35300 direct laborhours Question e 100000 out of 100000 poin

35,300 direct labor-hours Question e 1.00000 out of 1.00000 points An income statement for Sam\'s Bookstore for the first quarter of the year is presented below Sam\'s Bookstore Income Statement For Quarter Ended March 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Selling Administration Net operating income 900,000 630,000 270,000 100,000 104,000 204,000 66,000 On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed. If 20,000 books are sold during the second quarter and this activity is within the relevant range, the company\'s expected contribution margin would be:

Solution

Answer

Existing Condition

Sales in units = $900,000 / $50 per unit

Sales in units = 18,000 Units

Variable Selling expenses = $5 per book

Variable Administrative expenses = 4% of Sales

COGS to Sales percent = (COGS / Total Sales) * 100

= (630,000 / 900,000) * 100

COGS to Sales percent = 70%

Sales (20,000 Units * $50)

1,000,000

Cost of Goods Sold ($1,000,000 * 70%)

(700,000)

Variable Selling Expenses (20,000 Units * $5)

(100,000)

Variable Administrative Expenses (4% * 1,000,000)

(40,000)

Contribution Margin

160,000

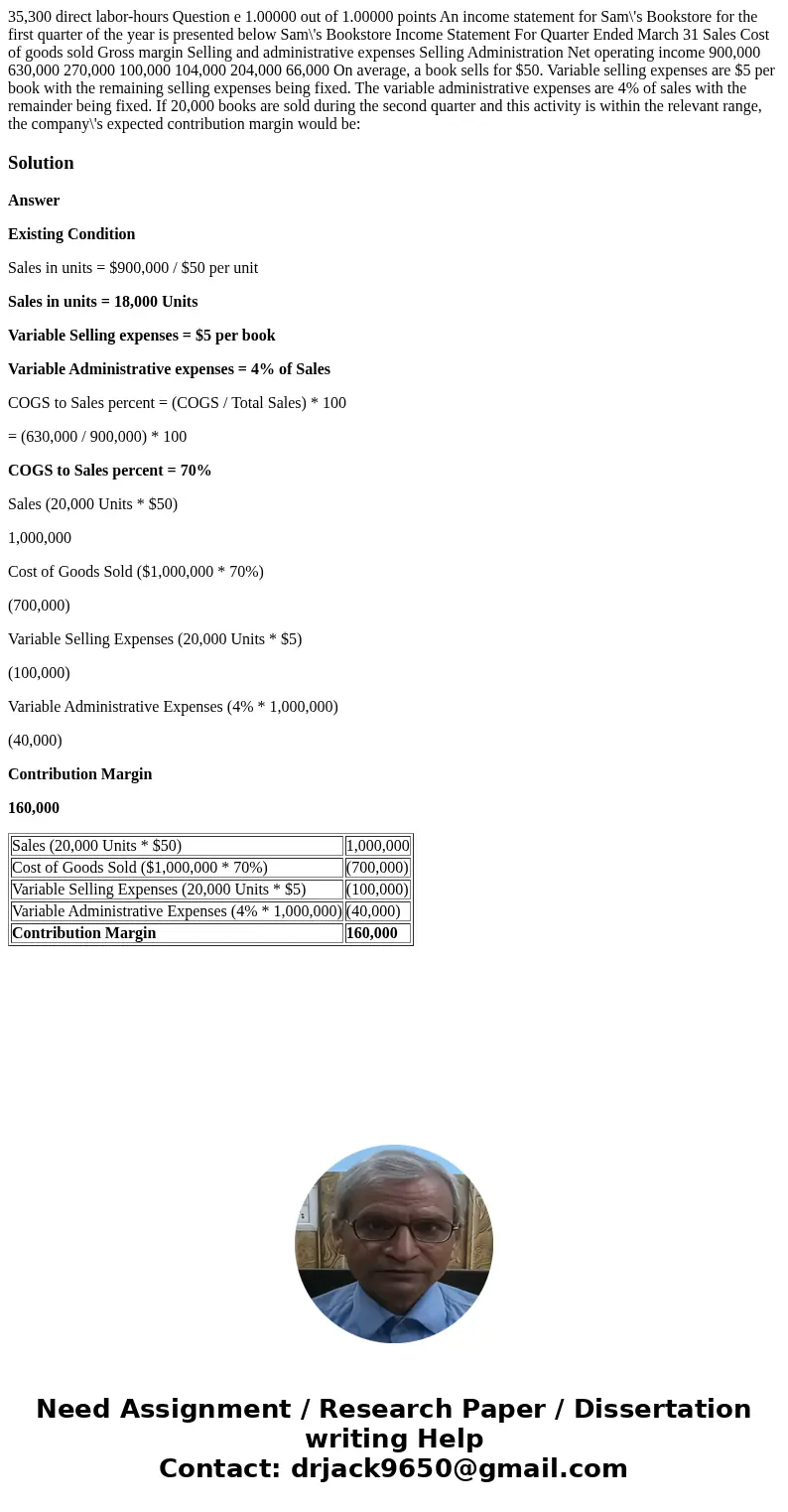

| Sales (20,000 Units * $50) | 1,000,000 |

| Cost of Goods Sold ($1,000,000 * 70%) | (700,000) |

| Variable Selling Expenses (20,000 Units * $5) | (100,000) |

| Variable Administrative Expenses (4% * 1,000,000) | (40,000) |

| Contribution Margin | 160,000 |

Homework Sourse

Homework Sourse