Low4egulara dextra dividend policy Benet Farm Equpment Sales

Low4egulara dextra dividend policy Benet Farm Equpment Sales, le a highly acicai business Anough th* firm has a target payout fato of 35%, board realenat nia aderence to that faba would resut ifa futuatng dividend and ?eate uncertanty thhe finn\'s stockholers thereforemefirm has decia edanegaer dvidend of $0.00pe snare per year etr* cashhdends to be paid when ear ngsy stry them Ear ngs per sharefo the last severe years are as folows . Calculate the payout rato for each year on the basis of the reguar $0 60 dividend and he cted EPS the differenoe bebween 50 60 dividend and a e. Ben en nas estabished a polo of payi gan@tad di dofS0 25 any unen the dnerence beheen the eaiw dvidend and a 35% payout am ores to$100ermore inwhich year would a e tra di der d be pad? what \"ud be done with eermings that are not pad out? d The em expects that uture earnings per share will continue to fuctuate but will remain above $2 25 per shane in most years What factors should be considered in making a evisin to the amount pais as a regular dividend? i the firm revises The regular avidend, what new amount should it pay? Data Table a. The payout rano for yeer 2010 on the basis of the reguer $0.0 dvidend and the cted EPS Is(Round to one deomal place The Dayouttatiofor year 201, onthe besis of the regular S060dvidend and ne dedEPSis[ (Round to one oernal pace ) The saysdtrato for year 2012 on the basis of the reqular 0 6o0 avidend andthe cied ERoundto one decimal placenenis io spresine Round to one decimal place) The payout natiofor year 2013onmobasis Cnereglar ?0 60 dvidend and the ded EPS % (Roundtoone decinal place > The payout natio for year 2014 an the basis of the regular 50.80 dividend and the cted EPRaund so one decimal place) The payouutofor year 2015 on me bass ofD6reglar S0 60 dividend and the ated EPS\' % (Roundtoone decrnai place > 2011 2252010 2 12 1.07

