A firms bonds have a maturity of 8 years with a 1000 face va

A firm\'s bonds have a maturity of 8 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 4 years at $1,048, and currently sell at a price of $1,093.74.

What is their nominal yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places.

%

What is their nominal yield to call? Do not round intermediate calculations. Round your answer to two decimal places.

%

Solution

Using financial calculator BA II Plus - Input details:

#

FV = Future Value =

-$1,000.00

PV = Present Value =

$1,093.74

N = Total number of periods = Number of years x frequency =

16

PMT = Payment = Coupon / frequency =

-$40.00

CPT > I/Y = Rate per period or YTM per period =

3.2400

Convert Nominal YTM in annual and percentage form = Yield*frequency / 100 =

6.48%

Using financial calculator BA II Plus - Input details:

#

FV = Call price =

$1,048.00

PV = Bond price =

$1,093.74

PMT = Coupon rate x face value / frequency of coupon in a year =

$40.00

N = Year to call x frequency of coupon =

8

CPT > I/Y = Rate =

3.19

Yield to call or Return Investors should expect to earn in % = Rate * 2 /100

6.38%

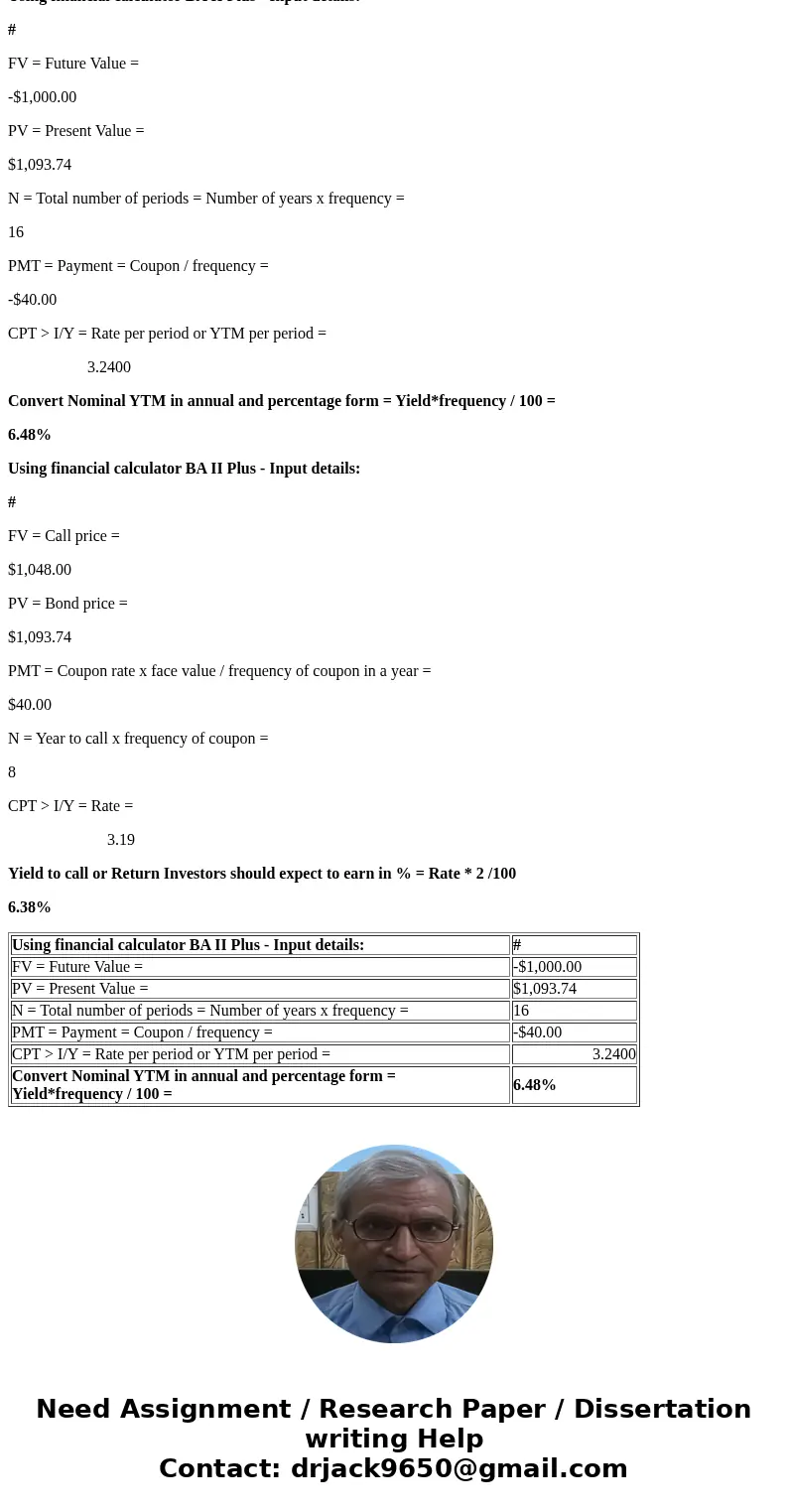

| Using financial calculator BA II Plus - Input details: | # |

| FV = Future Value = | -$1,000.00 |

| PV = Present Value = | $1,093.74 |

| N = Total number of periods = Number of years x frequency = | 16 |

| PMT = Payment = Coupon / frequency = | -$40.00 |

| CPT > I/Y = Rate per period or YTM per period = | 3.2400 |

| Convert Nominal YTM in annual and percentage form = Yield*frequency / 100 = | 6.48% |

Homework Sourse

Homework Sourse