In 2008 voters in Minnesota were asked to vote on the Clean

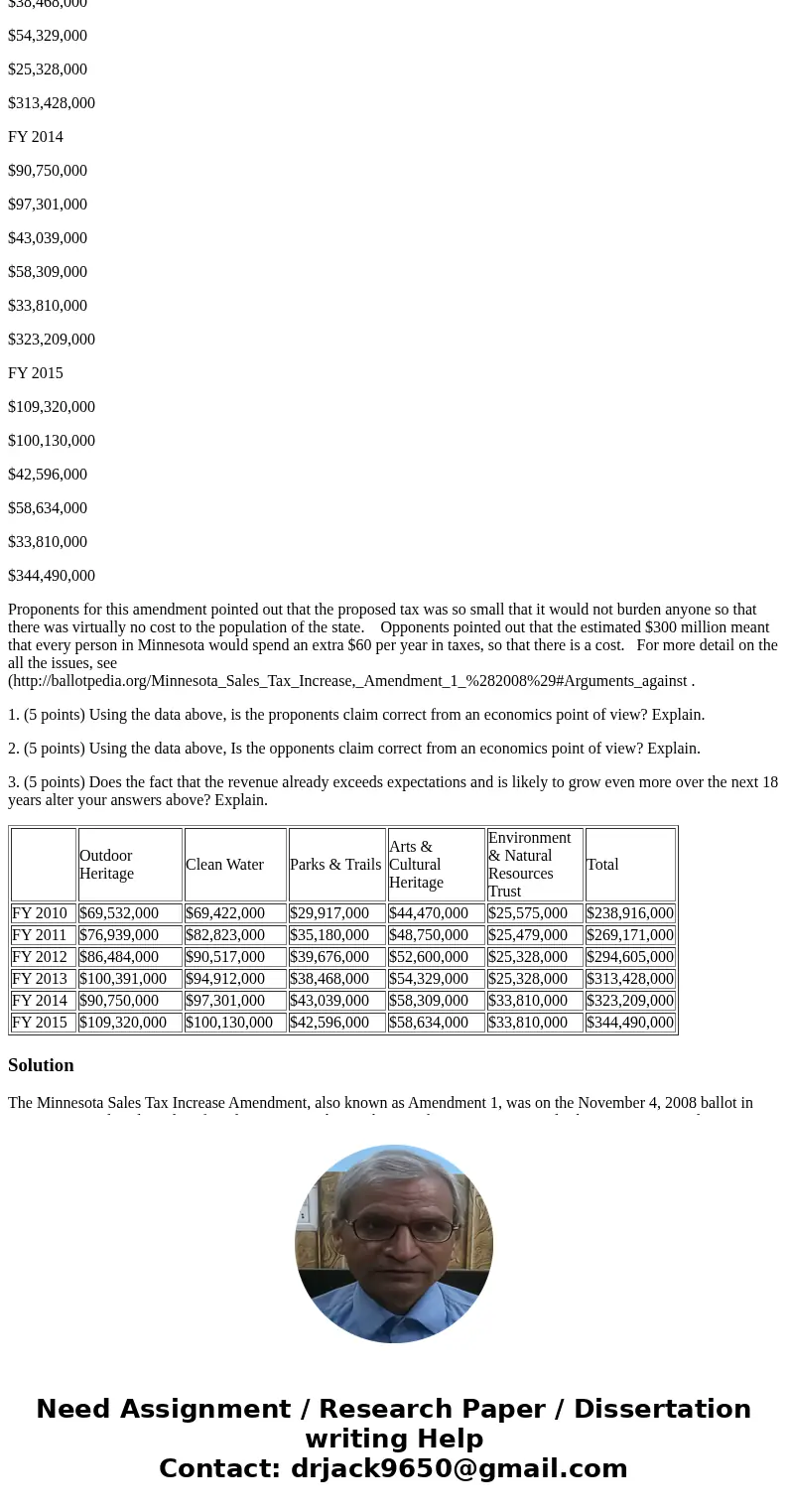

In 2008, voters in Minnesota were asked to vote on the Clean Land, Water and Legacy Amendment to the state constitution to raise the state sales tax by three eighths of one percent (0.00375) for 25 years to dedicate funds for various environmental and cultural projects. The tax was expected to raise around $300 million dollars annually. Below are the appropriations (and total) by FY.

