0umal Instructions Bergan Company estimates that total facto

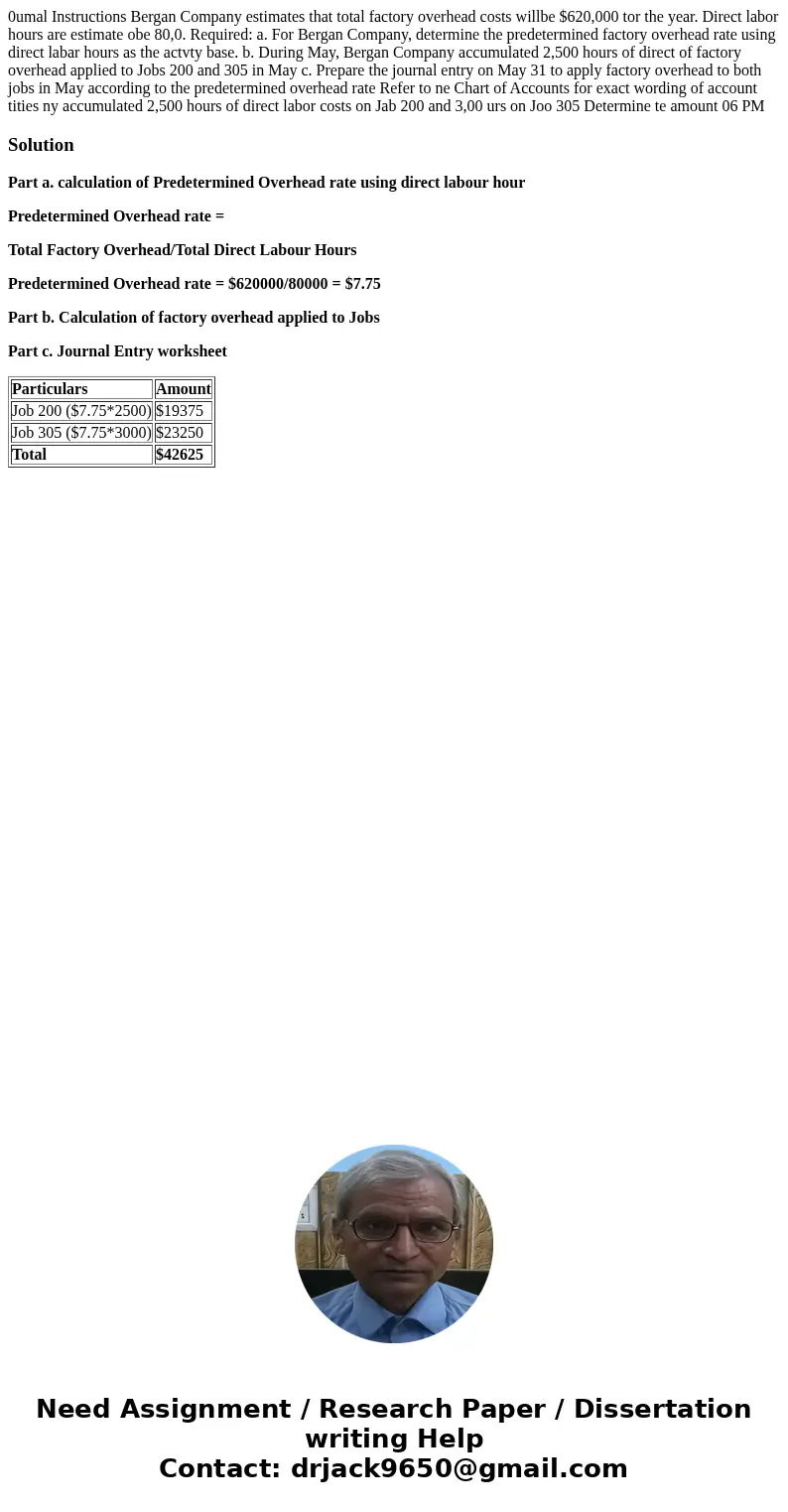

0umal Instructions Bergan Company estimates that total factory overhead costs willbe $620,000 tor the year. Direct labor hours are estimate obe 80,0. Required: a. For Bergan Company, determine the predetermined factory overhead rate using direct labar hours as the actvty base. b. During May, Bergan Company accumulated 2,500 hours of direct of factory overhead applied to Jobs 200 and 305 in May c. Prepare the journal entry on May 31 to apply factory overhead to both jobs in May according to the predetermined overhead rate Refer to ne Chart of Accounts for exact wording of account tities ny accumulated 2,500 hours of direct labor costs on Jab 200 and 3,00 urs on Joo 305 Determine te amount 06 PM

Solution

Part a. calculation of Predetermined Overhead rate using direct labour hour

Predetermined Overhead rate =

Total Factory Overhead/Total Direct Labour Hours

Predetermined Overhead rate = $620000/80000 = $7.75

Part b. Calculation of factory overhead applied to Jobs

Part c. Journal Entry worksheet

| Particulars | Amount |

| Job 200 ($7.75*2500) | $19375 |

| Job 305 ($7.75*3000) | $23250 |

| Total | $42625 |

Homework Sourse

Homework Sourse