B Trend analysi D Horizontal analysis ratio Common sire sta

B) Trend analysi D) Horizontal analysis ratio ) Common sire statements SHORT ANSWER Wite the word or phrase that best completes each statement or answer 11) Sketches Ine purchased a machine on January 1, 2016. The cost of the machine 000 its estimated ressdual value was $5,000 at the end of an estimated wa $17, S yenr l eompany produced 2,500 units in 2016 and 3,200 units in 2017 ife The company expects to produce a total of 20,000 units. The Requiredi Part a Caleulate depreciation expense for 2016 and 2017 using the straight-line method Part b Caloulate the depreciation expense for 2016 and 2017 using the units-of production method Part e Caleulate depreciation expense for 2016 through 2020 using the double-deelining balance method 32) Wade Industries reported the following information in its accounting records orn December 31, 201 ross salaries earned by employees (December 29-31) $7,200 ncome taxes withheld from employees (December 29-31) 1,100 ICA taxes withheld from employees (December 29-31) 420 let payment to employees (made on December 31) $5,680 The employees were paid $5,680 on Dcember 31, 2015, but the withholdings have not yet been remitted nor have the matching employer FICA contributions. Required: Part a Compute the total payroll costs relating to the period from December 29 31. (Assume $560 in total unemployment taxes.) Part b Show the accounting equation effects and give the journal entries or December 31 to adjust for salarics and wages relating to December 29-31, 2015 Part o. Show the accounting equation effects and give the journal entries on December 31 to adjust for payroll taxes relating to December 29-31, 2015

Solution

Part A : Straight line depreciation :

Straight line dep = Original cost-salvage value/useful life

= (17000-5000/5)

Straight line dep = 2400

2016 dep = 2400

2017 dep = 2400

Part B: Unit of production method depreciation :

Unit of production method dep rate = Original cost-salvage value/Estimated production unit

= (17000-5000/20000)

Dep rate = 0.60 per unit

2016 dep = 2500*.60 = 1500

2017 dep = 3200*.60 = 1920

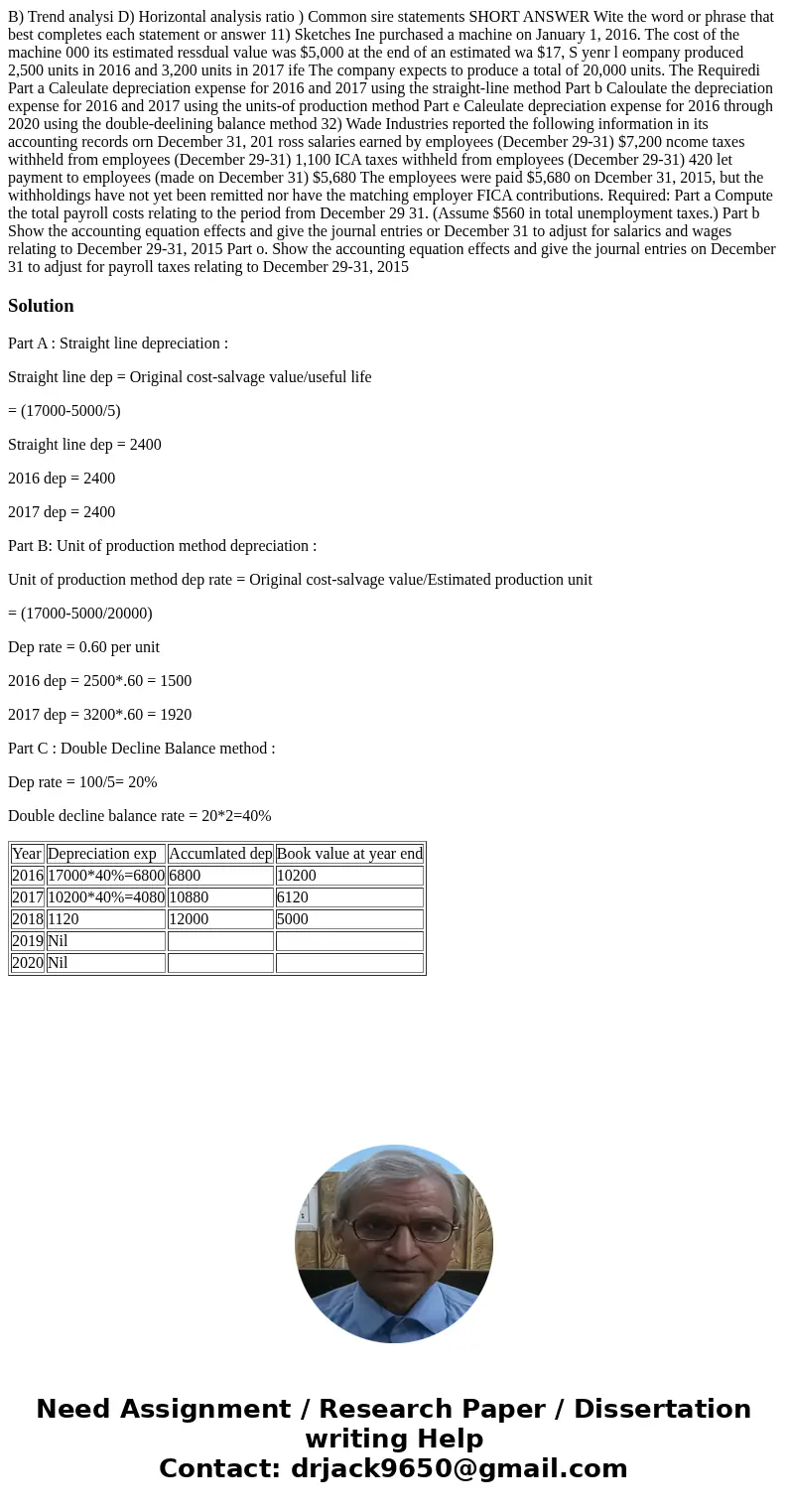

Part C : Double Decline Balance method :

Dep rate = 100/5= 20%

Double decline balance rate = 20*2=40%

| Year | Depreciation exp | Accumlated dep | Book value at year end |

| 2016 | 17000*40%=6800 | 6800 | 10200 |

| 2017 | 10200*40%=4080 | 10880 | 6120 |

| 2018 | 1120 | 12000 | 5000 |

| 2019 | Nil | ||

| 2020 | Nil |

Homework Sourse

Homework Sourse