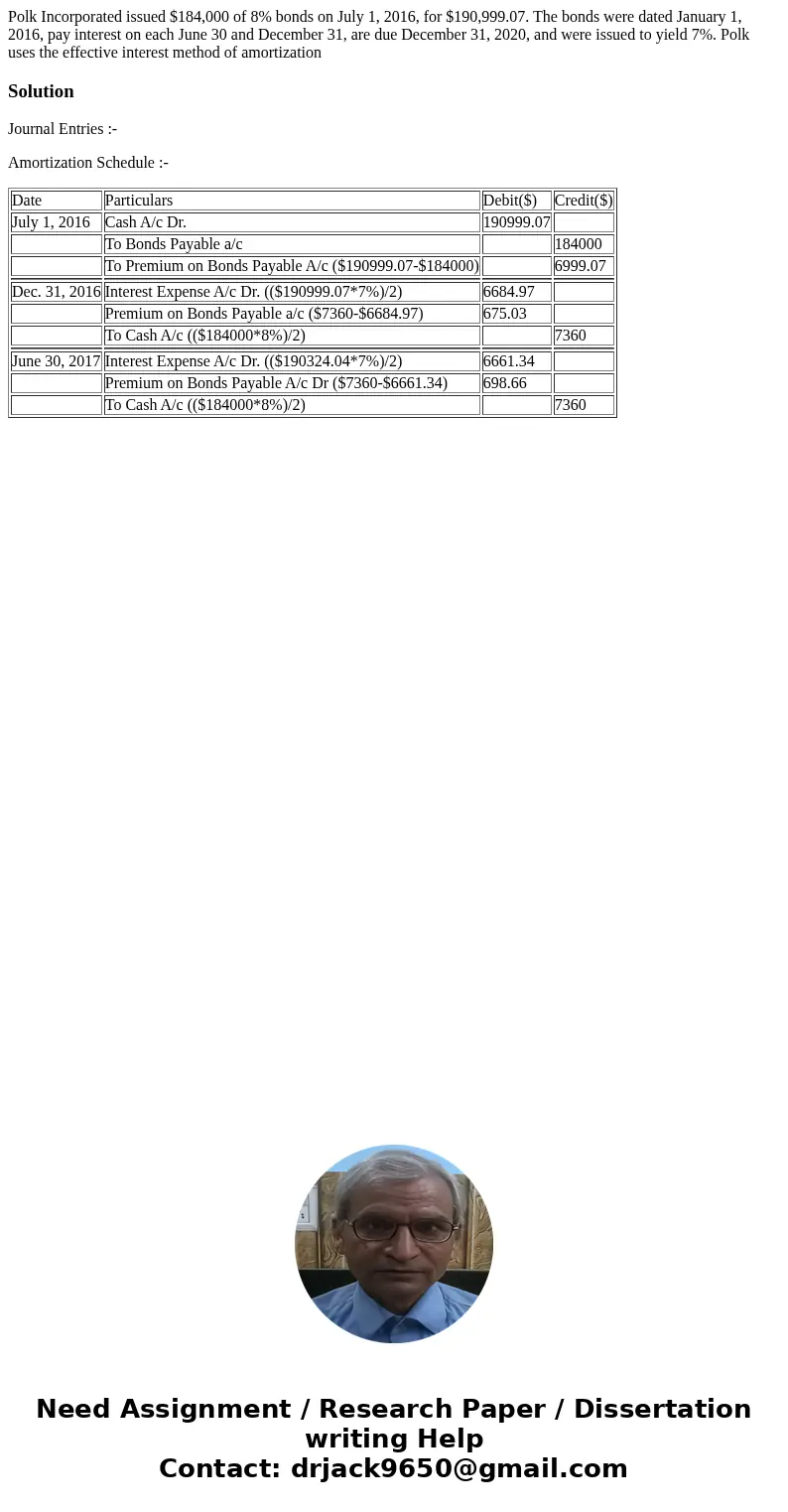

Polk Incorporated issued $184,000 of 8% bonds on July 1, 2016, for $190,999.07. The bonds were dated January 1, 2016, pay interest on each June 30 and December 31, are due December 31, 2020, and were issued to yield 7%. Polk uses the effective interest method of amortization

Solution

Journal Entries :-

Amortization Schedule :-

| Date | Particulars | Debit($) | Credit($) |

| July 1, 2016 | Cash A/c Dr. | 190999.07 | |

| To Bonds Payable a/c | 184000 | ||

| To Premium on Bonds Payable A/c ($190999.07-$184000) | 6999.07 | ||

| Dec. 31, 2016 | Interest Expense A/c Dr. (($190999.07*7%)/2) | 6684.97 | |

| Premium on Bonds Payable a/c ($7360-$6684.97) | 675.03 | ||

| To Cash A/c (($184000*8%)/2) | 7360 | ||

| June 30, 2017 | Interest Expense A/c Dr. (($190324.04*7%)/2) | 6661.34 | |

| Premium on Bonds Payable A/c Dr ($7360-$6661.34) | 698.66 | ||

| To Cash A/c (($184000*8%)/2) | 7360 |

Homework Sourse

Homework Sourse