The conference on evaluating capital projects has been very

The conference on evaluating capital projects has been very helpful. You have received a significant amount of information and multiple projects to evaluate to hone your skills. To adequately teach Grammy and the Board you will need to answer several questions about the capital-budgeting process. You will do this in a business memo that is no more than four pages long. Provide an evaluation of two proposed projects, both with 5-year expected lives and identical initial outlays of $110,000. Both of these projects involve additions to a highly successful product line, and as a result, the required rate of return on both projects has been established at 12 percent. The expected free cash flows from each project are as follows: Project A Project B Initial outlay -$110,000 -$110,000 Inflow year 1 20,000 40,000 Inflow year 2 30,000 40,000 Inflow year 3 40,000 40,000 Inflow year 4 50,000 40,000 Inflow year 5 70,000 40,000 In evaluating these projects, please respond to the following 12 questions: 1. Why is the capital-budgeting process so important? 2. Why is it difficult to find exceptionally profitable projects? 3. What is the payback period on each project? If the organization imposes a 3-year maximum acceptable payback period, which of these projects should be accepted? 4. What are the criticisms of the payback period? 5. Determine the NPV for each of these projects. Should they be accepted? 6. Describe the logic behind the NPV. 7. Determine the PI for each of these projects. Should they be accepted? 8. Would you expect the NPV and PI methods to give consistent accept/reject decisions? Why or why not? 9. What would happen to the NPV and PI for each project if the required rate of return increased? If the required rate of return decreased? 10. Determine the IRR for each project. Should they be accepted? 11. How does a change in the required rate of return affect the project’s internal rate of return? 12. What reinvestment rate assumptions are implicitly made by the NPV and IRR methods? Which one is better?

Solution

1) Why is Capital Budgeting process so important:

Capital Budgeting involves huge investments of money and time by companies. Decisions taken once are usually irreversible. Even if reversed, it would be at a huge loss of money to businesses.

Capital Budgeting helps businesses make valuable choices between projects that give them better returns over the life of the project. After all businesses exist for making profits and right Capital decisions can significantly improve the long term value of a company.

Capital Budgeting involves financial decision as well as investment decision. It helps measure the long term cash flow of the business by projecting carefully all the expenses as well as incomes.

It brings about accountability in the business.

3) What is the Pay Back Period on each of the project?

Pay Back period is defined as the period within which the business will recover the initial investment in the project. It is a simple way to calculate the feasibility of a project. But it ignores the time value of money. It does not consider the futre cash flows beyond the payback period and thereore may miss out good projects that give better returns in the later periods.

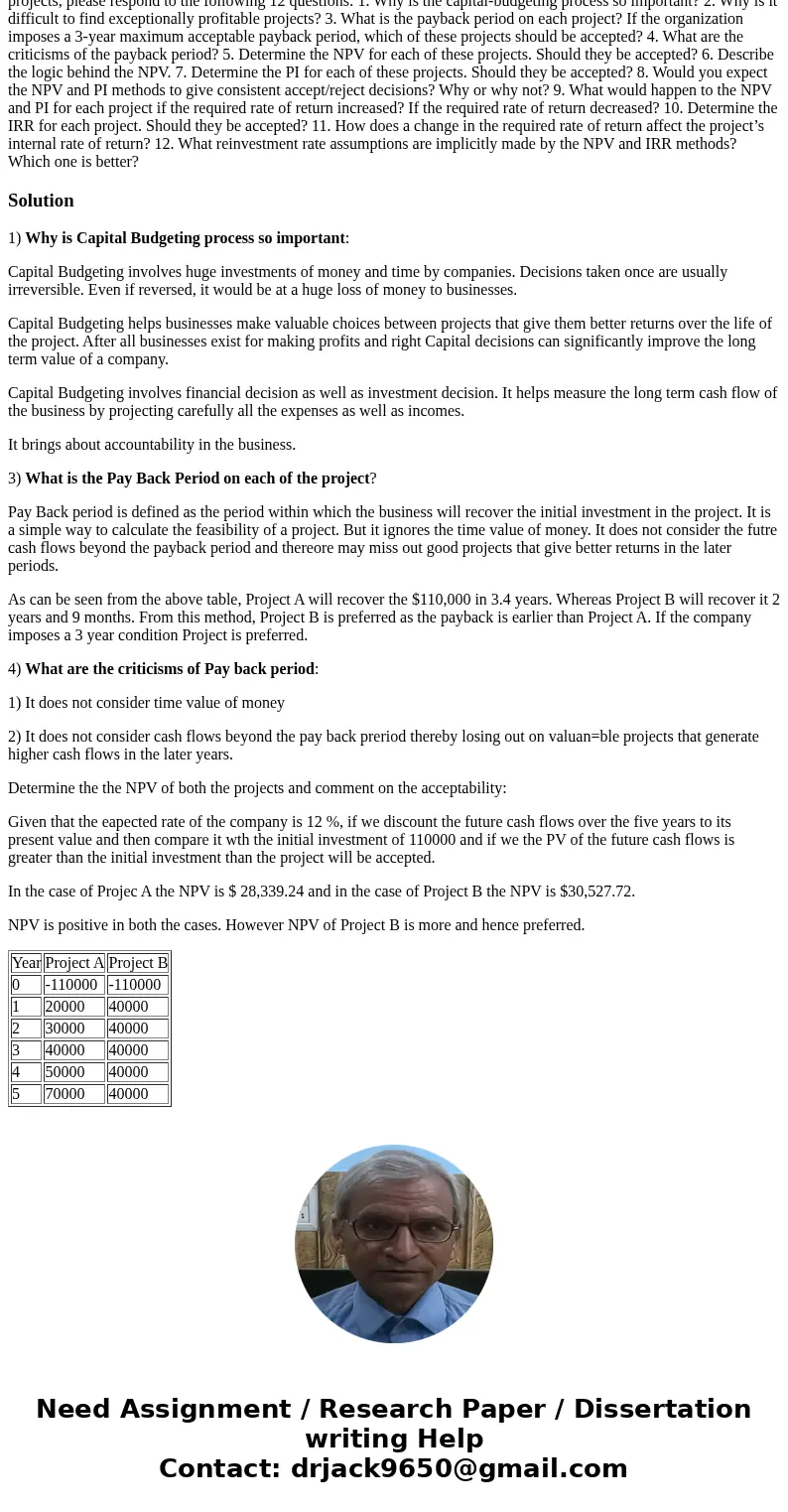

As can be seen from the above table, Project A will recover the $110,000 in 3.4 years. Whereas Project B will recover it 2 years and 9 months. From this method, Project B is preferred as the payback is earlier than Project A. If the company imposes a 3 year condition Project is preferred.

4) What are the criticisms of Pay back period:

1) It does not consider time value of money

2) It does not consider cash flows beyond the pay back preriod thereby losing out on valuan=ble projects that generate higher cash flows in the later years.

Determine the the NPV of both the projects and comment on the acceptability:

Given that the eapected rate of the company is 12 %, if we discount the future cash flows over the five years to its present value and then compare it wth the initial investment of 110000 and if we the PV of the future cash flows is greater than the initial investment than the project will be accepted.

In the case of Projec A the NPV is $ 28,339.24 and in the case of Project B the NPV is $30,527.72.

NPV is positive in both the cases. However NPV of Project B is more and hence preferred.

| Year | Project A | Project B |

| 0 | -110000 | -110000 |

| 1 | 20000 | 40000 |

| 2 | 30000 | 40000 |

| 3 | 40000 | 40000 |

| 4 | 50000 | 40000 |

| 5 | 70000 | 40000 |

Homework Sourse

Homework Sourse