Estaibans Taco Shack Current Income Statement Gross Sales 43

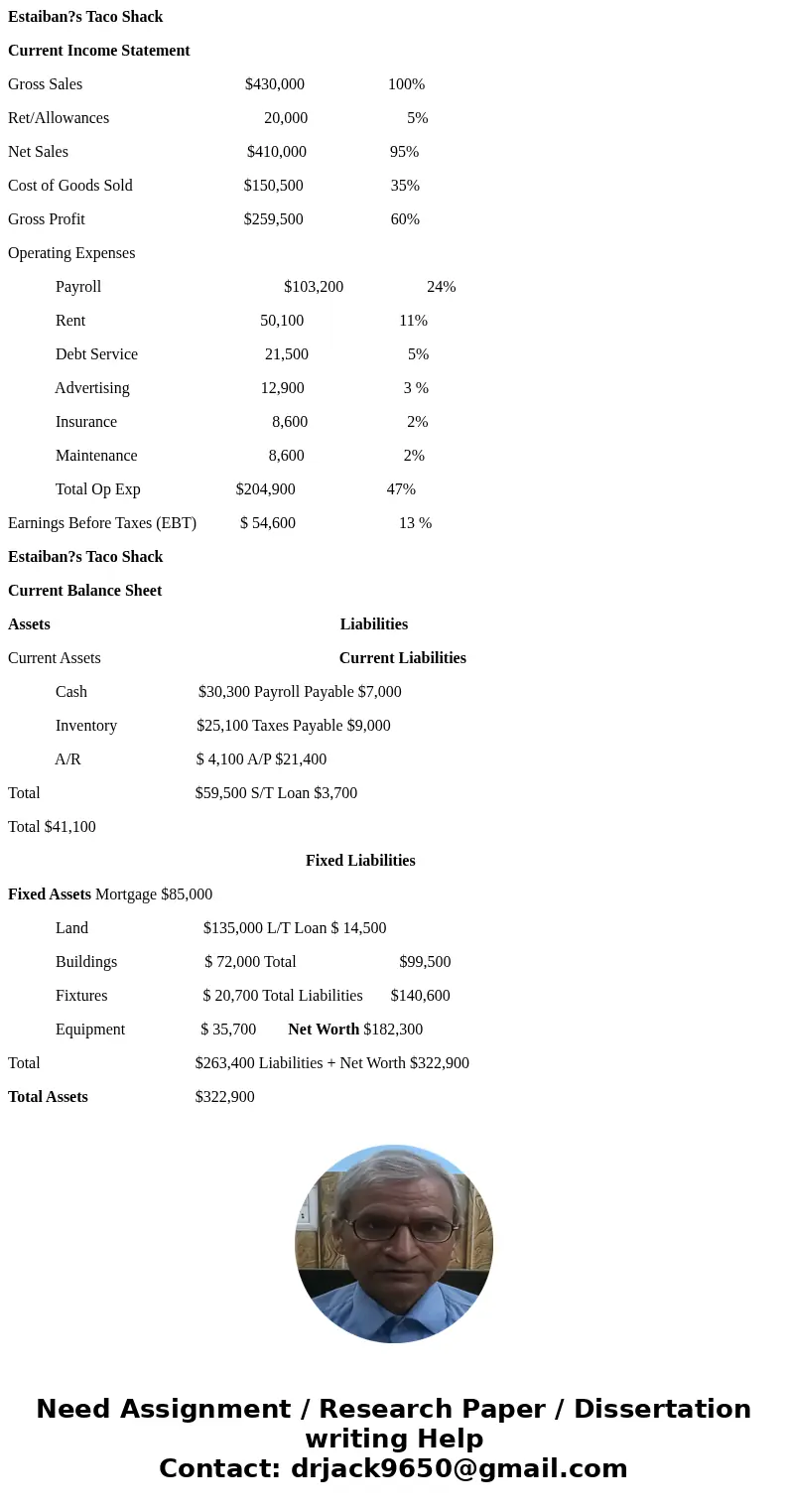

Estaiban?s Taco Shack

Current Income Statement

Gross Sales $430,000 100%

Ret/Allowances 20,000 5%

Net Sales $410,000 95%

Cost of Goods Sold $150,500 35%

Gross Profit $259,500 60%

Operating Expenses

Payroll $103,200 24%

Rent 50,100 11%

Debt Service 21,500 5%

Advertising 12,900 3 %

Insurance 8,600 2%

Maintenance 8,600 2%

Total Op Exp $204,900 47%

Earnings Before Taxes (EBT) $ 54,600 13 %

Estaiban?s Taco Shack

Current Balance Sheet

Assets Liabilities

Current Assets Current Liabilities

Cash $30,300 Payroll Payable $7,000

Inventory $25,100 Taxes Payable $9,000

A/R $ 4,100 A/P $21,400

Total $59,500 S/T Loan $3,700

Total $41,100

Fixed Liabilities

