Historical Realized Rates of Return Stocks A and B have the

Historical Realized Rates of Return

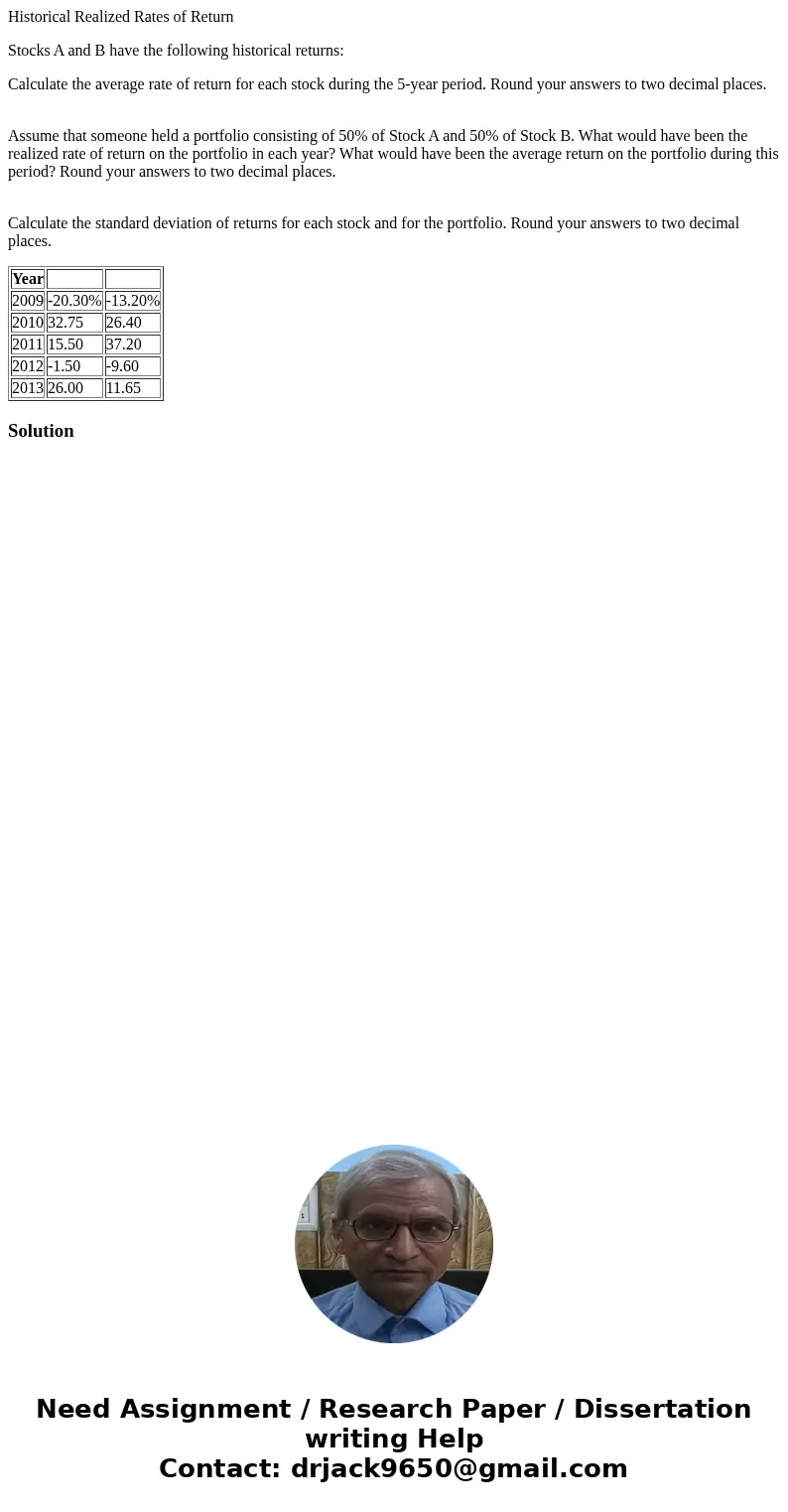

Stocks A and B have the following historical returns:

Calculate the average rate of return for each stock during the 5-year period. Round your answers to two decimal places.

Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? Round your answers to two decimal places.

Calculate the standard deviation of returns for each stock and for the portfolio. Round your answers to two decimal places.

| Year | ||

| 2009 | -20.30% | -13.20% |

| 2010 | 32.75 | 26.40 |

| 2011 | 15.50 | 37.20 |

| 2012 | -1.50 | -9.60 |

| 2013 | 26.00 | 11.65 |

Solution

Homework Sourse

Homework Sourse