cure httpsnewconnectmheducationcomflowconnecthtml INAL EXAM

Solution

1. Stormy weather

Discount rate =20%

Expected earning this year =$2 per share

According to dividend growth model,

stock price = dividend per share/ discount rate

A. Plowback ratio = 0

Dividend per share = Earnings per share =$2

Stock price = 2/0.2 = $10

P/E ratio = Price per Share/ Earnings per share =10/2 = 5

Growth rate =20%×0 =0

B. Plowback ratio= 0.2

Dividend per share = 2×(1-0.2) = $1.6

Stock price = 1.6/0.2 = $8

Growth rate = 20%×0.2 =4%

P/E ratio =8/2 = 4

C. Plowback ratio =0.6

Dividend per share = 2×(1-0.6) = $0.8

Stock price =0.8/0.2 = $4

P/E ratio = 4/2 = 2

Growth rate = 20% × 0.6 = 12%

A.

0.30

A. Yes, treasury bonds will provide higher returns in recessions than in booms. As bond prices has inverse relarionship with intrest rates, hence bonds provide higher returns during recessions when inrest rate falls. Intrest rate falls during recessions and rise during booms.

B.

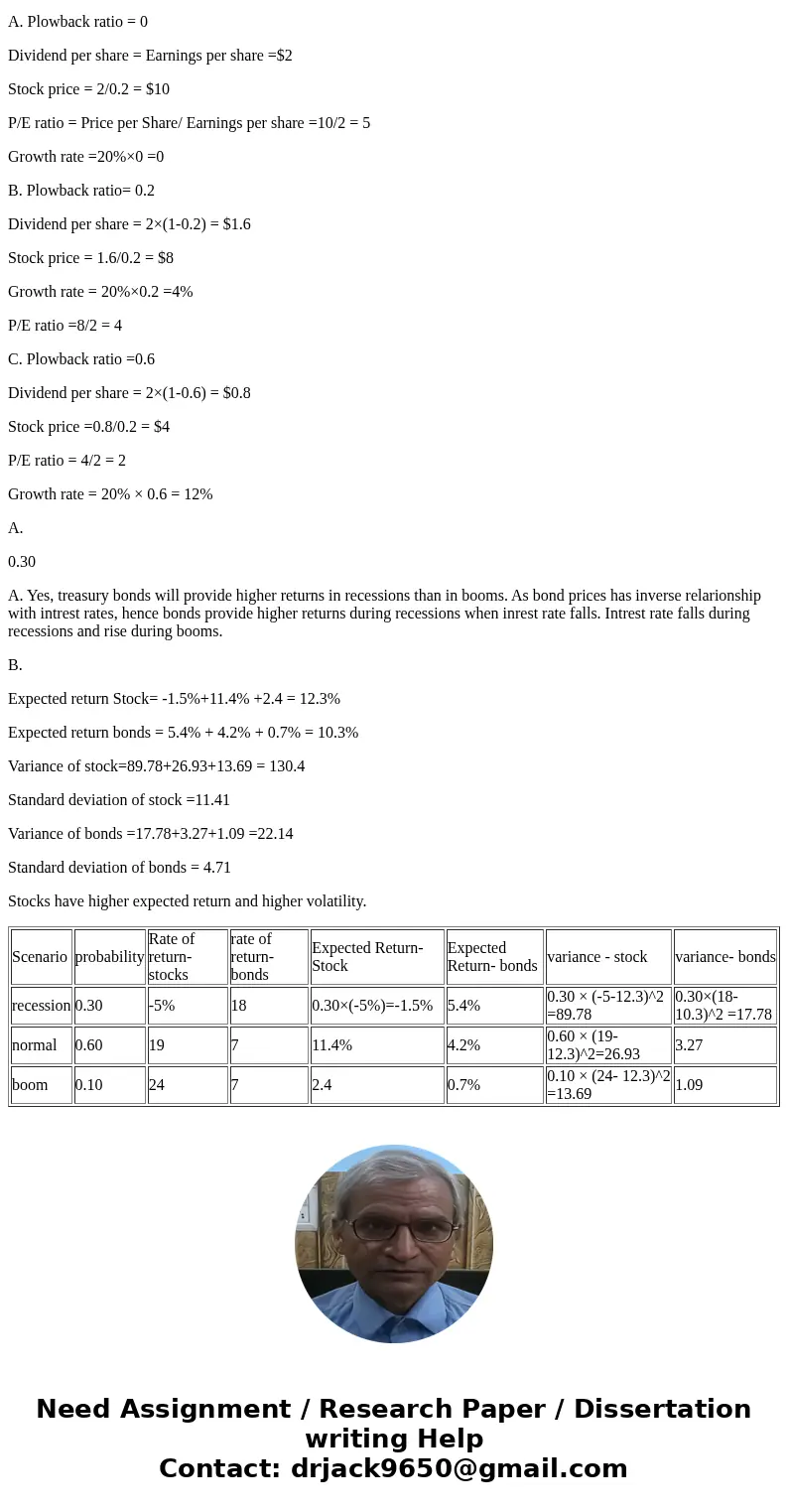

Expected return Stock= -1.5%+11.4% +2.4 = 12.3%

Expected return bonds = 5.4% + 4.2% + 0.7% = 10.3%

Variance of stock=89.78+26.93+13.69 = 130.4

Standard deviation of stock =11.41

Variance of bonds =17.78+3.27+1.09 =22.14

Standard deviation of bonds = 4.71

Stocks have higher expected return and higher volatility.

| Scenario | probability | Rate of return-stocks | rate of return- bonds | Expected Return-Stock | Expected Return- bonds | variance - stock | variance- bonds |

| recession | 0.30 | -5% | 18 | 0.30×(-5%)=-1.5% | 5.4% | 0.30 × (-5-12.3)^2 =89.78 | 0.30×(18-10.3)^2 =17.78 |

| normal | 0.60 | 19 | 7 | 11.4% | 4.2% | 0.60 × (19-12.3)^2=26.93 | 3.27 |

| boom | 0.10 | 24 | 7 | 2.4 | 0.7% | 0.10 × (24- 12.3)^2 =13.69 | 1.09 |

Homework Sourse

Homework Sourse