Fixed Assets Mortgage $85,000

Land $135,000 L/T Loan $ 14,500

Buildings $ 72,000 Total $99,500

Fixtures $ 20,700 Total Liabilities $140,600

Equipment $ 35,700 Net Worth $182,300

Total $263,400 Liabilities + Net Worth $322,900

Total Assets $322,900

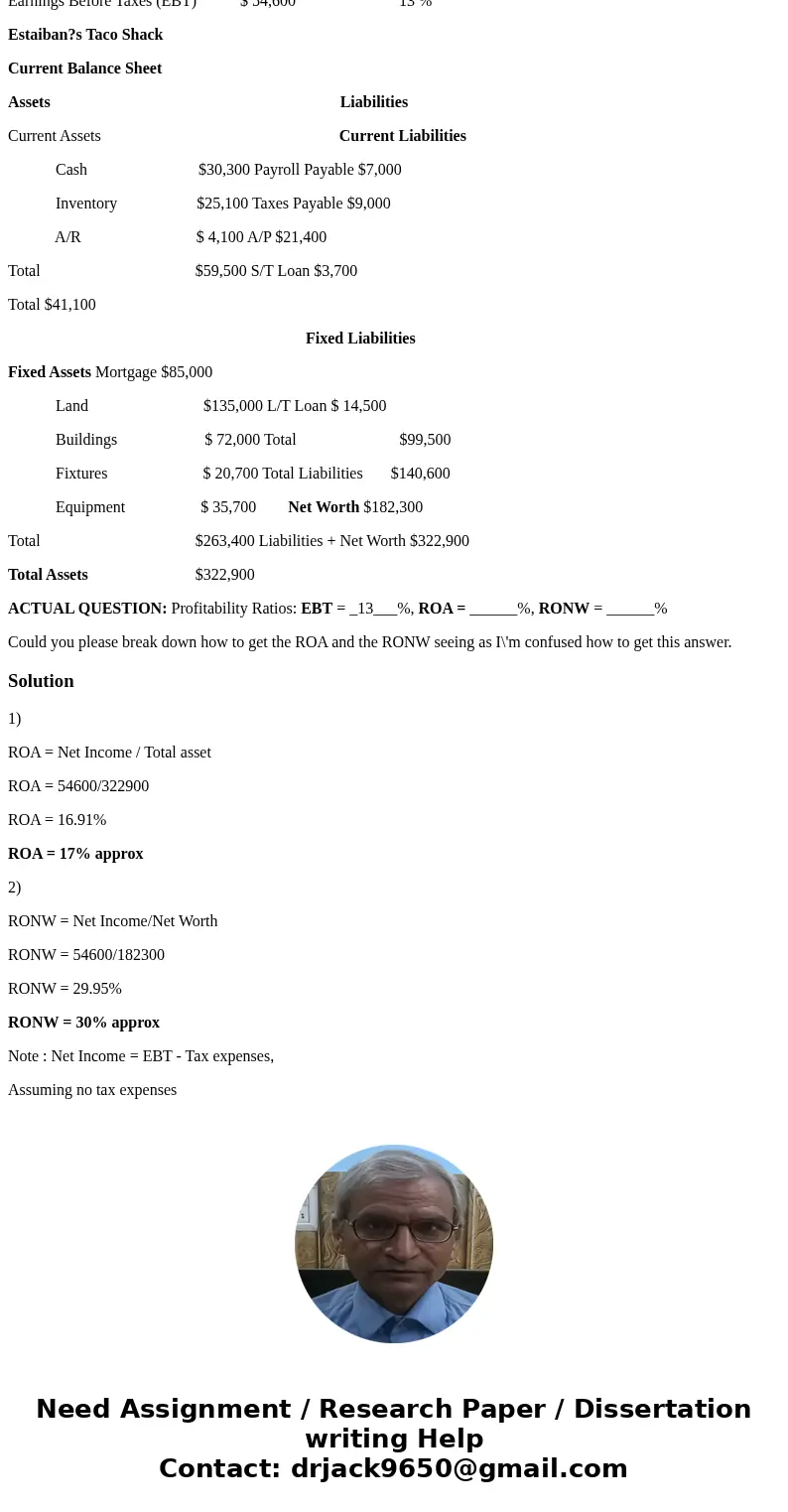

ACTUAL QUESTION: Profitability Ratios: EBT = _13___%, ROA = ______%, RONW = ______%

Could you please break down how to get the ROA and the RONW seeing as I\'m confused how to get this answer.

Solution

1)

ROA = Net Income / Total asset

ROA = 54600/322900

ROA = 16.91%

ROA = 17% approx

2)

RONW = Net Income/Net Worth

RONW = 54600/182300

RONW = 29.95%

RONW = 30% approx

Note : Net Income = EBT - Tax expenses,

Assuming no tax expenses

Homework Sourse

Homework Sourse