Please show all calculationsSolution1 Step 1 Computation of

Please show all calculations

Solution

1.

Step -1 Computation of Initial Investment

Cost of Machine = 100000

Add: Working Capital = 40000

Less: PV of Salavage Value (10000x.112) = 1120

Less: PV working capital recapture (40000x.112) = 4480

NET INITIAL INVESTMENT = 134400

Step - 2 In between cash flows

There is no income tax. Hence deprection has no effect on cash flow. So its not considered for calculations

Depreciation = Cost-Salvage value/ useful life

= (100000-10000)/12 = 7500

Total Fixed cost per year = 127500

Less: Depreciation = 7500

So, Fixed cost consifdered for cash flow informations = 120000

2. Sum of Present value of Inflows = (-91630-34700+17370+186720) = 77760

Net Present Value = 77760-134400

= -56640

( To find out the present value annuity factor of 4-12 year, just sum up the present value factor given in your table from 4 th year to 12 th year. I had taken as 0.482+0.402+0.335+0.279+0.233+0.194+0.162+0.135+0.112)

3.

To Mr Cindy Grinch

CFO

The follwing document will be determine the potential and viability of the proposed project of of New carbon Monoxide detector for homes.

As we know that that there will be a higher demand for the product in the near time future.

Based on the calculations made the present project shows a negative net present value of 56640. In the first two years the project is not able to capture its annual fixed cost atleast.

Hence, the project is not viable. The machine should be replaced with a better one with lesser operating cost and capable to produce sufficient units to cover the requierd rate of return of the project.

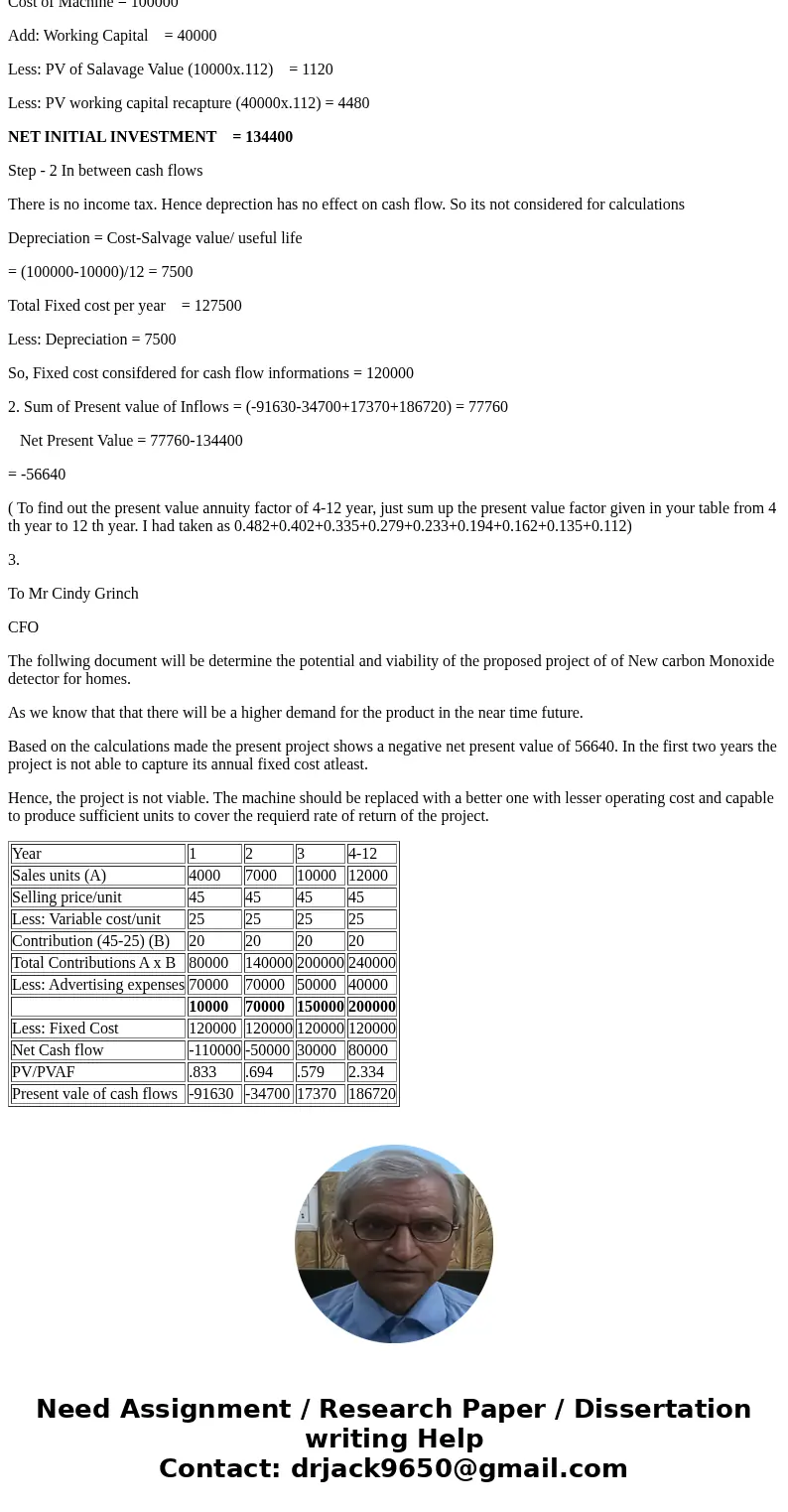

| Year | 1 | 2 | 3 | 4-12 |

| Sales units (A) | 4000 | 7000 | 10000 | 12000 |

| Selling price/unit | 45 | 45 | 45 | 45 |

| Less: Variable cost/unit | 25 | 25 | 25 | 25 |

| Contribution (45-25) (B) | 20 | 20 | 20 | 20 |

| Total Contributions A x B | 80000 | 140000 | 200000 | 240000 |

| Less: Advertising expenses | 70000 | 70000 | 50000 | 40000 |

| 10000 | 70000 | 150000 | 200000 | |

| Less: Fixed Cost | 120000 | 120000 | 120000 | 120000 |

| Net Cash flow | -110000 | -50000 | 30000 | 80000 |

| PV/PVAF | .833 | .694 | .579 | 2.334 |

| Present vale of cash flows | -91630 | -34700 | 17370 | 186720 |

Homework Sourse

Homework Sourse