Global Finance Andrea McDiffit 7518 852 PM Homework Module I

Global Finance Andrea McDiffit& 7/5/18 852 PM Homework: Module IV-Practice Exercises: Part B Score: 0 of 5 pts Problem 14-7 (algorithmic) 2ct 5 (2 complete) ? HW Score: 40%, 10 of 25 pts Oinston Help * Sunrise Manufacturing. Inc. Sunrise Manufacturing Inc, a U.S muitinational company, has the following detr components in it estrnates their Of equity to be 90%. Current exchange rates are assumptions implicit in your caloulation? consolidated capital setion, Sunvise\'s sharsholdens\' equity s545,000 000 and Its a world aher alowingforenes, Caiculate Sunse\'s weghed ame cent of capta. Am any also ited ite tatie. Inome taxes are 40% around the What is Sunvrise\'s weighted average cost of capital? s(Round to two decimal places ?Data Table 25-year USS bonds -year USs bonds 10-year eurobonds (euros) 20-year yen bonds (yen) Before-tax cost of 25-year USS bonds Before-tax coso 5-year USS bonds Before-tax cost of 10 year eurobonds Before-tax cost of 20-year yen bonds Spot rate (S/E) Spot rate ? Spot rate (VS) $10,000.000 $5,000.000 750,000.000 6,0% 35% 1.8900 105.00 Pint Done Enter your answer in the answer box and then click Check Answer Clear All O Type here to search

