Advanced Automotive paid 130000 for a group purchase of land

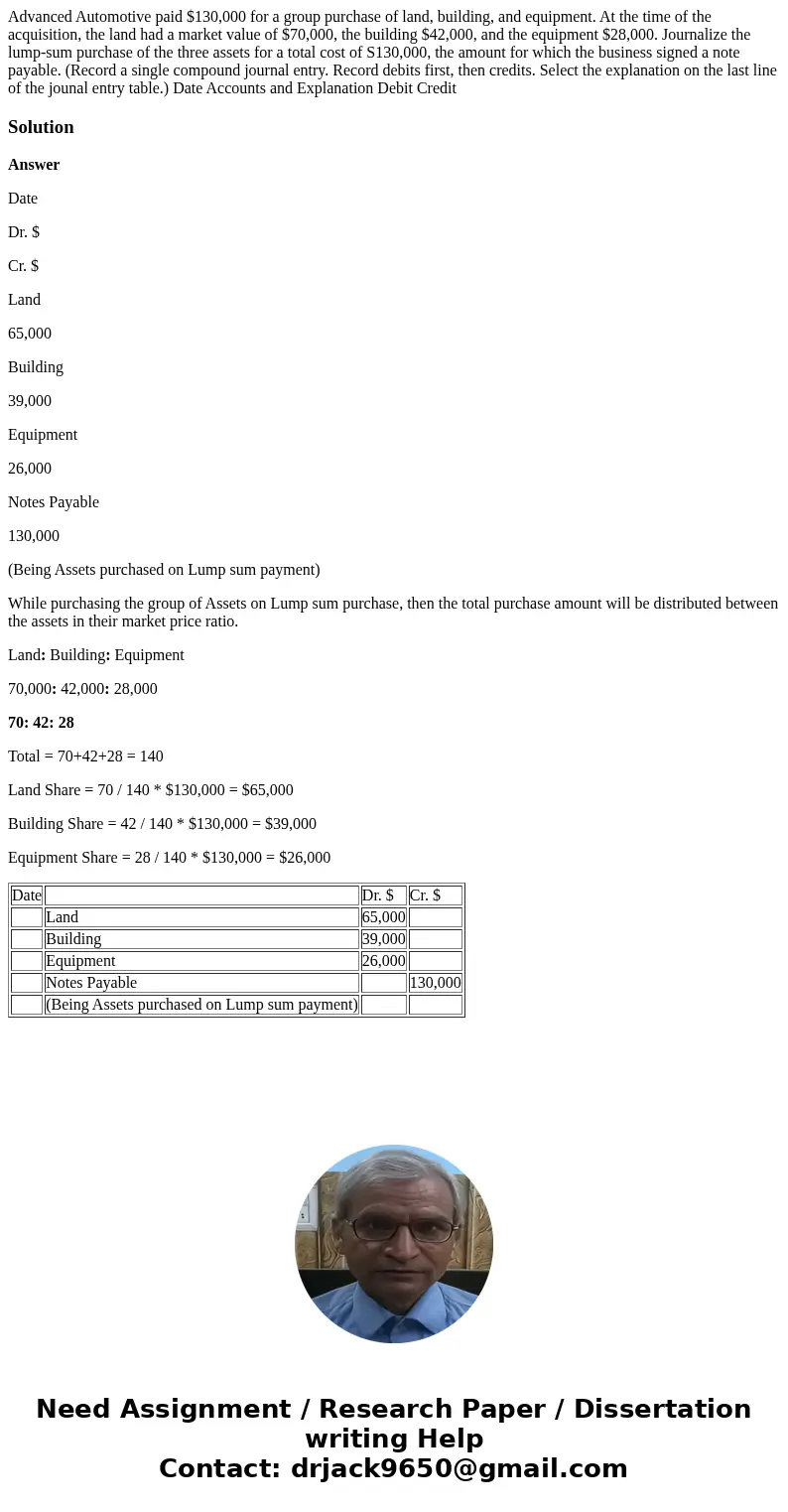

Advanced Automotive paid $130,000 for a group purchase of land, building, and equipment. At the time of the acquisition, the land had a market value of $70,000, the building $42,000, and the equipment $28,000. Journalize the lump-sum purchase of the three assets for a total cost of S130,000, the amount for which the business signed a note payable. (Record a single compound journal entry. Record debits first, then credits. Select the explanation on the last line of the jounal entry table.) Date Accounts and Explanation Debit Credit

Solution

Answer

Date

Dr. $

Cr. $

Land

65,000

Building

39,000

Equipment

26,000

Notes Payable

130,000

(Being Assets purchased on Lump sum payment)

While purchasing the group of Assets on Lump sum purchase, then the total purchase amount will be distributed between the assets in their market price ratio.

Land: Building: Equipment

70,000: 42,000: 28,000

70: 42: 28

Total = 70+42+28 = 140

Land Share = 70 / 140 * $130,000 = $65,000

Building Share = 42 / 140 * $130,000 = $39,000

Equipment Share = 28 / 140 * $130,000 = $26,000

| Date | Dr. $ | Cr. $ | |

| Land | 65,000 | ||

| Building | 39,000 | ||

| Equipment | 26,000 | ||

| Notes Payable | 130,000 | ||

| (Being Assets purchased on Lump sum payment) |

Homework Sourse

Homework Sourse