ross salaries earned by employees December 2931 ncome taxes

Solution

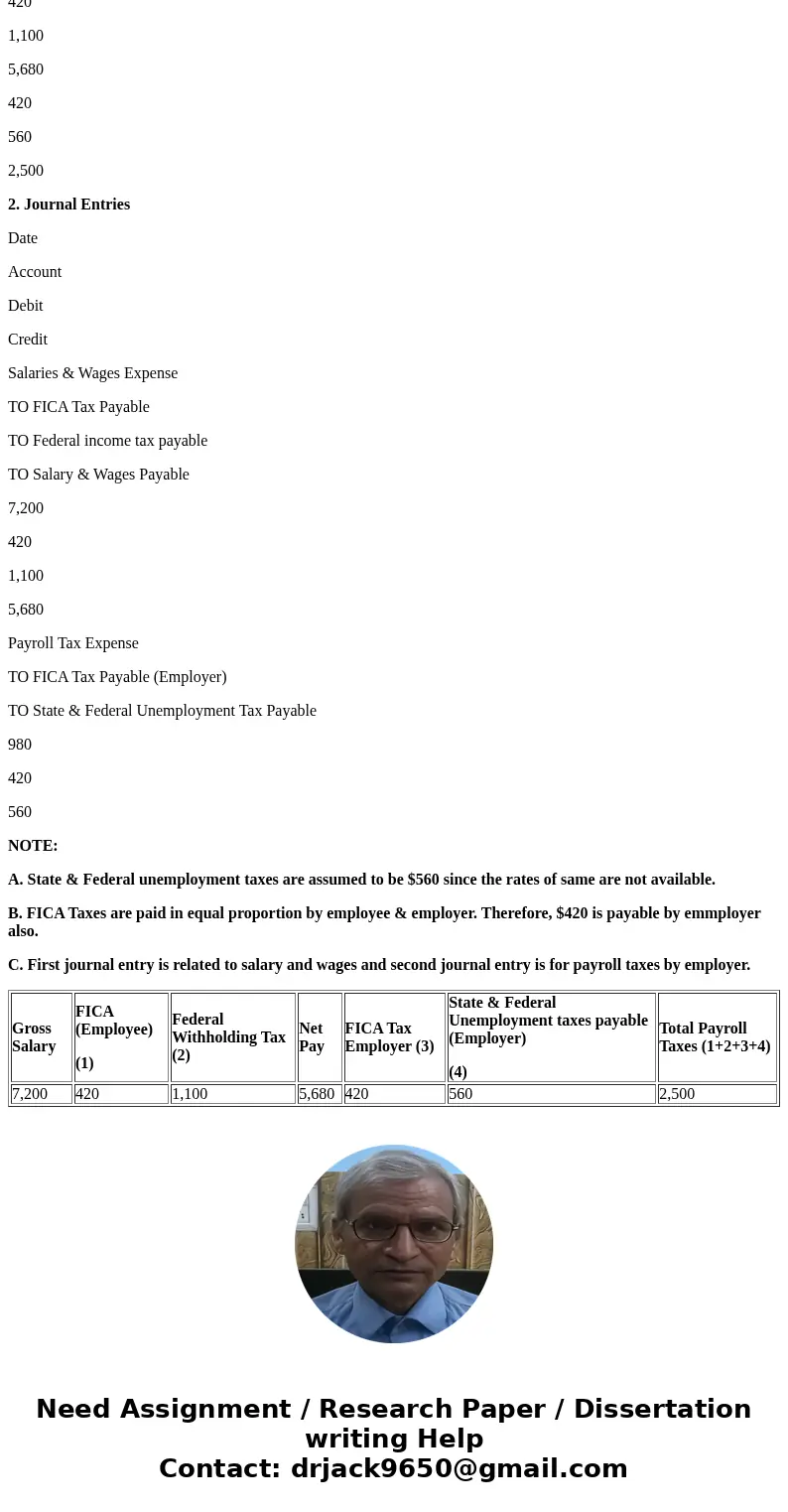

1. Calculaiton of Payrolll taxes payable.

Gross Salary

FICA (Employee)

(1)

Federal Withholding Tax (2)

Net Pay

FICA Tax Employer (3)

State & Federal Unemployment taxes payable (Employer)

(4)

Total Payroll Taxes (1+2+3+4)

7,200

420

1,100

5,680

420

560

2,500

2. Journal Entries

Date

Account

Debit

Credit

Salaries & Wages Expense

TO FICA Tax Payable

TO Federal income tax payable

TO Salary & Wages Payable

7,200

420

1,100

5,680

Payroll Tax Expense

TO FICA Tax Payable (Employer)

TO State & Federal Unemployment Tax Payable

980

420

560

NOTE:

A. State & Federal unemployment taxes are assumed to be $560 since the rates of same are not available.

B. FICA Taxes are paid in equal proportion by employee & employer. Therefore, $420 is payable by emmployer also.

C. First journal entry is related to salary and wages and second journal entry is for payroll taxes by employer.

| Gross Salary | FICA (Employee) (1) | Federal Withholding Tax (2) | Net Pay | FICA Tax Employer (3) | State & Federal Unemployment taxes payable (Employer) (4) | Total Payroll Taxes (1+2+3+4) |

| 7,200 | 420 | 1,100 | 5,680 | 420 | 560 | 2,500 |

Homework Sourse

Homework Sourse