Helmets purchased equipment for 124000 cash sold equipment c

Helmets purchased equipment for $124,000 cash, sold equipment costing $72, FOR $38,000 Pinaniclal deta tolion 2010. No new notes payables were isued during the year 10. (20 polnts) Cash Flow Statement 2015 586,000 $3,200 Sales revenue 27,600 34,800 Cost of sales 42,000 14,000 Salaries expense 2016 $1,700,00 850,00 Accounts receivable 62,400 270,00 56,000 36,00 308,000 2,000 Depreciation expense Equipment Accum. depreciation Accounts payable 7,00 6,00 88,00 Interest expense (92,000) (84,000) (8,000) I (22,000) Loss on sale of equipment 32,400 42,400 (10,000) Income taxes expense 14,000 17,600 (3,600) Net income 23,200 Unearned revenue Accrued salaries $.443.0 Taxes payable 16,000 7,200 Long-term notes payable74,000 110,000 (36,000) 180,000 56,000 124,000 101,200 64,800 36,400 Common stock Retained earnings Required: Prepare a Cash Flow Statement using the indirect method for 2016.

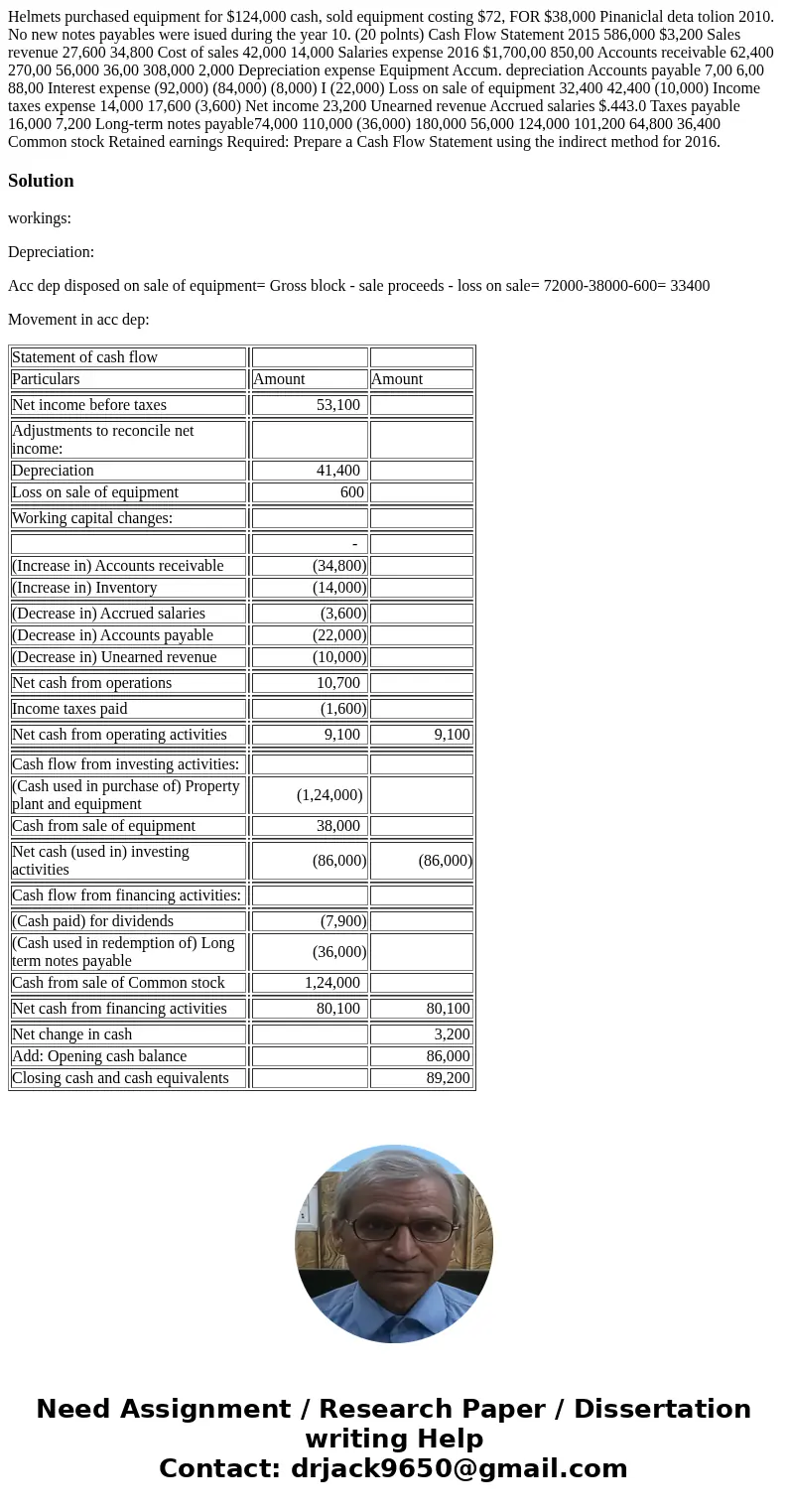

Solution

workings:

Depreciation:

Acc dep disposed on sale of equipment= Gross block - sale proceeds - loss on sale= 72000-38000-600= 33400

Movement in acc dep:

| Statement of cash flow | |||

| Particulars | Amount | Amount | |

| Net income before taxes | 53,100 | ||

| Adjustments to reconcile net income: | |||

| Depreciation | 41,400 | ||

| Loss on sale of equipment | 600 | ||

| Working capital changes: | |||

| - | |||

| (Increase in) Accounts receivable | (34,800) | ||

| (Increase in) Inventory | (14,000) | ||

| (Decrease in) Accrued salaries | (3,600) | ||

| (Decrease in) Accounts payable | (22,000) | ||

| (Decrease in) Unearned revenue | (10,000) | ||

| Net cash from operations | 10,700 | ||

| Income taxes paid | (1,600) | ||

| Net cash from operating activities | 9,100 | 9,100 | |

| Cash flow from investing activities: | |||

| (Cash used in purchase of) Property plant and equipment | (1,24,000) | ||

| Cash from sale of equipment | 38,000 | ||

| Net cash (used in) investing activities | (86,000) | (86,000) | |

| Cash flow from financing activities: | |||

| (Cash paid) for dividends | (7,900) | ||

| (Cash used in redemption of) Long term notes payable | (36,000) | ||

| Cash from sale of Common stock | 1,24,000 | ||

| Net cash from financing activities | 80,100 | 80,100 | |

| Net change in cash | 3,200 | ||

| Add: Opening cash balance | 86,000 | ||

| Closing cash and cash equivalents | 89,200 |

Homework Sourse

Homework Sourse