The following are selected 2017 transactions of Flint Corpor

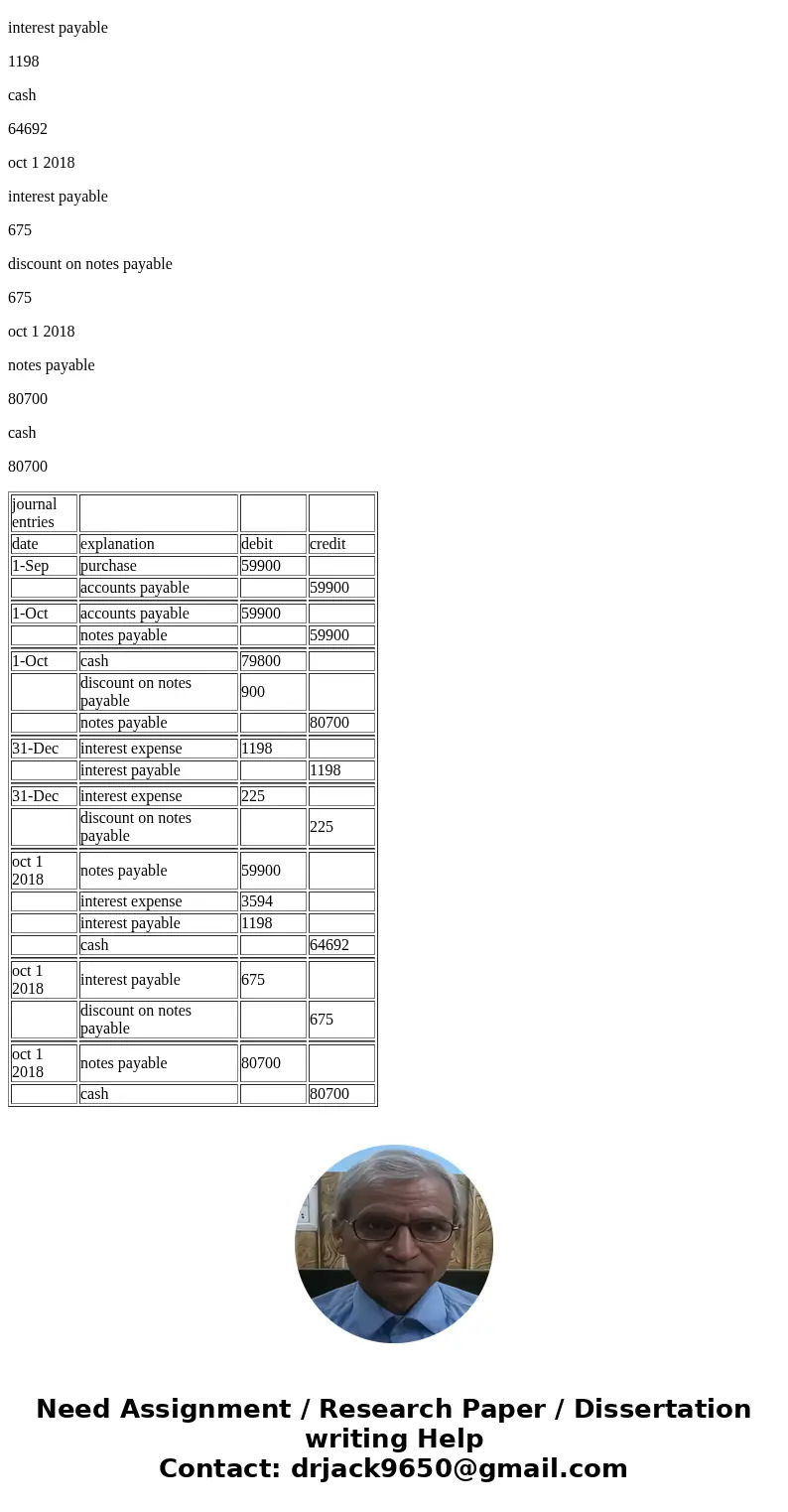

The following are selected 2017 transactions of Flint Corporation, which has a calendar year end.

Borrowed $79,800 from the bank by signing a 12-month, non–interest-bearing $80,700 note.

Prepare the journal entries for the payment of the notes at maturity.

Prepare the journal entries for the payment of the notes at maturity, assuming the company uses reversing entries. (Show the reversing entries at January 1, 2018.)

| Sept. 1 | Purchased inventory from Orion Company on account for $59,900. Flint uses a periodic inventory system and records purchases using the gross method of accounting for purchase discounts. | |

| Oct. 1 | Issued a $59,900, 12-month, 8% note to Orion in payment of Flint’s account. | |

| 1 | Borrowed $79,800 from the bank by signing a 12-month, non–interest-bearing $80,700 note. Prepare the journal entries for the payment of the notes at maturity. Prepare the journal entries for the payment of the notes at maturity, assuming the company uses reversing entries. (Show the reversing entries at January 1, 2018.) |

Solution

journal entries

date

explanation

debit

credit

1-Sep

purchase

59900

accounts payable

59900

1-Oct

accounts payable

59900

notes payable

59900

1-Oct

cash

79800

discount on notes payable

900

notes payable

80700

31-Dec

interest expense

1198

interest payable

1198

31-Dec

interest expense

225

discount on notes payable

225

oct 1 2018

notes payable

59900

interest expense

3594

interest payable

1198

cash

64692

oct 1 2018

interest payable

675

discount on notes payable

675

oct 1 2018

notes payable

80700

cash

80700

| journal entries | |||

| date | explanation | debit | credit |

| 1-Sep | purchase | 59900 | |

| accounts payable | 59900 | ||

| 1-Oct | accounts payable | 59900 | |

| notes payable | 59900 | ||

| 1-Oct | cash | 79800 | |

| discount on notes payable | 900 | ||

| notes payable | 80700 | ||

| 31-Dec | interest expense | 1198 | |

| interest payable | 1198 | ||

| 31-Dec | interest expense | 225 | |

| discount on notes payable | 225 | ||

| oct 1 2018 | notes payable | 59900 | |

| interest expense | 3594 | ||

| interest payable | 1198 | ||

| cash | 64692 | ||

| oct 1 2018 | interest payable | 675 | |

| discount on notes payable | 675 | ||

| oct 1 2018 | notes payable | 80700 | |

| cash | 80700 |

Homework Sourse

Homework Sourse