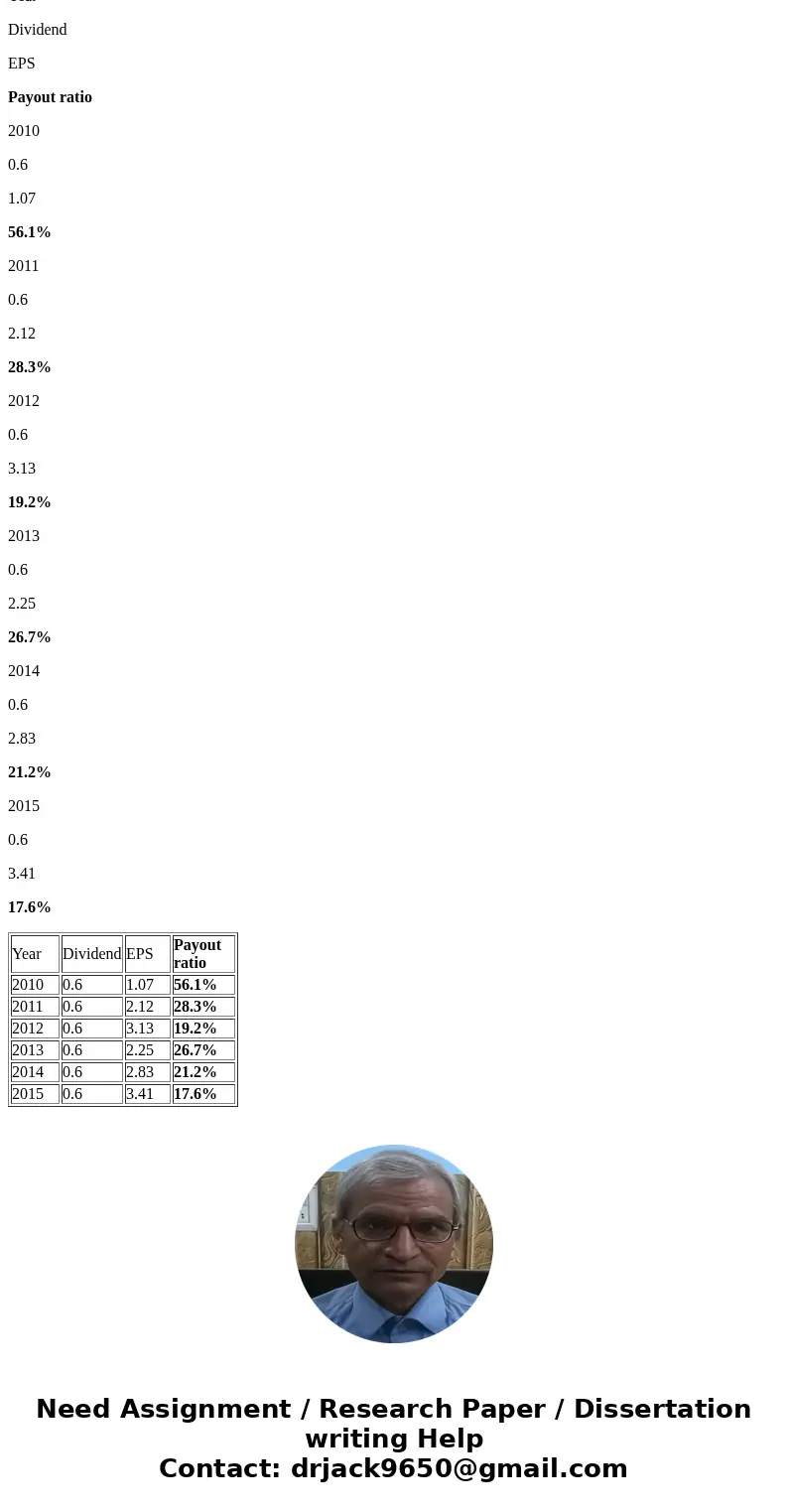

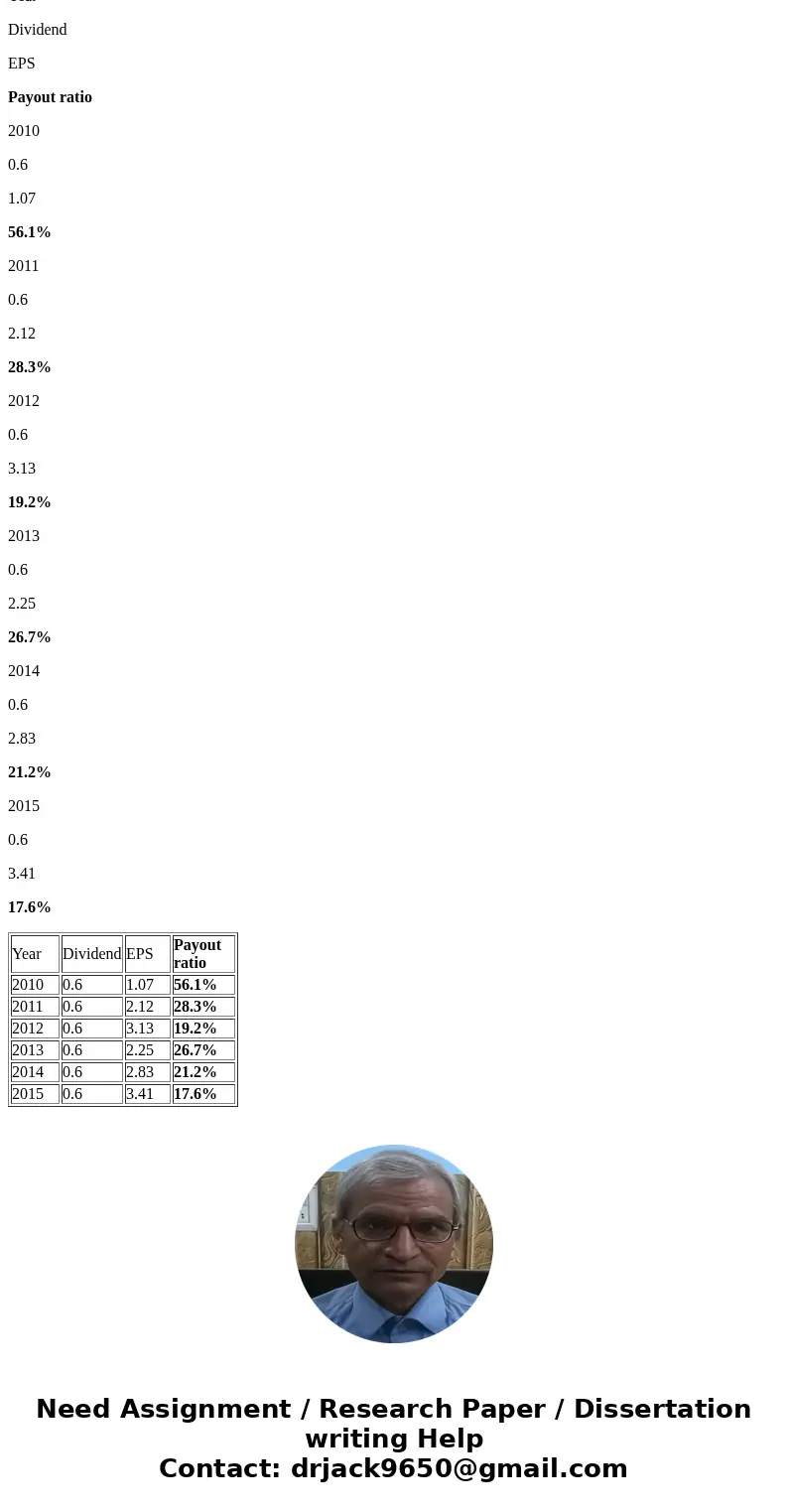

Solution

Payout ratio = Dividend per share / Earnings per share

Table below:

Year

Dividend

EPS

Payout ratio

2010

0.6

1.07

56.1%

2011

0.6

2.12

28.3%

2012

0.6

3.13

19.2%

2013

0.6

2.25

26.7%

2014

0.6

2.83

21.2%

2015

0.6

3.41

17.6%

| Year | Dividend | EPS | Payout ratio |

| 2010 | 0.6 | 1.07 | 56.1% |

| 2011 | 0.6 | 2.12 | 28.3% |

| 2012 | 0.6 | 3.13 | 19.2% |

| 2013 | 0.6 | 2.25 | 26.7% |

| 2014 | 0.6 | 2.83 | 21.2% |

| 2015 | 0.6 | 3.41 | 17.6% |

Homework Sourse

Homework Sourse