For the following set of cash flows Solution a NPV 1110000

| For the following set of cash flows, |

Solution

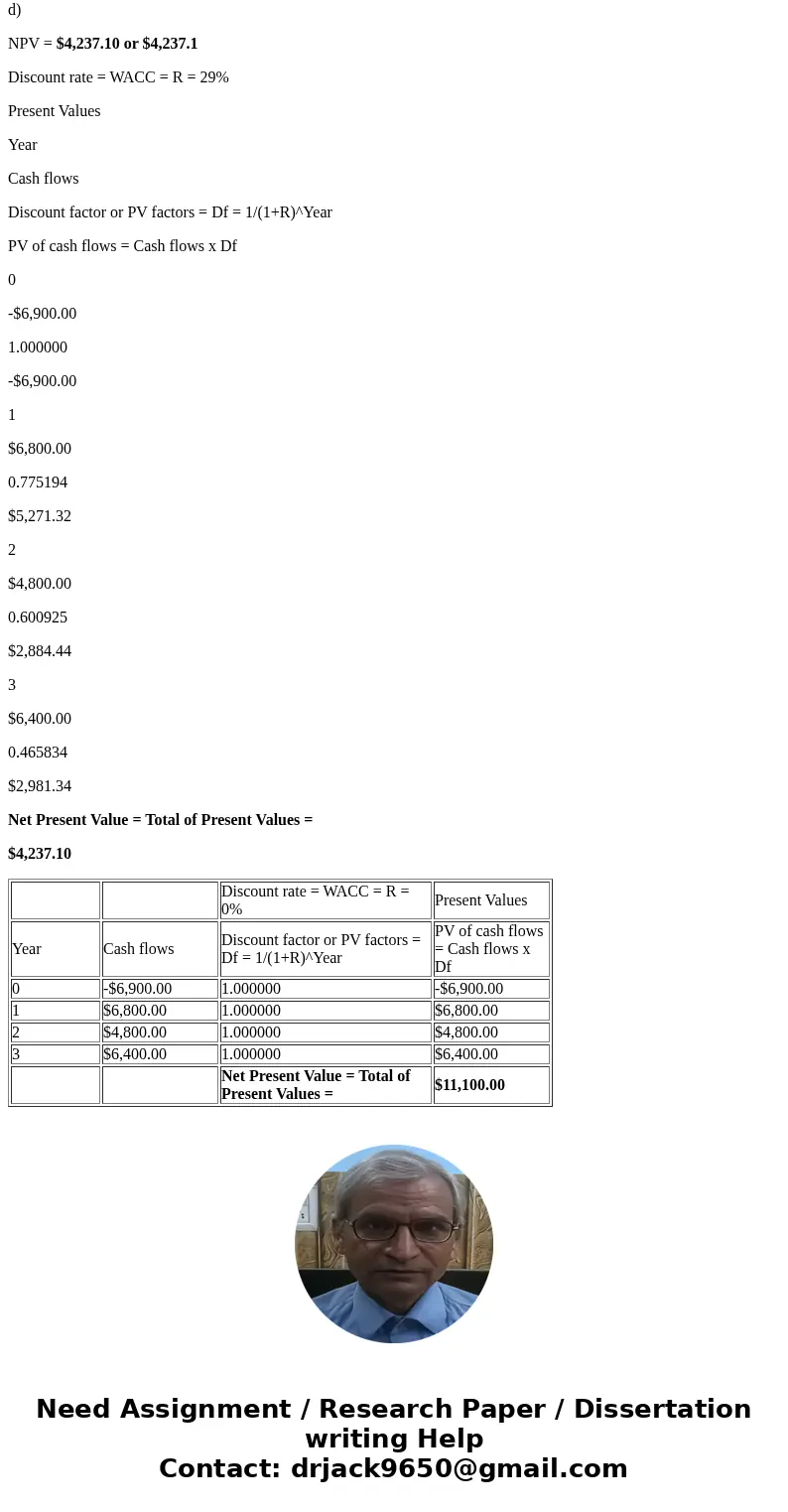

a)

NPV = $11,100.00

Discount rate = WACC = R = 0%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$6,900.00

1.000000

-$6,900.00

1

$6,800.00

1.000000

$6,800.00

2

$4,800.00

1.000000

$4,800.00

3

$6,400.00

1.000000

$6,400.00

Net Present Value = Total of Present Values =

$11,100.00

b)

NPV = $7,801.54

Discount rate = WACC = R = 11%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$6,900.00

1.000000

-$6,900.00

1

$6,800.00

0.900901

$6,126.13

2

$4,800.00

0.811622

$3,895.79

3

$6,400.00

0.731191

$4,679.62

Net Present Value = Total of Present Values =

$7,801.54

c)

NPV = $5,062.34

Discount rate = WACC = R = 24%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$6,900.00

1.000000

-$6,900.00

1

$6,800.00

0.806452

$5,483.87

2

$4,800.00

0.650364

$3,121.75

3

$6,400.00

0.524487

$3,356.72

Net Present Value = Total of Present Values =

$5,062.34

d)

NPV = $4,237.10 or $4,237.1

Discount rate = WACC = R = 29%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$6,900.00

1.000000

-$6,900.00

1

$6,800.00

0.775194

$5,271.32

2

$4,800.00

0.600925

$2,884.44

3

$6,400.00

0.465834

$2,981.34

Net Present Value = Total of Present Values =

$4,237.10

| Discount rate = WACC = R = 0% | Present Values | ||

| Year | Cash flows | Discount factor or PV factors = Df = 1/(1+R)^Year | PV of cash flows = Cash flows x Df |

| 0 | -$6,900.00 | 1.000000 | -$6,900.00 |

| 1 | $6,800.00 | 1.000000 | $6,800.00 |

| 2 | $4,800.00 | 1.000000 | $4,800.00 |

| 3 | $6,400.00 | 1.000000 | $6,400.00 |

| Net Present Value = Total of Present Values = | $11,100.00 |

Homework Sourse

Homework Sourse