Outdoor Heritage

Clean Water

Parks & Trails

Arts & Cultural Heritage

Environment & Natural Resources Trust

Total

FY 2010

$69,532,000

$69,422,000

$29,917,000

$44,470,000

$25,575,000

$238,916,000

FY 2011

$76,939,000

$82,823,000

$35,180,000

$48,750,000

$25,479,000

$269,171,000

FY 2012

$86,484,000

$90,517,000

$39,676,000

$52,600,000

$25,328,000

$294,605,000

FY 2013

$100,391,000

$94,912,000

$38,468,000

$54,329,000

$25,328,000

$313,428,000

FY 2014

$90,750,000

$97,301,000

$43,039,000

$58,309,000

$33,810,000

$323,209,000

FY 2015

$109,320,000

$100,130,000

$42,596,000

$58,634,000

$33,810,000

$344,490,000

Proponents for this amendment pointed out that the proposed tax was so small that it would not burden anyone so that there was virtually no cost to the population of the state. Opponents pointed out that the estimated $300 million meant that every person in Minnesota would spend an extra $60 per year in taxes, so that there is a cost. For more detail on the all the issues, see (http://ballotpedia.org/Minnesota_Sales_Tax_Increase,_Amendment_1_%282008%29#Arguments_against .

1. (5 points) Using the data above, is the proponents claim correct from an economics point of view? Explain.

2. (5 points) Using the data above, Is the opponents claim correct from an economics point of view? Explain.

3. (5 points) Does the fact that the revenue already exceeds expectations and is likely to grow even more over the next 18 years alter your answers above? Explain.

| Outdoor Heritage | Clean Water | Parks & Trails | Arts & Cultural Heritage | Environment & Natural Resources Trust | Total | |

| FY 2010 | $69,532,000 | $69,422,000 | $29,917,000 | $44,470,000 | $25,575,000 | $238,916,000 |

| FY 2011 | $76,939,000 | $82,823,000 | $35,180,000 | $48,750,000 | $25,479,000 | $269,171,000 |

| FY 2012 | $86,484,000 | $90,517,000 | $39,676,000 | $52,600,000 | $25,328,000 | $294,605,000 |

| FY 2013 | $100,391,000 | $94,912,000 | $38,468,000 | $54,329,000 | $25,328,000 | $313,428,000 |

| FY 2014 | $90,750,000 | $97,301,000 | $43,039,000 | $58,309,000 | $33,810,000 | $323,209,000 |

| FY 2015 | $109,320,000 | $100,130,000 | $42,596,000 | $58,634,000 | $33,810,000 | $344,490,000 |

Solution

The Minnesota Sales Tax Increase Amendment, also known as Amendment 1, was on the November 4, 2008 ballot in Minnesota as a legislatively referred constitutional amendment, where it was approved. The measure enacted an increase of three-eighths of one percent in the sales and use tax in order to provide revenue to protect the natural resources of the state and to preserve Minnesota\'s arts and cultural heritage. The increases began on July 1, 2009 and continue until the year 2034.

In Favour =58.89%

In Against = 41.11%

Arguments in favor

Notable arguments made in support of the measure included:

§ The arts in Minnesota are in desperate need of funding and are otherwise left on the sidelines financially because of other pressures on the state\'s budget.

§ The amendment will protect drinking water and provide funding for the cleanup of rivers, lakes and streams.

§ It will create a chance to preserve open spaces before they are lost to development.

§ Investing in this type of spending will make it easier for businesses to attract top employees.

§ It is a way to meet critical needs after years of under funding.

Arguments against

Notable arguments made in opposition to the measure included:

Arguments from No SalesTaxIncrease.org

1. It’s $11 billion out of Minnesotan’s pockets. The almost half percent sales tax increase will generate $11 billion over 25 years, paid for by you, the taxpayer, and given into the hands of government.

2. It’s a Constitutional Amendment. If passed, the question on the ballot will be an amendment to the state Constitution, which will never go away. The Constitution is a document formed for the purposes of giving rights to the people and limiting the rights of government. A mandated tax increase and a mandated way to spend that money is an abuse of the state Constitution.

3. It mandates where $300 million each year will be spent. If passed, $300 million each year will be dedicated solely for the purposes of the arts and outdoors. Although these things are important, the role of the state legislature is to decide where taxpayer dollars are spent each 2-year budget cycle. We elect representatives to the legislature to prioritize spending. This amendment would allow $300 million of taxpayer money to bypass the legislative process and force them to spend it on the arts and outdoors, even if that year there were higher-priority needs for other things, like roads and education.

4. There’s no lack of current funds. Although few know it, millions of taxpayer dollars already go to fund environmental projects. The Department of Natural Resources has a 2-year budget of $1.5 billion. A portion of the state lottery proceeds goes to the Environmental and Natural Resources Trust Fund. The market value of this fund is currently at $415 million. Clearly, there is no lack of funding for environmental projects.

5. We can’t follow the money. If this tax increase passes, hundreds of nonprofit organizations will lobby to get their hands on these government grants. As opposed to government departments, nonprofits do not have to report where and how they spend their money. Once these nonprofits receive government grants from the dedicated funding, taxpayers will never see where their money is spent.

Homework Sourse

Homework Sourse