Find FCF for 2014 Asset Year 2014 2013 2012 Cash 14000 7282

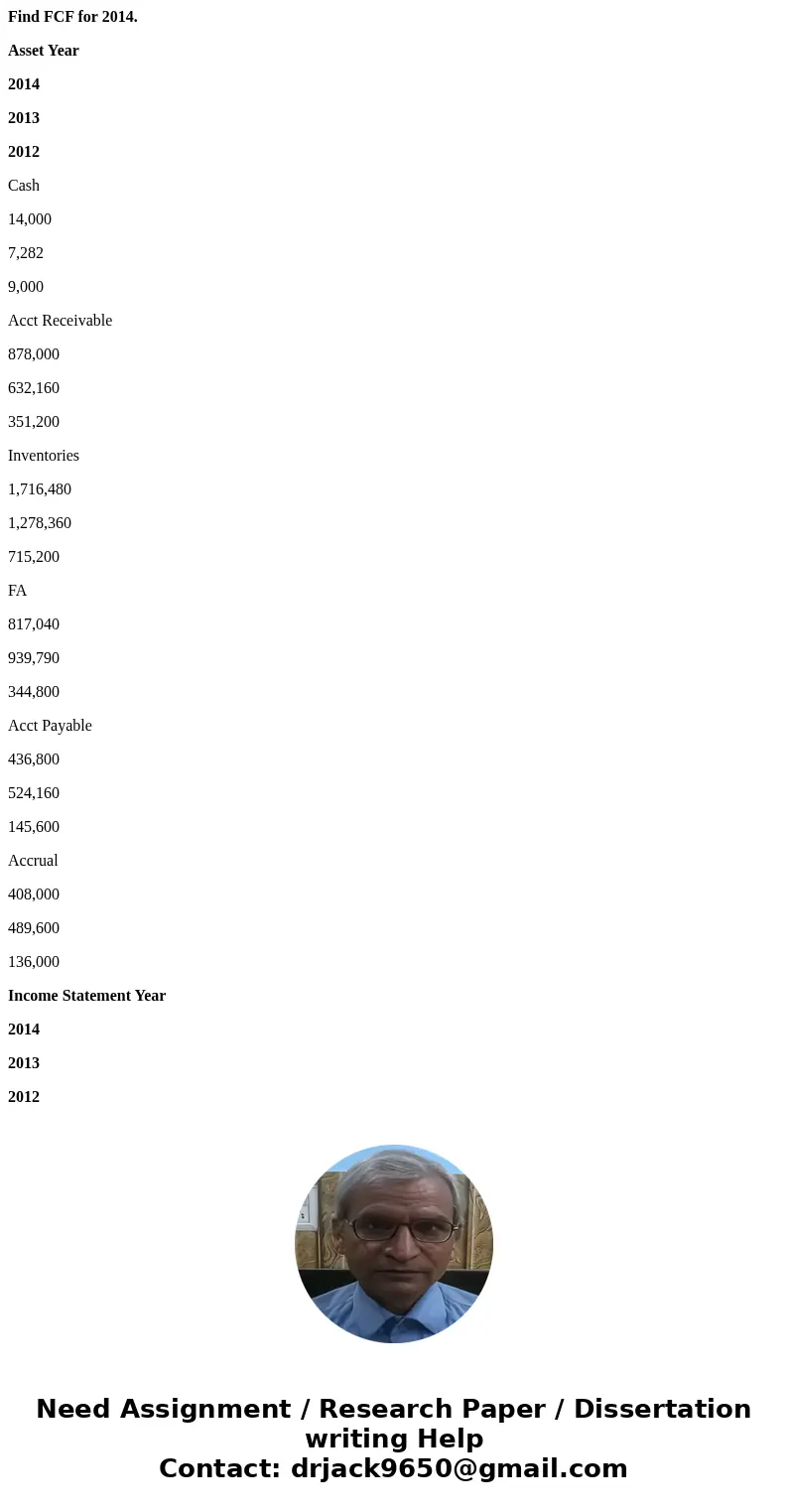

Find FCF for 2014.

