Income from Continuing Operations 400 Fiscal Year Ended Janu

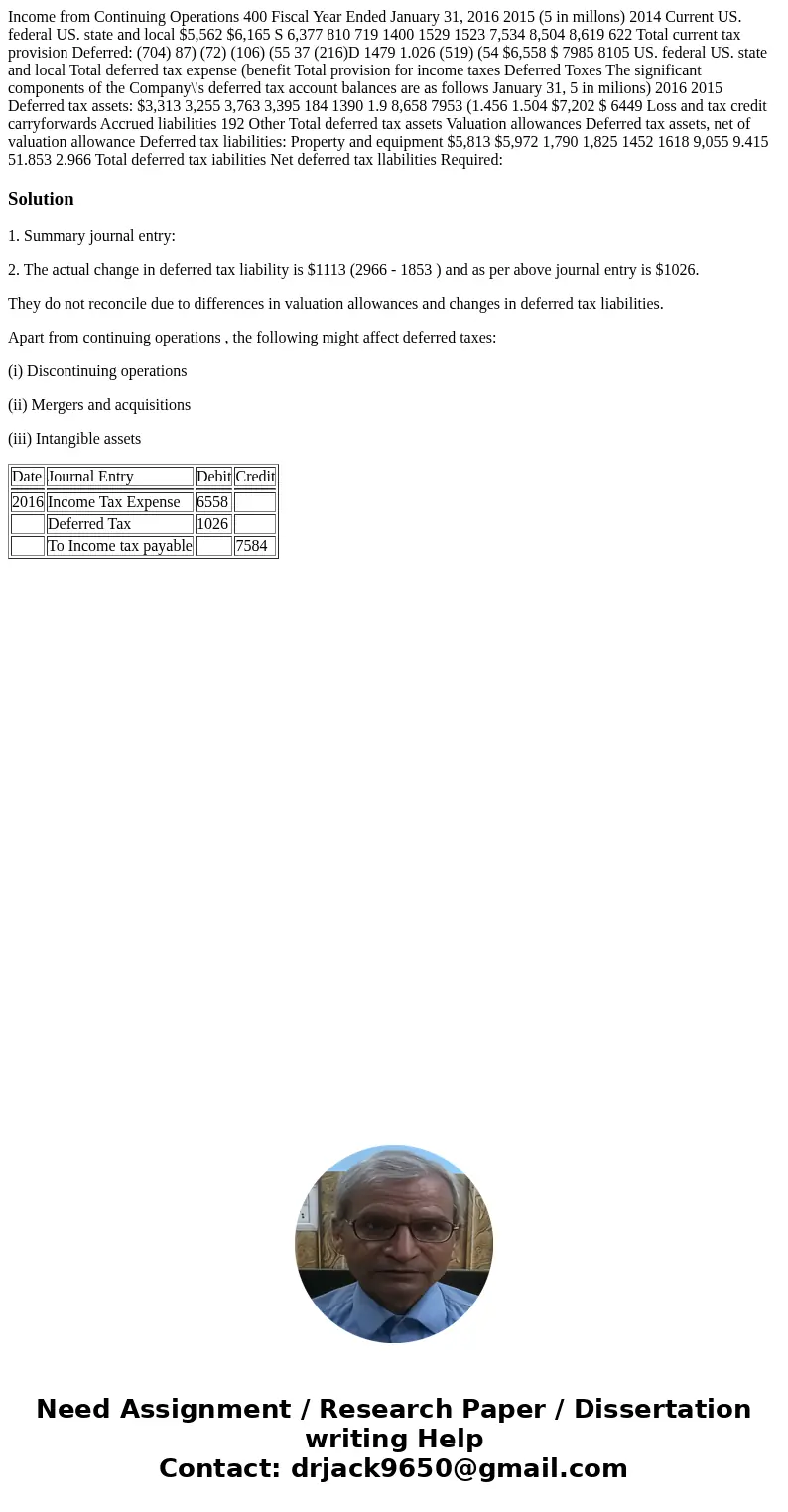

Income from Continuing Operations 400 Fiscal Year Ended January 31, 2016 2015 (5 in millons) 2014 Current US. federal US. state and local $5,562 $6,165 S 6,377 810 719 1400 1529 1523 7,534 8,504 8,619 622 Total current tax provision Deferred: (704) 87) (72) (106) (55 37 (216)D 1479 1.026 (519) (54 $6,558 $ 7985 8105 US. federal US. state and local Total deferred tax expense (benefit Total provision for income taxes Deferred Toxes The significant components of the Company\'s deferred tax account balances are as follows January 31, 5 in milions) 2016 2015 Deferred tax assets: $3,313 3,255 3,763 3,395 184 1390 1.9 8,658 7953 (1.456 1.504 $7,202 $ 6449 Loss and tax credit carryforwards Accrued liabilities 192 Other Total deferred tax assets Valuation allowances Deferred tax assets, net of valuation allowance Deferred tax liabilities: Property and equipment $5,813 $5,972 1,790 1,825 1452 1618 9,055 9.415 51.853 2.966 Total deferred tax iabilities Net deferred tax llabilities Required:

Solution

1. Summary journal entry:

2. The actual change in deferred tax liability is $1113 (2966 - 1853 ) and as per above journal entry is $1026.

They do not reconcile due to differences in valuation allowances and changes in deferred tax liabilities.

Apart from continuing operations , the following might affect deferred taxes:

(i) Discontinuing operations

(ii) Mergers and acquisitions

(iii) Intangible assets

| Date | Journal Entry | Debit | Credit |

| 2016 | Income Tax Expense | 6558 | |

| Deferred Tax | 1026 | ||

| To Income tax payable | 7584 |

Homework Sourse

Homework Sourse