Paul takes a loan of 225000 from the bank at 7 interest rate

Paul takes a loan of $225,000 from the bank at 7% interest rate per year over a 10-year period. He plans to pay off the loan in 10 yearly payments of $16,000 each, and with the money that he is going to inherit from his grand parents. How much should he inherit to pay off the entire loan if the grand parents give him the money at the end of the 4th year and he hands over the entire amount to the bank on the day he receives it?

Solution

Solution:

Paul plant to pay off loan in 10 yearly instalments of $16,000 each plus money inherit from grand father at the end of 4th year.

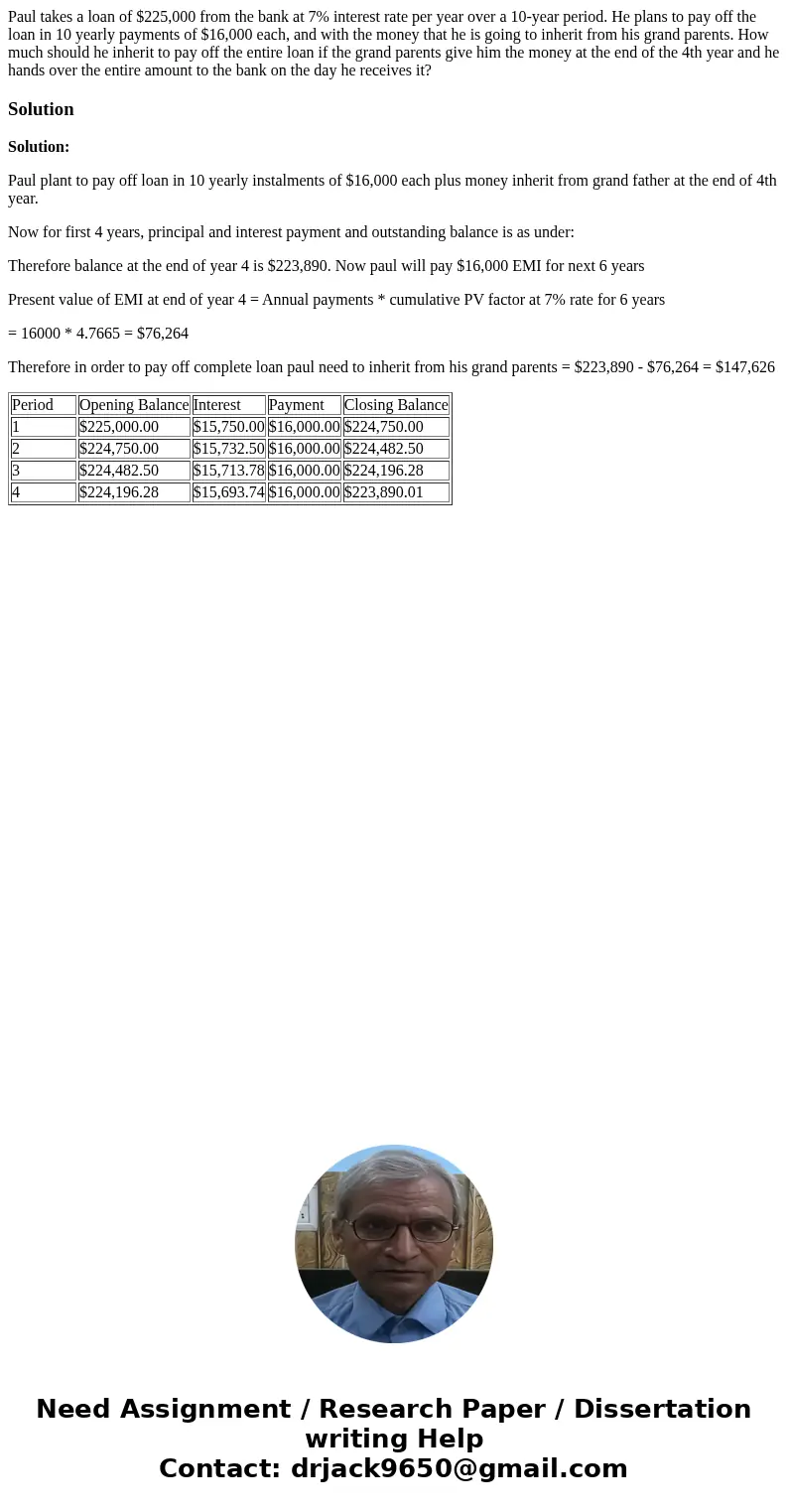

Now for first 4 years, principal and interest payment and outstanding balance is as under:

Therefore balance at the end of year 4 is $223,890. Now paul will pay $16,000 EMI for next 6 years

Present value of EMI at end of year 4 = Annual payments * cumulative PV factor at 7% rate for 6 years

= 16000 * 4.7665 = $76,264

Therefore in order to pay off complete loan paul need to inherit from his grand parents = $223,890 - $76,264 = $147,626

| Period | Opening Balance | Interest | Payment | Closing Balance |

| 1 | $225,000.00 | $15,750.00 | $16,000.00 | $224,750.00 |

| 2 | $224,750.00 | $15,732.50 | $16,000.00 | $224,482.50 |

| 3 | $224,482.50 | $15,713.78 | $16,000.00 | $224,196.28 |

| 4 | $224,196.28 | $15,693.74 | $16,000.00 | $223,890.01 |

Homework Sourse

Homework Sourse