Asset Year

2014

2013

2012

Cash

14,000

7,282

9,000

Acct Receivable

878,000

632,160

351,200

Inventories

1,716,480

1,278,360

715,200

FA

817,040

939,790

344,800

Acct Payable

436,800

524,160

145,600

Accrual

408,000

489,600

136,000

Income Statement Year

2014

2013

2012

EBIT

510,640

-690,560

209,100

TAX

40%

| Asset Year | 2014 | 2013 | 2012 |

| Cash | 14,000 | 7,282 | 9,000 |

| Acct Receivable | 878,000 | 632,160 | 351,200 |

| Inventories | 1,716,480 | 1,278,360 | 715,200 |

| FA | 817,040 | 939,790 | 344,800 |

| Acct Payable | 436,800 | 524,160 | 145,600 |

| Accrual | 408,000 | 489,600 | 136,000 |

| Income Statement Year | 2014 | 2013 | 2012 |

| EBIT | 510,640 | -690,560 | 209,100 |

| TAX | 40% |

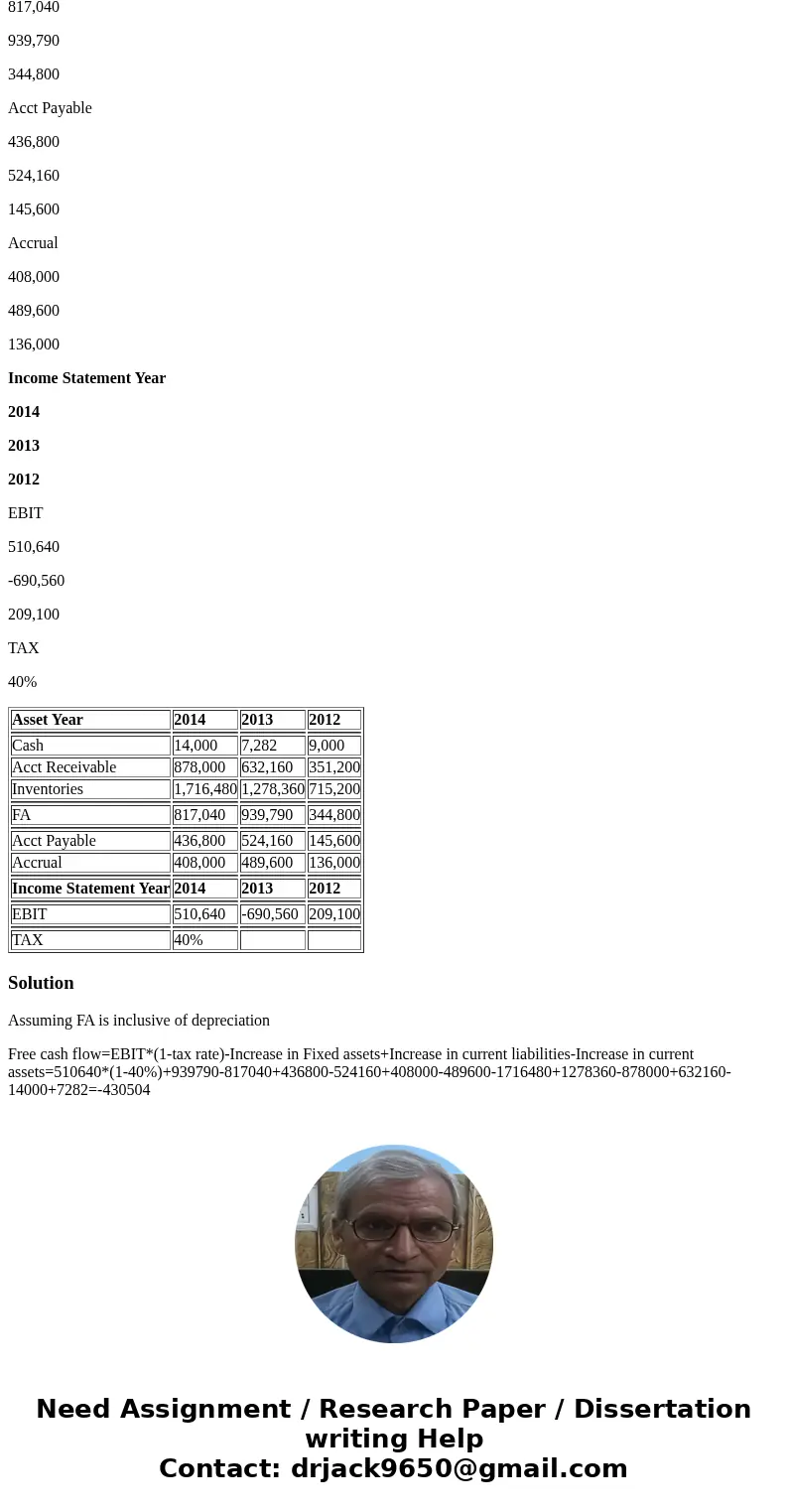

Solution

Assuming FA is inclusive of depreciation

Free cash flow=EBIT*(1-tax rate)-Increase in Fixed assets+Increase in current liabilities-Increase in current assets=510640*(1-40%)+939790-817040+436800-524160+408000-489600-1716480+1278360-878000+632160-14000+7282=-430504

Homework Sourse

Homework Sourse