Required information Part 1 of 3 The following information a

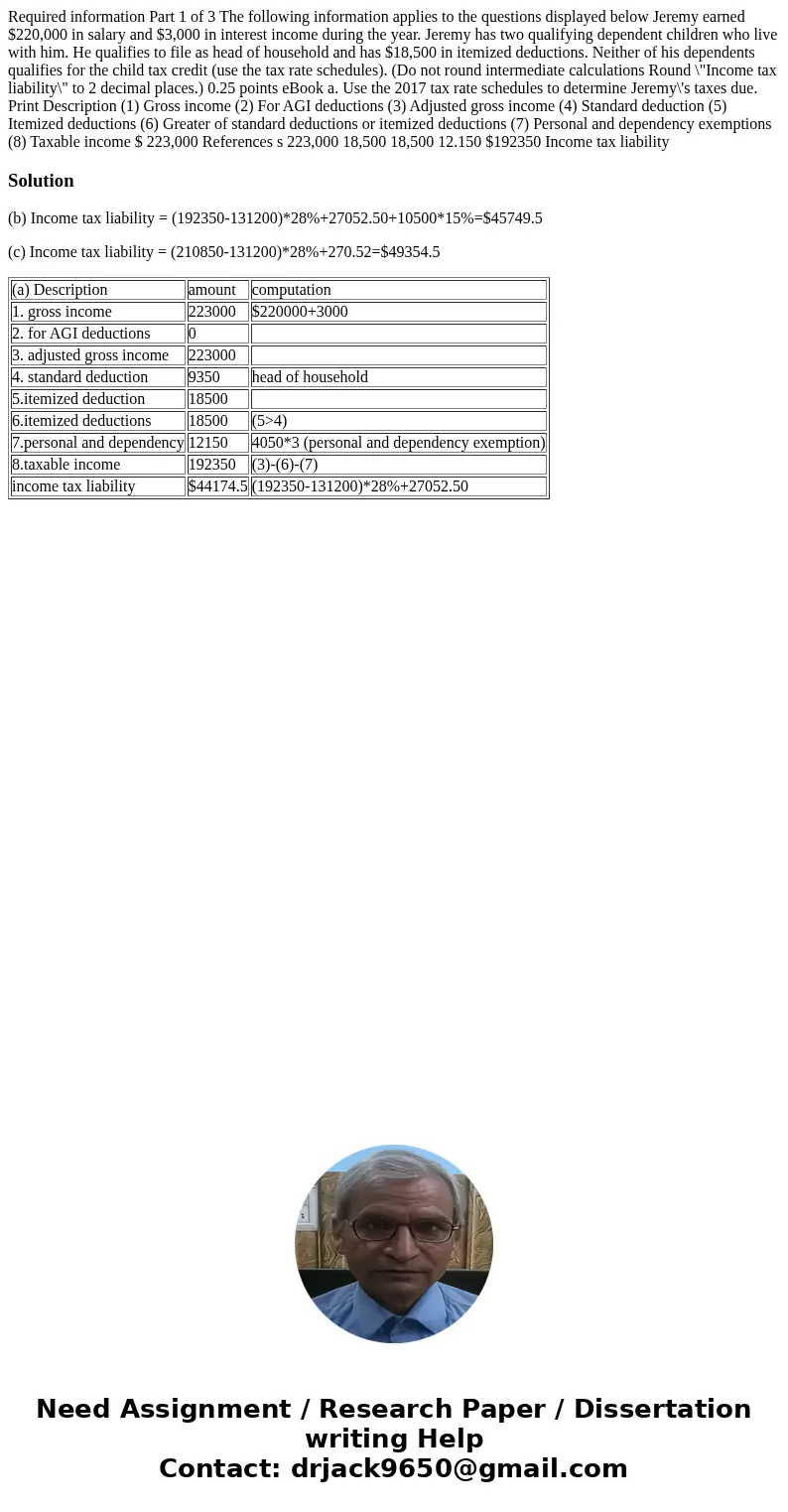

Required information Part 1 of 3 The following information applies to the questions displayed below Jeremy earned $220,000 in salary and $3,000 in interest income during the year. Jeremy has two qualifying dependent children who live with him. He qualifies to file as head of household and has $18,500 in itemized deductions. Neither of his dependents qualifies for the child tax credit (use the tax rate schedules). (Do not round intermediate calculations Round \"Income tax liability\" to 2 decimal places.) 0.25 points eBook a. Use the 2017 tax rate schedules to determine Jeremy\'s taxes due. Print Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard deductions or itemized deductions (7) Personal and dependency exemptions (8) Taxable income $ 223,000 References s 223,000 18,500 18,500 12.150 $192350 Income tax liability

Solution

(b) Income tax liability = (192350-131200)*28%+27052.50+10500*15%=$45749.5

(c) Income tax liability = (210850-131200)*28%+270.52=$49354.5

| (a) Description | amount | computation |

| 1. gross income | 223000 | $220000+3000 |

| 2. for AGI deductions | 0 | |

| 3. adjusted gross income | 223000 | |

| 4. standard deduction | 9350 | head of household |

| 5.itemized deduction | 18500 | |

| 6.itemized deductions | 18500 | (5>4) |

| 7.personal and dependency | 12150 | 4050*3 (personal and dependency exemption) |

| 8.taxable income | 192350 | (3)-(6)-(7) |

| income tax liability | $44174.5 | (192350-131200)*28%+27052.50 |

Homework Sourse

Homework Sourse