On January 1 Cooper Inc entered into two lease contracts The

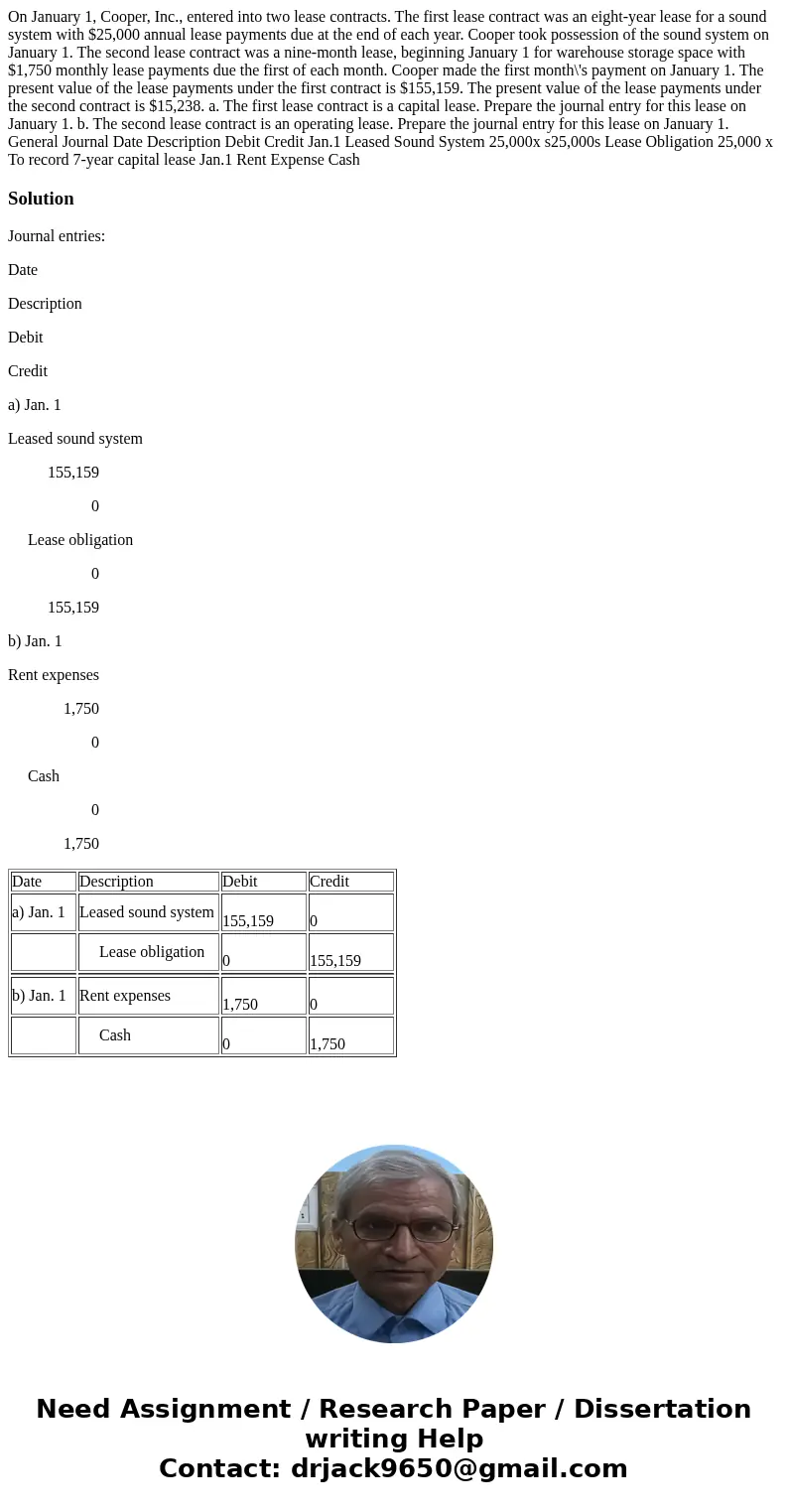

On January 1, Cooper, Inc., entered into two lease contracts. The first lease contract was an eight-year lease for a sound system with $25,000 annual lease payments due at the end of each year. Cooper took possession of the sound system on January 1. The second lease contract was a nine-month lease, beginning January 1 for warehouse storage space with $1,750 monthly lease payments due the first of each month. Cooper made the first month\'s payment on January 1. The present value of the lease payments under the first contract is $155,159. The present value of the lease payments under the second contract is $15,238. a. The first lease contract is a capital lease. Prepare the journal entry for this lease on January 1. b. The second lease contract is an operating lease. Prepare the journal entry for this lease on January 1. General Journal Date Description Debit Credit Jan.1 Leased Sound System 25,000x s25,000s Lease Obligation 25,000 x To record 7-year capital lease Jan.1 Rent Expense Cash

Solution

Journal entries:

Date

Description

Debit

Credit

a) Jan. 1

Leased sound system

155,159

0

Lease obligation

0

155,159

b) Jan. 1

Rent expenses

1,750

0

Cash

0

1,750

| Date | Description | Debit | Credit |

| a) Jan. 1 | Leased sound system | 155,159 | 0 |

| Lease obligation | 0 | 155,159 | |

| b) Jan. 1 | Rent expenses | 1,750 | 0 |

| Cash | 0 | 1,750 |

Homework Sourse

Homework Sourse