Using the following transactions prepare the adjusting entry

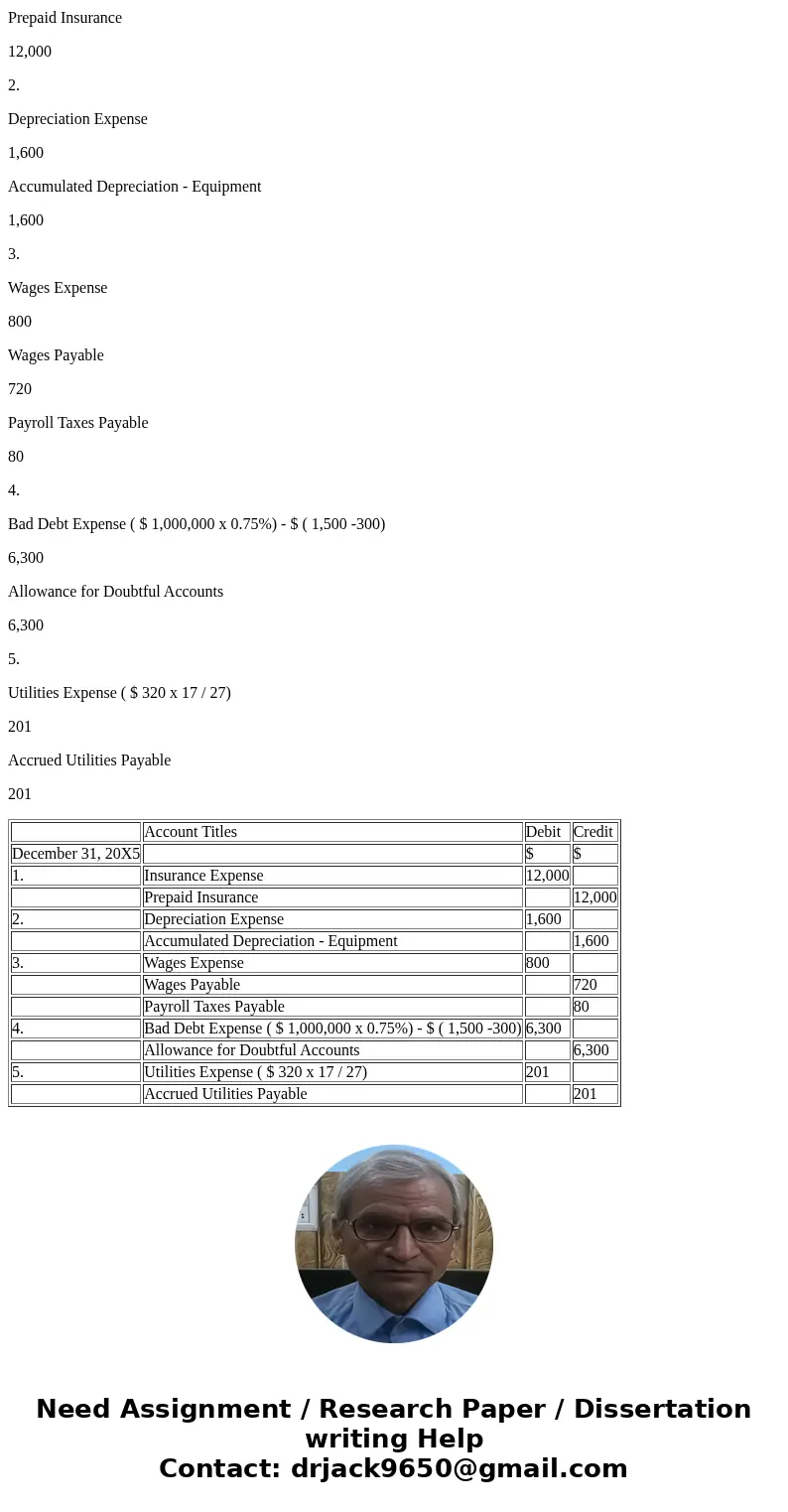

Using the following transactions, prepare the adjusting entry to record the proper expense for 2017 and the journal entry to write off two uncollectible accounts for Fee’s Fountain.

A fire insurance policy for January 1, 2015, through December 31, 2016 was purchased on December 15, 2014. The premium paid totaled $24,000 and was recorded as prepaid insurance.

The operation purchased a used cash register costing $8,000 on December 18, 2014 and recorded it on the equipment account. The cash register is expected to have a useful life of five years and a salvage value of $0. No depreciation has been recorded. Fee’s uses the straight-line method of depreciation.

The employees were paid for their work through December 28. They worked 100 hours for the period of December 29-31 and will be paid January 10. The average hourly wage is $8.00. The related payroll taxes are 10 percent of the wages.

Sales for the year totaled $1,000,000. The allowance for doubtful accounts has a December 31 balance of $1,500 prior to write-off of two accounts totaling $300. The allowance should be adjusted at year-end to ¾ percent of sales for the year.

The electric bill for the period of December 15 through Jan. 10th totaled $320. It has not been recorded and will be paid January 15.

Solution

Account Titles

Debit

Credit

December 31, 20X5

$

$

1.

Insurance Expense

12,000

Prepaid Insurance

12,000

2.

Depreciation Expense

1,600

Accumulated Depreciation - Equipment

1,600

3.

Wages Expense

800

Wages Payable

720

Payroll Taxes Payable

80

4.

Bad Debt Expense ( $ 1,000,000 x 0.75%) - $ ( 1,500 -300)

6,300

Allowance for Doubtful Accounts

6,300

5.

Utilities Expense ( $ 320 x 17 / 27)

201

Accrued Utilities Payable

201

| Account Titles | Debit | Credit | |

| December 31, 20X5 | $ | $ | |

| 1. | Insurance Expense | 12,000 | |

| Prepaid Insurance | 12,000 | ||

| 2. | Depreciation Expense | 1,600 | |

| Accumulated Depreciation - Equipment | 1,600 | ||

| 3. | Wages Expense | 800 | |

| Wages Payable | 720 | ||

| Payroll Taxes Payable | 80 | ||

| 4. | Bad Debt Expense ( $ 1,000,000 x 0.75%) - $ ( 1,500 -300) | 6,300 | |

| Allowance for Doubtful Accounts | 6,300 | ||

| 5. | Utilities Expense ( $ 320 x 17 / 27) | 201 | |

| Accrued Utilities Payable | 201 |

Homework Sourse

Homework Sourse