Exercise 1618 Pronghorn Inc presented the following data Net

Solution

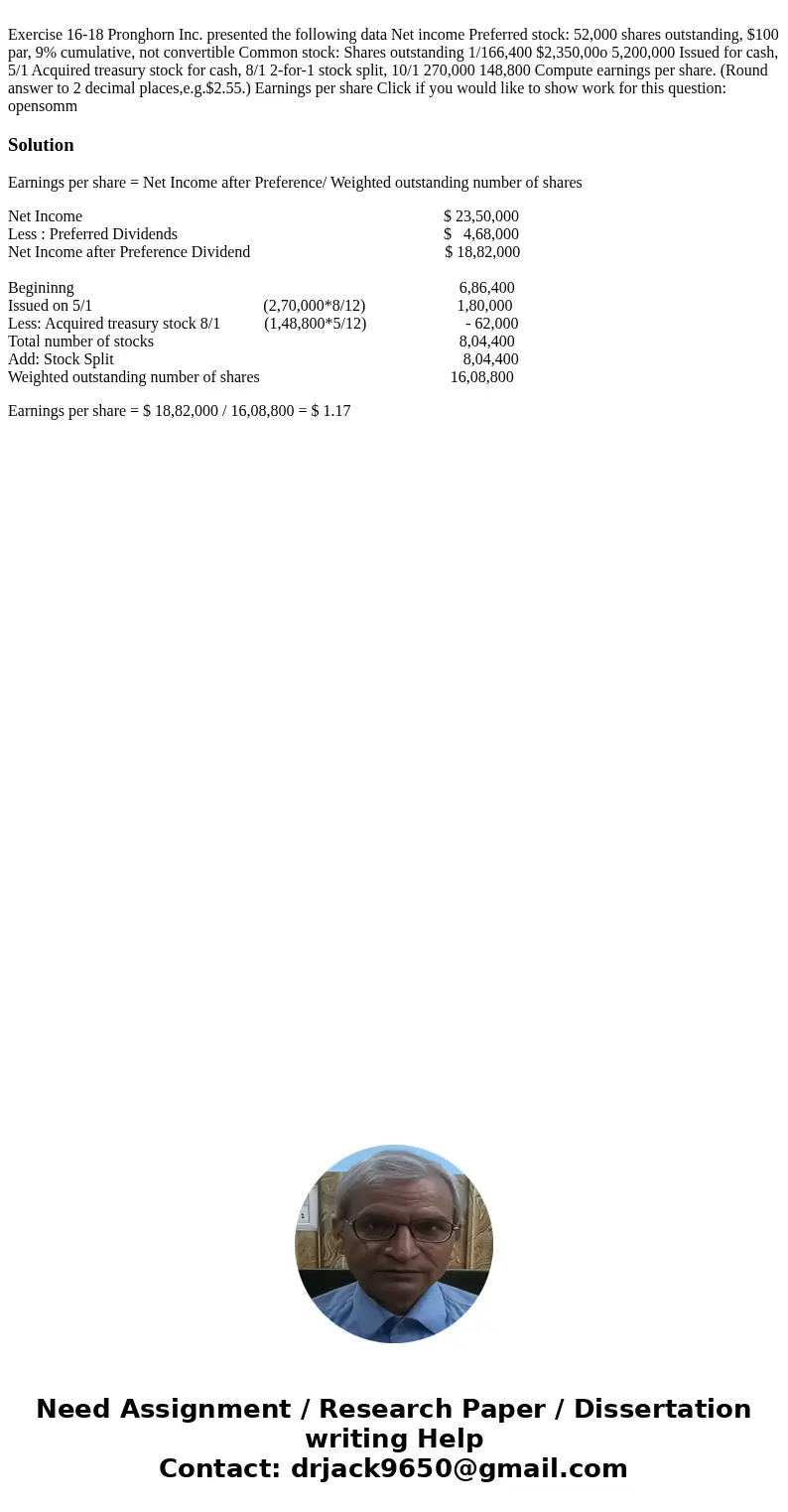

Earnings per share = Net Income after Preference/ Weighted outstanding number of shares

Net Income $ 23,50,000

Less : Preferred Dividends $ 4,68,000

Net Income after Preference Dividend $ 18,82,000

Begininng 6,86,400

Issued on 5/1 (2,70,000*8/12) 1,80,000

Less: Acquired treasury stock 8/1 (1,48,800*5/12) - 62,000

Total number of stocks 8,04,400

Add: Stock Split 8,04,400

Weighted outstanding number of shares 16,08,800

Earnings per share = $ 18,82,000 / 16,08,800 = $ 1.17

Homework Sourse

Homework Sourse