Roger who is in the 32 marginal tax bracket must decide betw

Roger, who is in the 32% marginal tax bracket, must decide between two investment opportunities, both of which require an initial cash outlay of $60,000 at the beginning of year 1. Investment A: This investment will yield $9,000 before-tax cash flow at the end of years 1, 2 and 3. This cash represents ordinary taxable income. At the end of year 3, Roger can liquidate the investment and recover his $60,000 cash outlay. He must pay a nondeductible (for tax purposes) $500 annual fee at the end of years 1, 2, and 3 to maintain Investment A. Investment B: This investment will not yield any before-tax cash flow during the period over which Roger will hold the investment. At the end of year 3, Roger will be able to sell Investment B for $82,000 cash. His $22,000 profit on the sale will be a capital gain. Required: Assuming a 6% discount rate and end-of-year tax payments, determine which investment has the greater net present value.

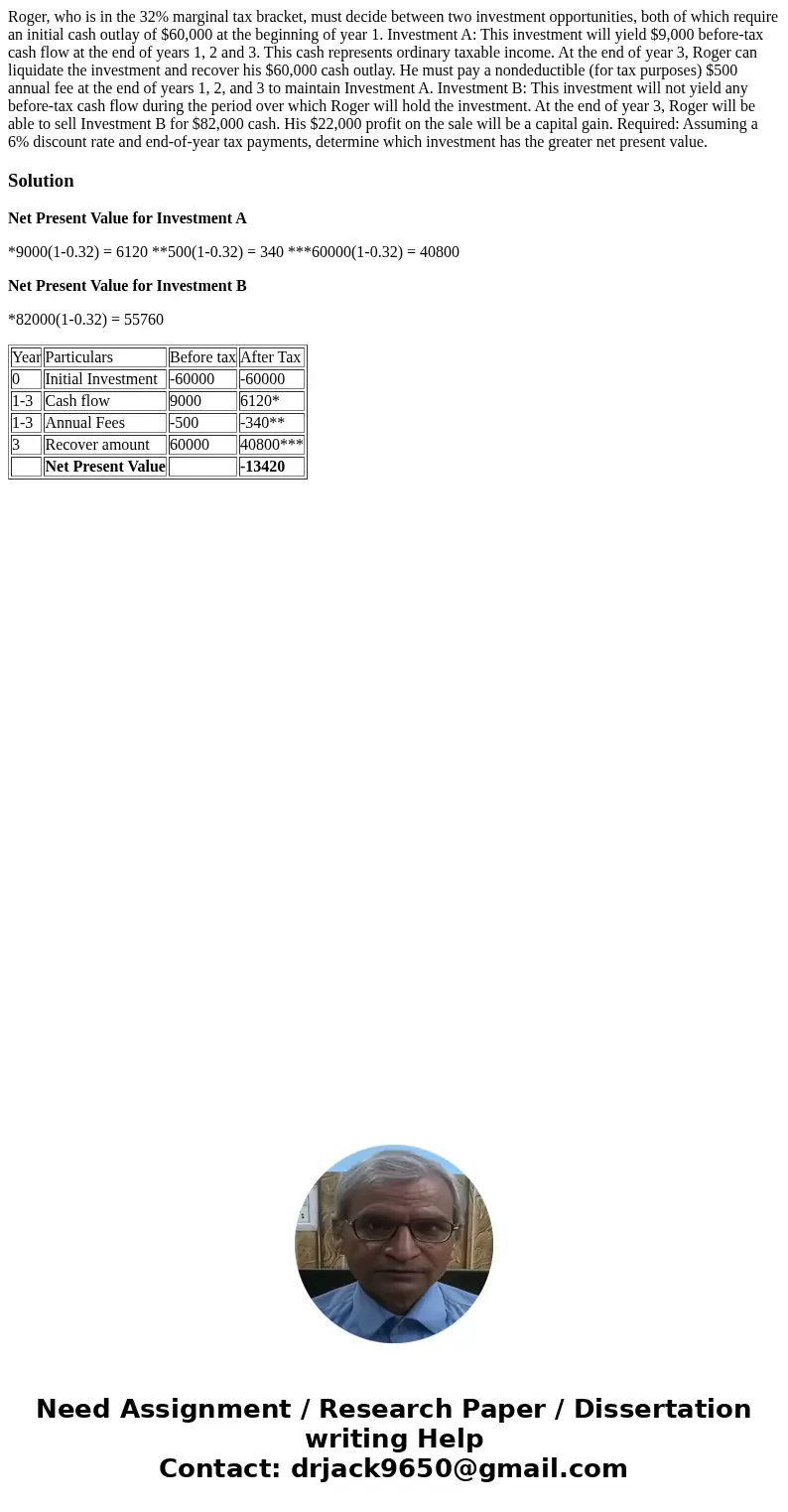

Solution

Net Present Value for Investment A

*9000(1-0.32) = 6120 **500(1-0.32) = 340 ***60000(1-0.32) = 40800

Net Present Value for Investment B

*82000(1-0.32) = 55760

| Year | Particulars | Before tax | After Tax |

| 0 | Initial Investment | -60000 | -60000 |

| 1-3 | Cash flow | 9000 | 6120* |

| 1-3 | Annual Fees | -500 | -340** |

| 3 | Recover amount | 60000 | 40800*** |

| Net Present Value | -13420 |

Homework Sourse

Homework Sourse