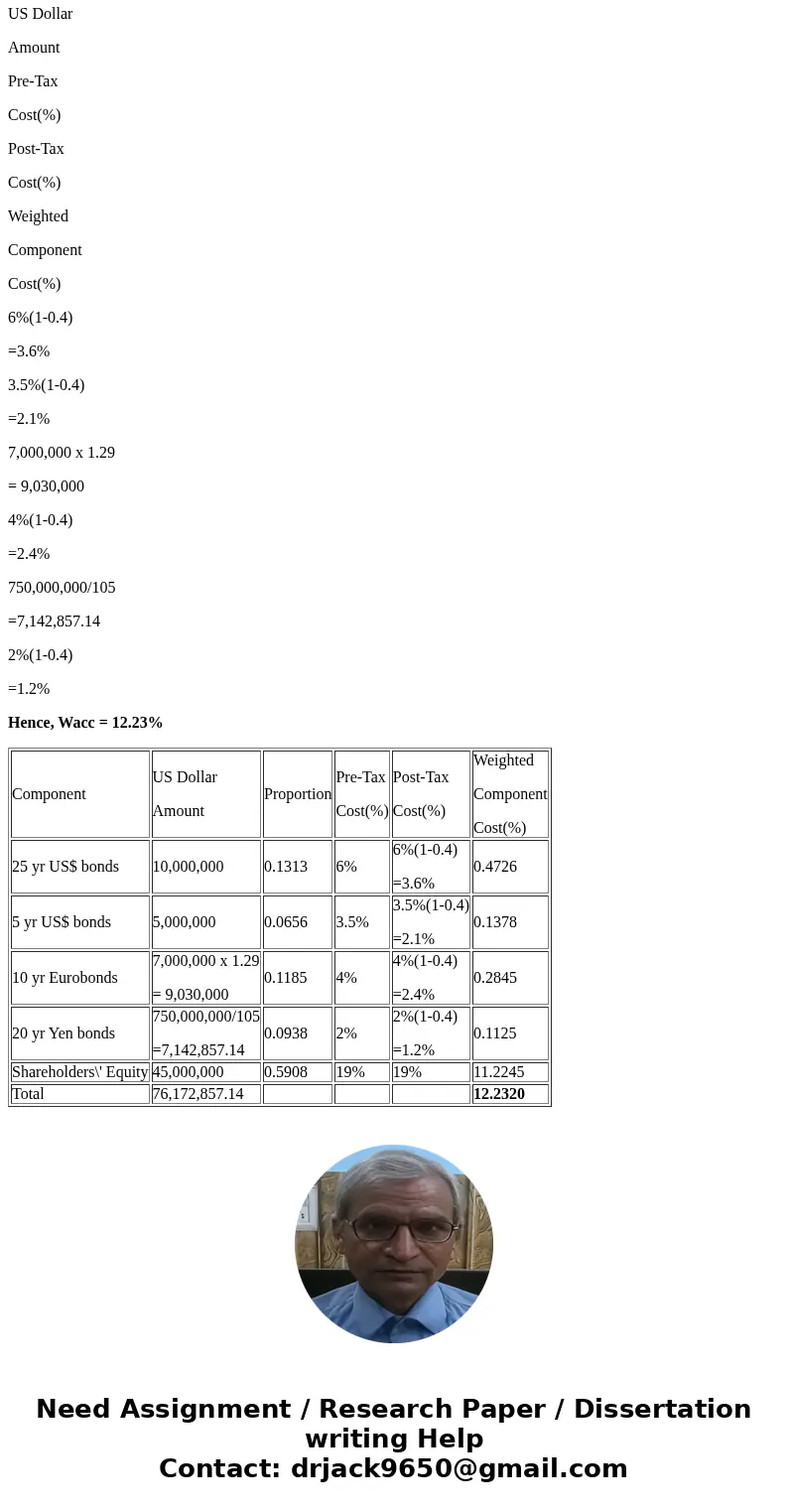

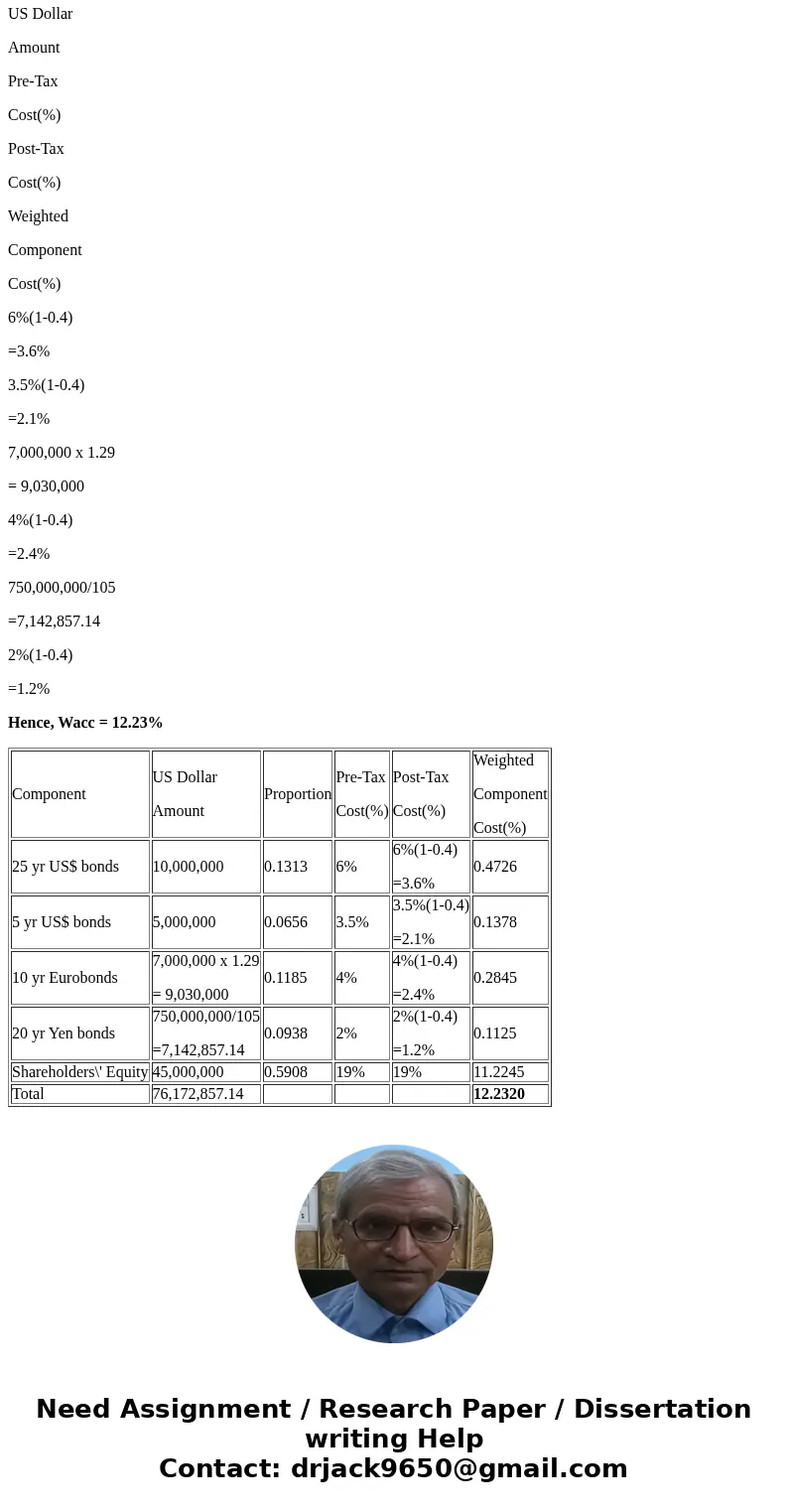

Solution

US Dollar

Amount

Pre-Tax

Cost(%)

Post-Tax

Cost(%)

Weighted

Component

Cost(%)

6%(1-0.4)

=3.6%

3.5%(1-0.4)

=2.1%

7,000,000 x 1.29

= 9,030,000

4%(1-0.4)

=2.4%

750,000,000/105

=7,142,857.14

2%(1-0.4)

=1.2%

Hence, Wacc = 12.23%

| Component | US Dollar Amount | Proportion | Pre-Tax Cost(%) | Post-Tax Cost(%) | Weighted Component Cost(%) |

| 25 yr US$ bonds | 10,000,000 | 0.1313 | 6% | 6%(1-0.4) =3.6% | 0.4726 |

| 5 yr US$ bonds | 5,000,000 | 0.0656 | 3.5% | 3.5%(1-0.4) =2.1% | 0.1378 |

| 10 yr Eurobonds | 7,000,000 x 1.29 = 9,030,000 | 0.1185 | 4% | 4%(1-0.4) =2.4% | 0.2845 |

| 20 yr Yen bonds | 750,000,000/105 =7,142,857.14 | 0.0938 | 2% | 2%(1-0.4) =1.2% | 0.1125 |

| Shareholders\' Equity | 45,000,000 | 0.5908 | 19% | 19% | 11.2245 |

| Total | 76,172,857.14 | 12.2320 |

Homework Sourse

Homework Sourse