Sweet Companys outstanding stock consists of 1100 shares of

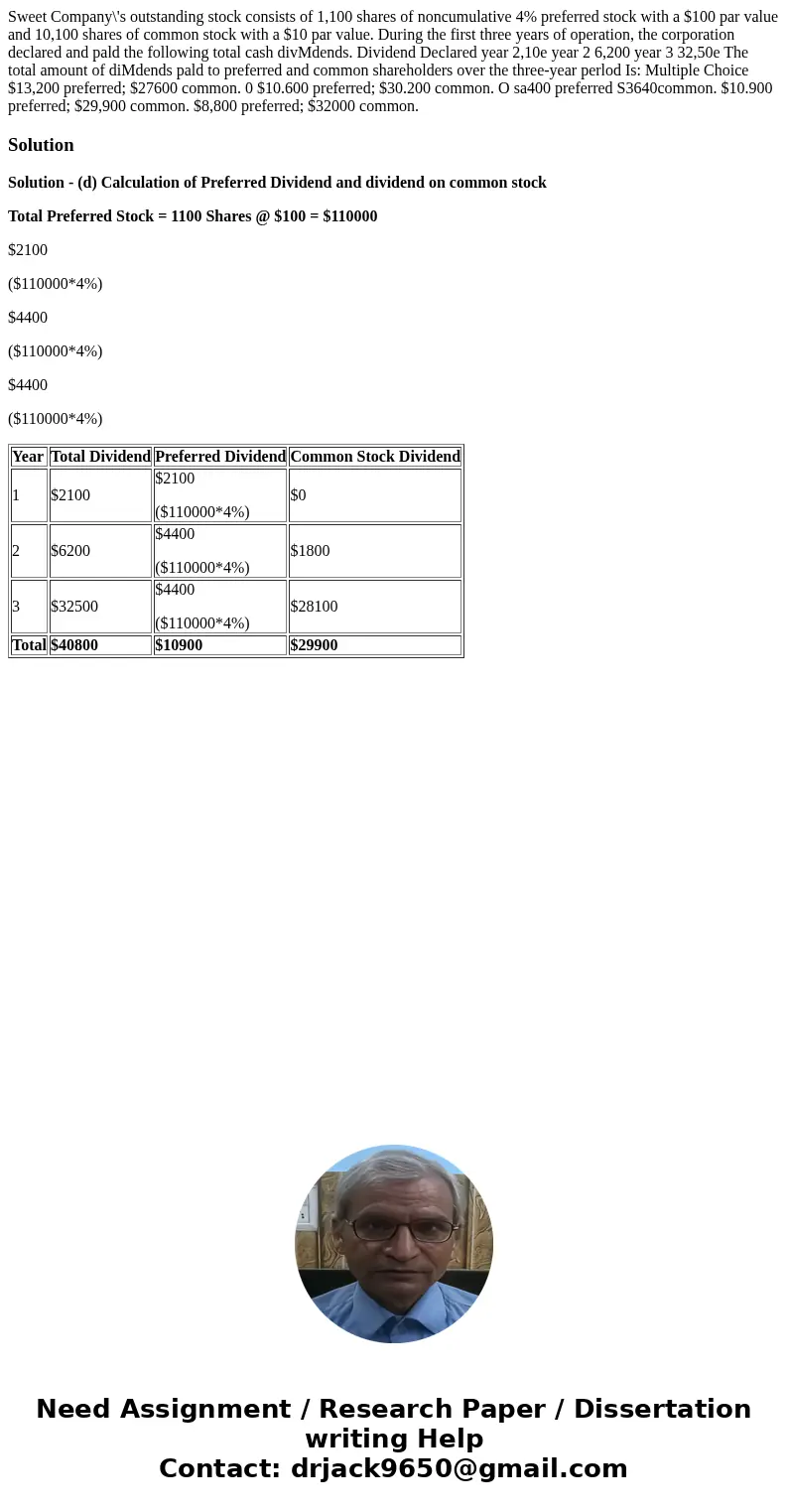

Sweet Company\'s outstanding stock consists of 1,100 shares of noncumulative 4% preferred stock with a $100 par value and 10,100 shares of common stock with a $10 par value. During the first three years of operation, the corporation declared and pald the following total cash divMdends. Dividend Declared year 2,10e year 2 6,200 year 3 32,50e The total amount of diMdends pald to preferred and common shareholders over the three-year perlod Is: Multiple Choice $13,200 preferred; $27600 common. 0 $10.600 preferred; $30.200 common. O sa400 preferred S3640common. $10.900 preferred; $29,900 common. $8,800 preferred; $32000 common.

Solution

Solution - (d) Calculation of Preferred Dividend and dividend on common stock

Total Preferred Stock = 1100 Shares @ $100 = $110000

$2100

($110000*4%)

$4400

($110000*4%)

$4400

($110000*4%)

| Year | Total Dividend | Preferred Dividend | Common Stock Dividend |

| 1 | $2100 | $2100 ($110000*4%) | $0 |

| 2 | $6200 | $4400 ($110000*4%) | $1800 |

| 3 | $32500 | $4400 ($110000*4%) | $28100 |

| Total | $40800 | $10900 | $29900 |

Homework Sourse

Homework Sourse