BACK Exercise 163 Swifty Company has bonds payable outstandi

BACK Exercise 16-3 Swifty Company has bonds payable outstanding in the amount of $520,000, and the Premium on Bonds Payable account has a balance of $7,500. Each $1,000 bond is convertible into 20 shares of preferred stock of par value of $50 per share. All bonds are converted into preferred stock -5 Assuming that the book value method was used, what entry would be made? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter O for the amounts.) Accsent Tales and Esplenatian LEST OP ACCOUNTS LINN TO TE Question Attempts of 6 used A FOR ATUBHIT ANSWE

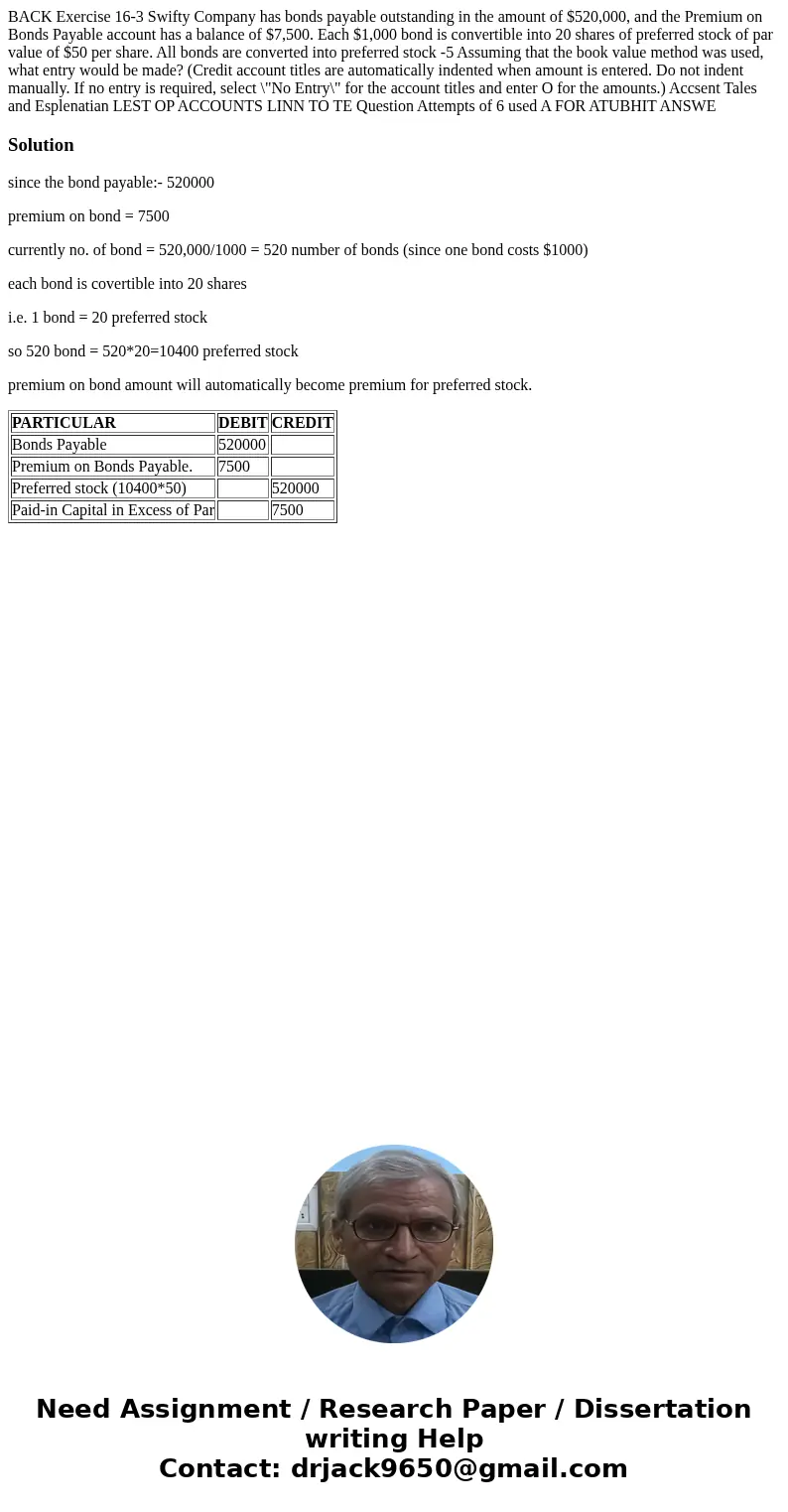

Solution

since the bond payable:- 520000

premium on bond = 7500

currently no. of bond = 520,000/1000 = 520 number of bonds (since one bond costs $1000)

each bond is covertible into 20 shares

i.e. 1 bond = 20 preferred stock

so 520 bond = 520*20=10400 preferred stock

premium on bond amount will automatically become premium for preferred stock.

| PARTICULAR | DEBIT | CREDIT |

| Bonds Payable | 520000 | |

| Premium on Bonds Payable. | 7500 | |

| Preferred stock (10400*50) | 520000 | |

| Paid-in Capital in Excess of Par | 7500 |

Homework Sourse

Homework Sourse