On March 1 2018 Navy Corporation used excess cash to purchas

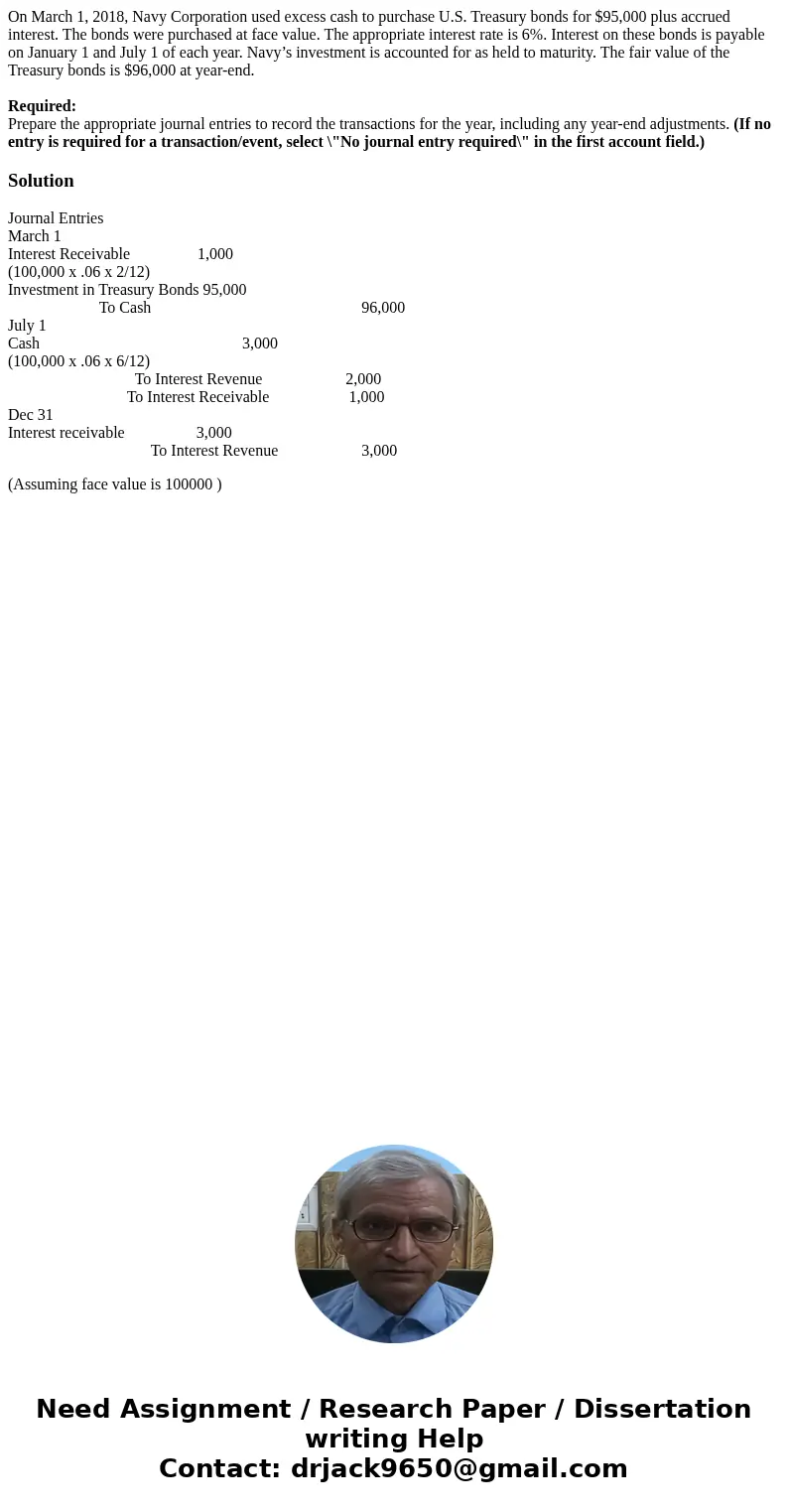

On March 1, 2018, Navy Corporation used excess cash to purchase U.S. Treasury bonds for $95,000 plus accrued interest. The bonds were purchased at face value. The appropriate interest rate is 6%. Interest on these bonds is payable on January 1 and July 1 of each year. Navy’s investment is accounted for as held to maturity. The fair value of the Treasury bonds is $96,000 at year-end.

Required:

Prepare the appropriate journal entries to record the transactions for the year, including any year-end adjustments. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field.)

Solution

Journal Entries

March 1

Interest Receivable 1,000

(100,000 x .06 x 2/12)

Investment in Treasury Bonds 95,000

To Cash 96,000

July 1

Cash 3,000

(100,000 x .06 x 6/12)

To Interest Revenue 2,000

To Interest Receivable 1,000

Dec 31

Interest receivable 3,000

To Interest Revenue 3,000

(Assuming face value is 100000 )

Homework Sourse

Homework Sourse