Sinclair Fund has invested in securities of five corporation

Sinclair Fund has invested in securities of five corporations. The market value of each of the investments and the beta of the corporations is as follows:

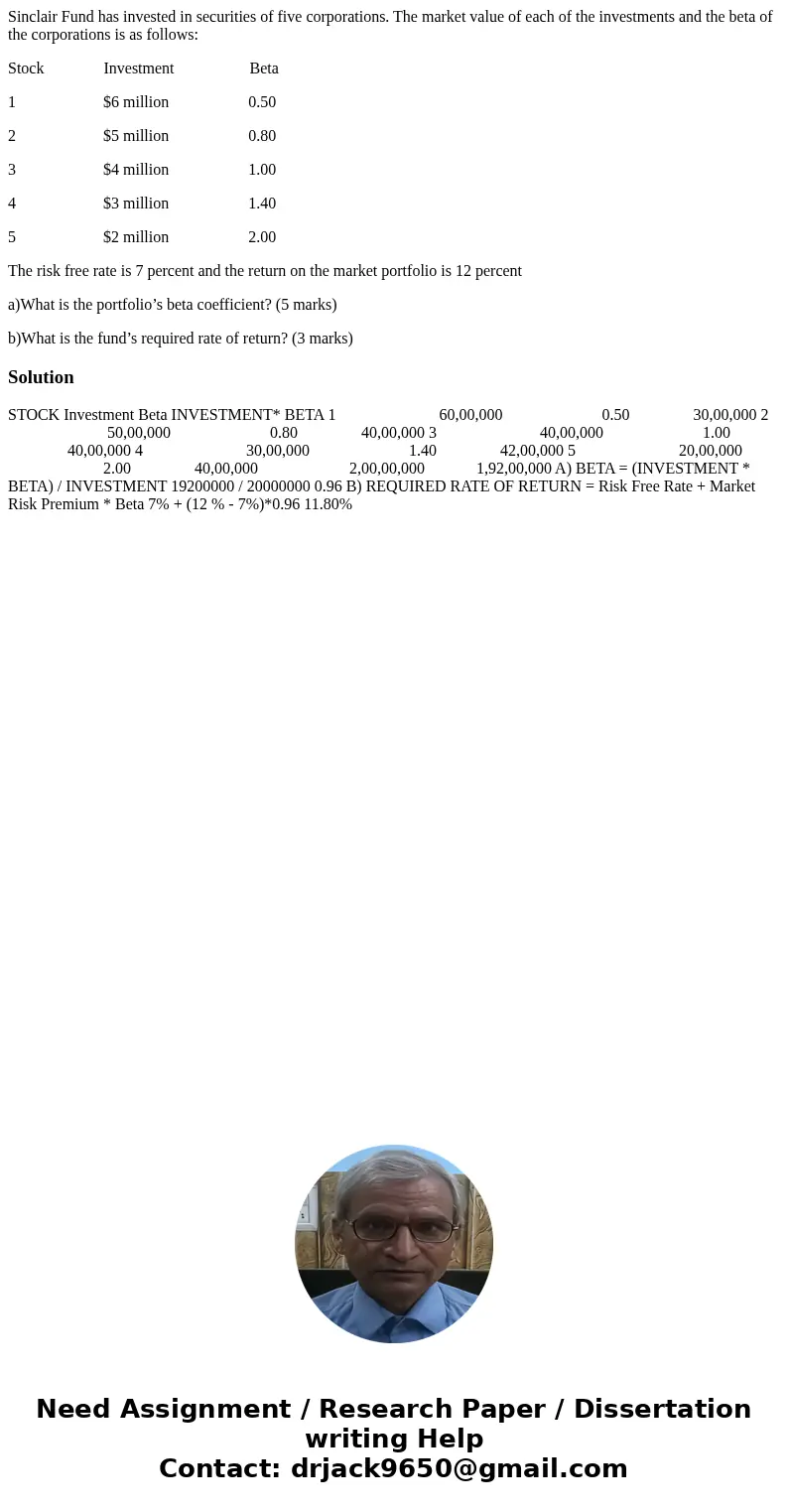

Stock Investment Beta

1 $6 million 0.50

2 $5 million 0.80

3 $4 million 1.00

4 $3 million 1.40

5 $2 million 2.00

The risk free rate is 7 percent and the return on the market portfolio is 12 percent

a)What is the portfolio’s beta coefficient? (5 marks)

b)What is the fund’s required rate of return? (3 marks)

Solution

STOCK Investment Beta INVESTMENT* BETA 1 60,00,000 0.50 30,00,000 2 50,00,000 0.80 40,00,000 3 40,00,000 1.00 40,00,000 4 30,00,000 1.40 42,00,000 5 20,00,000 2.00 40,00,000 2,00,00,000 1,92,00,000 A) BETA = (INVESTMENT * BETA) / INVESTMENT 19200000 / 20000000 0.96 B) REQUIRED RATE OF RETURN = Risk Free Rate + Market Risk Premium * Beta 7% + (12 % - 7%)*0.96 11.80%

Homework Sourse

Homework Sourse