Use the deductions of Social Security 75 Medicare 25 State t

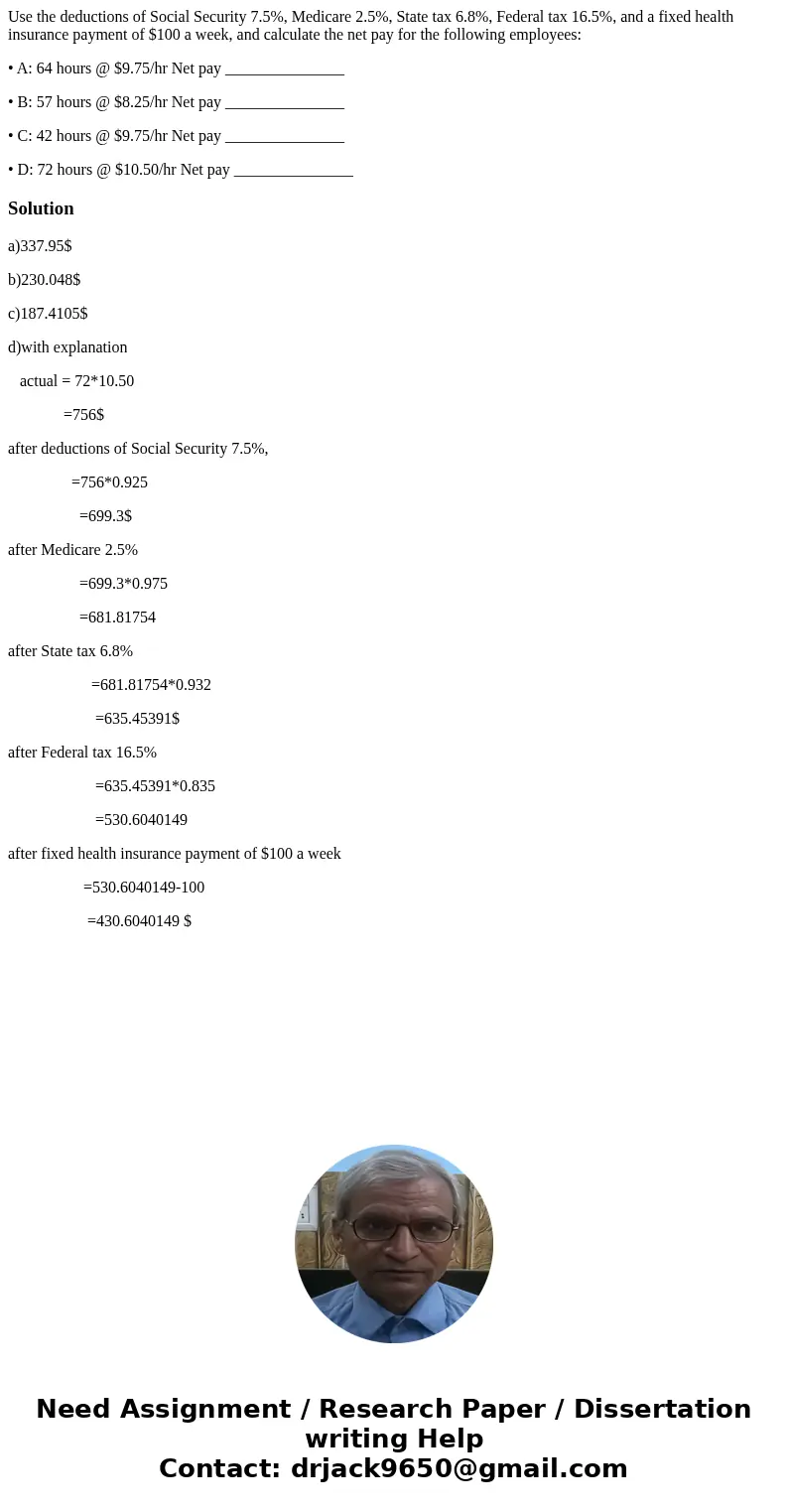

Use the deductions of Social Security 7.5%, Medicare 2.5%, State tax 6.8%, Federal tax 16.5%, and a fixed health insurance payment of $100 a week, and calculate the net pay for the following employees:

• A: 64 hours @ $9.75/hr Net pay _______________

• B: 57 hours @ $8.25/hr Net pay _______________

• C: 42 hours @ $9.75/hr Net pay _______________

• D: 72 hours @ $10.50/hr Net pay _______________

Solution

a)337.95$

b)230.048$

c)187.4105$

d)with explanation

actual = 72*10.50

=756$

after deductions of Social Security 7.5%,

=756*0.925

=699.3$

after Medicare 2.5%

=699.3*0.975

=681.81754

after State tax 6.8%

=681.81754*0.932

=635.45391$

after Federal tax 16.5%

=635.45391*0.835

=530.6040149

after fixed health insurance payment of $100 a week

=530.6040149-100

=430.6040149 $

Homework Sourse

Homework Sourse